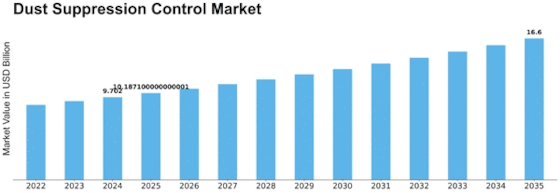

Dust Suppression Control Size

Dust Suppression Control Market Growth Projections and Opportunities

Rising industrial sectors such as mining, construction and manufacturing heavily fuel demand for dust suppression control solutions. As industrial activities expand then becomes becoming of ever-increasing importance the need to reduce airborne dust particles generated by processes like excavation, crushing and material handling. Rising environmental regulations and standards forces industries to regulate dust emissions. Many governments from around the world have tight restrictions concerning particulate matter emissions. As a result, many industries seek to adopt suitable dust suppression methods so they can follow environmental laws and cause as little impact on nature (or ecology) as possible. This increases public health concerns about the relationship between airborne dust particles and respiratory problems. With rising public consciousness about the health dangers posed by dust, industries must find ways to control their emissions of fumes in order preserve worker welfare and protect neighboring communities and people. Advances in dust suppression systems help spur market growth. Many new equipment designs, like misting systems and dust control agents as well as automated processes are more effective methods of reducing emissions in different industrial applications. Dust generation from mining and quarrying are major industries. Naturally, extracting and processing minerals generates airborne particles. There is a wide variety of application for dust suppression control solutions here, including creating better working environments and compliance with regulations as well as helping to alleviate the concerns from nearby communities that sometimes arise during mining operations. Dust suppression control is needed to support large-scale infrastructure projects such as road construction, bridge building and city development. With governments investing heavily to build infrastructure, controlling dust emissions from the construction sites is essential in order that government may maintain environmental sustainability and also standardize standards. An awareness of air quality and the effects that it has on human health and environmental also leads to dust suppression control being adopted. Industries are taking proactive steps to implement solutions to improve air quality, reduce particulate matter emissions and bring efforts consistent with broader environmental stewardship. Many dust suppression methods of the past were based on water. But then there are the fears about drought and water shortages in some areas, which means dust control agents must be found that can do effective work without demanding high levels of water consumption.

Leave a Comment