- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

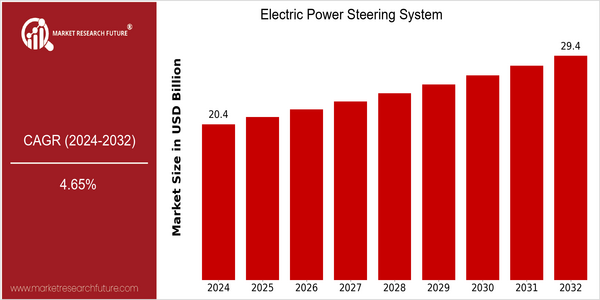

| Year | Value |

|---|---|

| 2024 | USD 20.42 Billion |

| 2032 | USD 29.4 Billion |

| CAGR (2024-2032) | 4.65 % |

Note – Market size depicts the revenue generated over the financial year

In the meantime, the electric power steering (EPS) market is growing at a rapid pace. The market is expected to reach a value of $ 20.42 billion in 2024 and reach $ 29.4 billion by 2032. This is equivalent to a CAGR of 4.65 % for the forecast period from 2024 to 2032. The high demand for fuel-efficient vehicles and the stricter government regulations to reduce CO2 emissions are driving the adoption of EPS systems, which provide better fuel economy and reduce vehicle weight compared to hydraulic systems. The increasing demand for electric and driverless cars, as well as the integration of EPS into ADAS systems, are also driving the EPS market. The leading companies, such as Bosch, ZF Friedrichshafen and JTEKT, are actively investing in research and development to improve their product offerings. Strategic alliances and acquisitions are also contributing to the market. As the automobile industry develops, the EPS market will play a crucial role in the future of vehicle control.

Regional Market Size

Regional Deep Dive

The electric power steering market is growing in all regions of the world, driven by the advancement in the automobile industry, the growing demand for fuel-efficient vehicles, and the strict government regulations for reducing the emission of harmful gases. Each region has its own characteristics, which influence the market dynamics, such as the preference of consumers, the regulatory framework, and the level of technological adoption. The electric power steering market is expected to grow at a CAGR of more than 6% over the forecast period.

Europe

- Europe is at the forefront of EPS technology innovation, with companies like Bosch and ZF Friedrichshafen leading the development of advanced steering systems that incorporate features like lane-keeping assistance and automated driving capabilities.

- The European Union's strict regulations on emissions and safety standards are driving the development of EPS systems. These are necessary to meet the requirements of new models, and the resulting competition is pushing technological development forward.

Asia Pacific

- The Asia-Pacific region, especially China and Japan, is experiencing rapid growth in the EPS market, which is mainly driven by the increasing production of electric vehicles, as well as the presence of large automobile manufacturers such as Toyota and Honda, which are investing heavily in EPS.

- The government's subsidies for the purchase of electric vehicles and the construction of smart transportation in China are also promoting the development of EPS systems, which are essential to the performance of modern electric and hybrid vehicles.

Latin America

- Latin America is witnessing a slow but steady growth in the EPS market, with Brazil and Mexico emerging as key players in automotive manufacturing, where local companies are beginning to adopt EPS systems to meet international standards.

- The region's automotive industry is influenced by economic factors such as currency fluctuations and trade agreements, which can impact the availability and pricing of EPS technologies, thereby shaping market dynamics.

North America

- The North American market is characterized by the increasing production of electric and hybrid vehicles by the leading automobile manufacturers, such as General Motors and Tesla. In these vehicles, the use of advanced steering systems is aimed at reducing fuel consumption.

- A change in the regulations, such as the CAFE, is pushing the automobile manufacturers to adopt EPS systems. As they help to reduce fuel consumption and emissions, they are changing the design and production strategies of automobile companies.

Middle East And Africa

- In the Middle East and Africa, the EPS market is gradually developing, mainly driven by the rising demand for passenger cars and the introduction of new car technology, and by companies like Hyundai and Nissan, which have EPS models.

- Economic diversification efforts in countries like the UAE are leading to increased investments in the automotive sector, which is expected to enhance the adoption of EPS systems as part of modern vehicle designs.

Did You Know?

“Did you know that EPS systems can reduce vehicle weight by up to 10% compared to traditional hydraulic steering systems, contributing to improved fuel efficiency and lower emissions?” — International Journal of Automotive Technology

Segmental Market Size

The electric power steering system is an important component of vehicle maneuverability and fuel economy, and it is currently a market with stable growth. Demand is mainly driven by the increasing demand for ADAS and the demand for lightweight steering systems for fuel-efficient vehicles. Also, the reduction of vehicle emissions has pushed the development of EPS technology, which is an important component of the whole vehicle efficiency. The EPS market is already a mature industry. Leading car manufacturers such as Toyota and Ford have already adopted the EPS system in many of their car models. EPS is mainly used in passenger cars, commercial vehicles and electric vehicles. It is mainly used to improve driving comfort and safety. The trend of global electric vehicles and the sustainable development of energy-saving technology are expected to promote the development of the EPS market. Also, with the development of sensors and artificial intelligence, the EPS system can be used for lane positioning and automatic parking, which can improve the driving experience.

Future Outlook

From 2024 to 2032, the electric power steering system market is expected to grow at a CAGR of 4.65%. The increasing adoption of electric vehicles (EVs) and the technological advancements in the automobile industry are expected to drive this growth. In addition, the manufacturers have started making EPS systems a standard feature in new models. By 2032, the EPS system is expected to be installed in about 75% of the passenger car models. Government regulations aimed at reducing CO2 emissions and increasing the safety of vehicles are also expected to boost the growth of the market. The increasing demand for EPS is also expected to increase as EPS systems provide the precision and responsiveness required for the development of advanced driver assistance systems (ADAS). Moreover, the integration of artificial intelligence and machine learning in EPS systems is expected to further enhance the performance and experience of the users, thereby enhancing the role of EPS in the future of the automobile industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 19.4 Billion |

| Growth Rate | 4.65% (2024-2032) |

Electric Power Steering System Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.