Diverse Revenue Streams

The Global Esports Market Industry benefits from a diverse range of revenue streams, including sponsorships, advertising, merchandise sales, and ticket sales for live events. This multifaceted approach to revenue generation enables the industry to remain resilient and adaptable to market fluctuations. Sponsorship deals with major brands, such as Intel and Coca-Cola, provide substantial financial support, while advertising revenue from streaming platforms contributes to overall growth. As the industry evolves, new revenue opportunities, such as in-game purchases and digital collectibles, are likely to emerge. This diversification of income sources positions the Global Esports Market Industry for sustained growth and profitability.

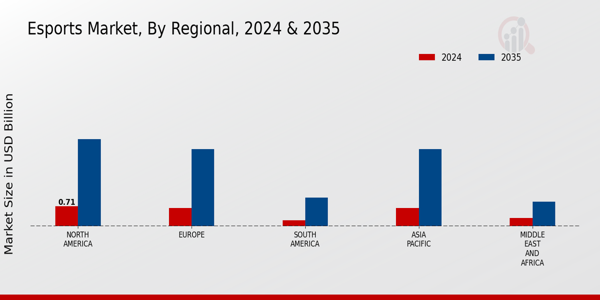

Market Growth Projections

The Global Esports Market Industry is projected to experience remarkable growth, with estimates indicating a market value of 10.5 USD Billion by 2035. This growth trajectory reflects the increasing acceptance of esports as a legitimate form of entertainment and competition. Factors contributing to this expansion include rising viewership, increased participation rates, and the ongoing development of esports infrastructure. The projected CAGR of 13.94% for the period of 2025-2035 underscores the industry's potential for long-term success. As more stakeholders enter the market, the Global Esports Market Industry is likely to evolve, adapting to changing consumer preferences and technological advancements.

Youth Engagement and Demographics

The Global Esports Market Industry is significantly influenced by the engagement of younger demographics, particularly Generation Z and Millennials, who are increasingly drawn to competitive gaming. This demographic shift is evident in the growing number of esports tournaments and events tailored to younger audiences. As these individuals prioritize digital entertainment, the industry is likely to see a sustained increase in participation and viewership. The appeal of esports as a social activity, combined with the rise of online communities, fosters a sense of belonging among players and fans. This trend suggests that the Global Esports Market Industry will continue to thrive as it aligns with the preferences of younger generations.

Technological Advancements in Gaming

Technological advancements play a crucial role in the evolution of the Global Esports Market Industry. Innovations in hardware and software enhance the gaming experience, allowing for more immersive and competitive gameplay. The rise of virtual reality and augmented reality technologies offers new opportunities for game developers and players alike. Furthermore, improvements in internet connectivity and streaming capabilities enable seamless broadcasting of esports events to global audiences. As these technologies continue to develop, they are likely to attract more participants and viewers, contributing to the projected CAGR of 13.94% for the period of 2025-2035. This growth reflects the industry's adaptability and potential for future expansion.

Rising Popularity of Competitive Gaming

The Global Esports Market Industry experiences a surge in popularity as competitive gaming becomes a mainstream entertainment option. With an estimated market value of 2.5 USD Billion in 2024, the industry attracts millions of viewers and participants worldwide. Major tournaments, such as the League of Legends World Championship, draw in large audiences, showcasing the appeal of esports. This growing interest is further fueled by the increasing accessibility of gaming platforms and the rise of streaming services, which allow fans to engage with their favorite games and players. As a result, the Global Esports Market Industry is poised for substantial growth in the coming years.

Investment from Traditional Sports Organizations

The Global Esports Market Industry benefits from significant investments by traditional sports organizations, which recognize the potential of esports as a lucrative venture. Notable franchises, such as the NBA and NFL, have established their own esports leagues, thereby legitimizing the industry and attracting a broader audience. This influx of capital not only enhances the competitive landscape but also facilitates the development of infrastructure and talent. As traditional sports entities continue to invest in esports, the market is expected to expand, potentially reaching a valuation of 10.5 USD Billion by 2035. This trend indicates a convergence of sports and gaming, further solidifying esports' position in the entertainment sector.

Leave a Comment