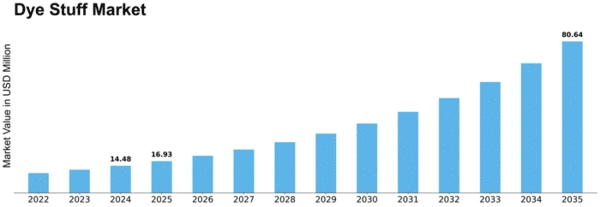

Dye Stuff Size

Dye Stuff Market Growth Projections and Opportunities

The Dyestuff market is shaped by diverse factors that collectively influence its growth and dynamics. One primary driver is the demand from the textile industry, which is the largest consumer of dyestuffs globally. The vibrant and diverse color options offered by dyestuffs play a crucial role in enhancing the aesthetic appeal of textiles. As the textile industry continues to grow, especially in emerging economies, the demand for dyestuffs rises proportionally, contributing significantly to the expansion of the Dyestuff market.

Technological advancements play a pivotal role in the evolution of the Dyestuff market. Ongoing research and development efforts focus on developing innovative dye formulations with improved color fastness, eco-friendly attributes, and versatility across various fabrics. The advent of sustainable and water-based dyeing technologies responds to the industry's commitment to reducing environmental impact. Technological innovations contribute to the market's growth by offering manufacturers and textile producers options that align with sustainability goals and regulatory requirements.

Market dynamics are significantly influenced by trends in end-use industries, particularly textiles, leather, and paper. For instance, the growing popularity of athleisure wear and sustainable fashion drives the demand for specialized dyes suitable for synthetic fibers and eco-friendly materials. Understanding and adapting to the specific needs and trends in these end-use industries are crucial for dyestuff manufacturers to stay competitive and meet the changing demands of consumers.

Global environmental regulations and sustainability considerations contribute significantly to shaping the Dyestuff market. Governments and regulatory bodies are implementing stringent regulations to reduce the environmental impact of dyeing processes. This has led to the development of eco-friendly and low-impact dyestuffs, such as azo-free and low-VOC formulations. Compliance with these regulations is not only a regulatory necessity but also positions dyestuff manufacturers favorably in a market where sustainability and environmental responsibility are becoming key differentiators.

Raw material availability and pricing dynamics play a crucial role in the Dyestuff market. The primary raw materials for dyestuffs, such as intermediates and pigments, are derived from various sources. Fluctuations in the prices of these raw materials can impact production costs, influencing market prices for dyestuffs. Effective supply chain management and strategic sourcing become crucial for manufacturers to maintain stability and competitiveness in the face of raw material price fluctuations.

Market competition is another pivotal factor influencing the Dyestuff sector. The presence of numerous players in the market drives continuous innovation in terms of dye formulations, color options, and application techniques. Companies vie for market share by focusing on product differentiation, cost competitiveness, and the development of dyes tailored to specific fabrics or applications. Strategic collaborations, partnerships, and mergers and acquisitions are common strategies employed by companies to strengthen their market position, expand their product portfolios, and stay ahead in an industry that values innovation.

Consumer preferences and market trends also contribute to shaping the Dyestuff market. The growing awareness among consumers about sustainable and eco-friendly products influences purchasing decisions. The demand for textiles and clothing made using environmentally responsible dyeing processes is on the rise. Additionally, trends in fashion, home décor, and personal expression impact the types of colors and dyes in demand, reflecting the dynamic nature of the consumer-driven market.

Leave a Comment