-

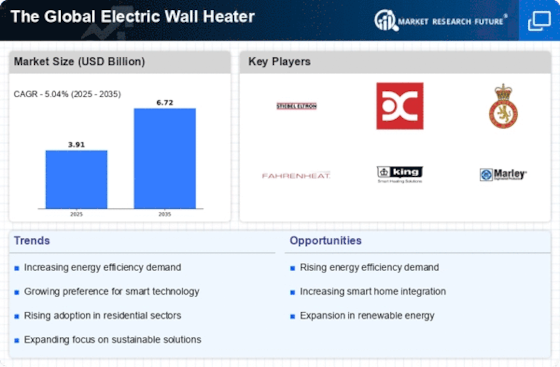

Executive Summary

-

Market Introduction

-

Definition 14

-

Scope Of The Study 14

-

List Of Assumptions 15

-

Market Structure 16

-

Market Attractiveness Analysis 16

-

Electric Wall Heater Market, By Application 17

-

Electric Wall Heater Market, By Power 18

-

Macro Factor Indicator Analyses 18

-

Key Takeaways 19

-

Research Methodology

-

Research Process 20

-

Primary Research 21

-

Secondary Research 22

-

Market Size Estimation 23

-

Forecast Model 23

-

Market Insights

-

Market Dynamics

-

Introduction 27

-

Drivers 27

- Demand For Energy-Efficient Products 27

- Rapid Urbanization And Evolving Lifestyles 28

- Drivers Impact Analysis 29

-

Restraints 29

- Availability Of Cost-Effective Alternatives 29

-

Restraints Impact Analysis 30

-

Opportunities 30

- Smart Electric Wall Heater Technologies 30

-

Challenges 31

- District Heating Solutions 31

-

Market Factor Analysis

-

Porter’s Five Forces Model 32

- Threat Of New Entrants 32

- Bargaining Power Of Suppliers 32

- Bargaining Power Of Buyers 33

- Threat Of Substitutes 33

- Rivalry 33

-

Supply Chain Analysis: Global Electric Wall Heater Market 34

- Design And Development 34

- Raw Material/Component Supply 34

- Electric Wall Heater Manufacture 35

- End-Use 35

- After-Sales Services 35

-

Technology Trends 36

- Evolution Of Smart Electric Wall Heaters 36

-

Electric Wall Heater Market, By Application

-

Overview 37

-

Residential 37

-

Non-Residential 37

-

Electric Wall Heater Market, By Power

-

Overview 39

-

2000 Watt 39

-

Electric Wall Heater Market, By Region

-

Introduction 41

-

North America 42

- US 43

- Canada 44

- Mexico 45

-

Europe 46

- Germany 48

- France 49

- UK 50

- Italy 51

- Rest Of Europe 52

-

Asia-Pacific 53

- China 55

- Japan 56

- India 57

- Rest Of Asia-Pacific 58

-

Rest Of The World (RoW) 59

- Middle East & Africa 61

- South America 62

-

Competitive Landscape

-

Competitive Overview 64

-

Global Electric Wall Heater Market, Share Analysis, 2020 (%) 65

-

Competitive Benchmarking 66

-

Company Profiles

-

Marley Engineered Products 67

- Company Overview 67

- Financial Overview 67

- Products/Services Offered 67

- Key Developments (2020-2027) 68

- SWOT Analysis 68

- Key Strategies 68

-

Stiebel Eltron Inc. 69

- Company Overview 69

- Financial Overview 69

- Products/Services Offered 69

- Key Developments (2020-2027) 70

- SWOT Analysis 70

- Key Strategies 70

-

Markel Products Company 71

- Company Overview 71

- Financial Overview 71

- Products/Services Offered 71

- Key Developments (2020-2027) 71

- SWOT Analysis 72

- Key Strategies 72

-

Trane (Ingersoll-Rand PLC) 73

- Company Overview 73

- Financial Overview 73

- Products/Services Offered 74

- Key Developments (2020-2027) 74

- SWOT Analysis 74

- Key Strategies 74

-

Broan, Inc. 75

- Company Overview 75

- Financial Overview 75

- Products/Services Offered 75

- Key Developments (2020-2027) 75

- SWOT Analysis 76

- Key Strategies 76

-

WarmlyYours.Com, Inc. 77

- Company Overview 77

- Financial Overview 77

- Products/Services Offered 77

- Key Developments (2020-2027) 77

- SWOT Analysis 78

- Key Strategies 78

-

King Electric 79

- Company Overview 79

- Financial Overview 79

- Products/Services Offered 79

- Key Developments (2020-2027) 80

- SWOT Analysis 80

- Key Strategies 80

-

Indeeco 81

- Company Overview 81

- Financial Overview 81

- Products/Services Offered 81

- Key Developments (2020-2027) 81

- SWOT Analysis 82

- Key Strategies 82

-

Glen Dimplex Group 83

- Company Overview 83

- Financial Overview 83

- Products/Services Offered 83

- Key Developments (2020-2027) 84

- SWOT Analysis 84

- Key Strategies 84

-

Radiant Systems 85

- Company Overview 85

- Financial Overview 85

- Products/Services Offered 85

- Key Developments (2020-2027) 85

- SWOT Analysis 86

- Key Strategies 86

-

Appendix

-

References 87

-

Related Reports 87

-

List Of Tables

-

LIST OF ASSUMPTIONS 15

-

GLOBAL ELECTRIC WALL HEATER MARKET: MACRO FACTOR INDICATOR ANALYSES 18

-

THE BEST RATED ELECTRIC WALL HEATERS ON THE RETAIL PLATFORM 36

-

Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 38

-

Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 40

-

Electric Wall Heater Market, BY REGION, 2020–2027 (USD MILLION) 41

-

NORTH AMERICA: Electric Wall Heater Market, BY COUNTRY, 2020–2027 (USD MILLION) 42

-

NORTH AMERICA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 43

-

NORTH AMERICA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 43

-

US: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 44

-

US: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 44

-

CANADA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 45

-

CANADA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 45

-

MEXICO: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 46

-

MEXICO: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 46

-

EUROPE: Electric Wall Heater Market, BY COUNTRY, 2020–2027 (USD MILLION) 47

-

EUROPE: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 48

-

EUROPE: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 48

-

GERMANY: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 49

-

GERMANY: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 49

-

FRANCE: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 50

-

FRANCE: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 50

-

UK: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 51

-

UK: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 51

-

ITALY: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 52

-

ITALY: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 52

-

REST OF EUROPE: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 53

-

REST OF EUROPE: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 53

-

ASIA–PACIFIC: Electric Wall Heater Market, BY COUNTRY, 2020–2027 (USD MILLION) 54

-

ASIA–PACIFIC: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 55

-

ASIA–PACIFIC: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 55

-

CHINA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 56

-

CHINA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 56

-

JAPAN: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 57

-

JAPAN: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 57

-

INDIA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 58

-

INDIA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 58

-

REST OF ASIA–PACIFIC: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 59

-

REST OF ASIA–PACIFIC: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 59

-

ROW: Electric Wall Heater Market, BY REGION, 2020–2027 (USD MILLION) 60

-

ROW: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 60

-

ROW: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 61

-

MIDDLE EAST & AFRICA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 61

-

MIDDLE EAST & AFRICA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 62

-

SOUTH AMERICA: Electric Wall Heater Market, BY APPLICATION, 2020–2027 (USD MILLION) 62

-

SOUTH AMERICA: Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 63

-

MARLEY ENGINEERED PRODUCTS: PRODUCTS/SERVICES OFFERED 67

-

STIEBEL ELTRON INC.: PRODUCTS/SERVICES OFFERED 69

-

STIEBEL ELTRON INC.: KEY DEVELOPMENTS 70

-

MARKEL PRODUCTS COMPANY: PRODUCTS/SERVICES OFFERED 71

-

TRANE: PRODUCTS/SERVICES OFFERED 74

-

BROAN, INC.: PRODUCTS/SERVICES OFFERED 75

-

WARMLYYOURS.COM, INC.: PRODUCTS/SERVICES OFFERED 77

-

KING ELECTRIC: PRODUCTS/SERVICES OFFERED 79

-

INDEECO: PRODUCTS/SERVICES OFFERED 81

-

GLEN DIMPLEX GROUP: PRODUCTS/SERVICES OFFERED 83

-

GLEN DIMPLEX GROUP: KEY DEVELOPMENTS 84

-

RADIANT SYSTEMS: PRODUCTS/SERVICES OFFERED 85

-

List Of Figures

-

MARKET SYNOPSIS 13

-

GLOBAL ELECTRIC WALL HEATER MARKET: MARKET STRUCTURE 16

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL ELECTRIC WALL HEATER MARKET, 2020, BY REGION 16

-

Electric Wall Heater Market, BY APPLICATION, 2020-2027 (USD MILLION) 17

-

Electric Wall Heater Market, BY POWER, 2020–2027 (USD MILLION) 18

-

GLOBAL ELECTRIC WALL HEATER MARKET: KEY TAKEAWAYS 19

-

RESEARCH PROCESS OF MRFR 20

-

TOP-DOWN & BOTTOM-UP APPROACHES 23

-

NORTH AMERICA: ELECTRIC WALL HEATER MARKET SIZE & Electric Wall Heater Market, BY VALUE (2020 VS 2027) 24

-

EUROPE: ELECTRIC WALL HEATER MARKET SIZE & Electric Wall Heater Market, BY VALUE (2020 VS 2027) 25

-

ASIA-PACIFIC: ELECTRIC WALL HEATER MARKET SIZE & Electric Wall Heater Market, BY VALUE (2020 VS 2027) 25

-

ROW: ELECTRIC WALL HEATER MARKET SIZE & Electric Wall Heater Market, BY VALUE (2020 VS 2027) 26

-

GLOBAL ELECTRIC WALL HEATER MARKET 27

-

DRIVERS IMPACT ANALYSIS: GLOBAL ELECTRIC WALL HEATER MARKET 29

-

RESTRAINTS IMPACT ANALYSIS: GLOBAL ELECTRIC WALL HEATER MARKET 30

-

PORTER FIVE FORCES ANALYSIS: GLOBAL ELECTRIC WALL HEATER MARKET 32

-

SUPPLY CHAIN: GLOBAL ELECTRIC WALL HEATER MARKET 34

-

Electric Wall Heater Market, BY APPLICATION, 2020 (% SHARE) 37

-

Electric Wall Heater Market, BY POWER, 2020 (% SHARE) 40

-

Electric Wall Heater Market, BY REGION, 2020 (%) (USD MILLION) 41

-

NORTH AMERICA: Electric Wall Heater Market, BY COUNTRY, 2020 (%) 42

-

EUROPE: Electric Wall Heater Market, BY COUNTRY, 2020 (%) 47

-

ASIA-PACIFIC: Electric Wall Heater Market, BY COUNTRY, 2020 (%) 54

-

ROW: Electric Wall Heater Market, BY COUNTRY, 2020 (%) 60

-

GLOBAL ELECTRIC WALL HEATER MARKET SHARE ANALYSIS, 2020 65

-

BENCHMARKING OF MAJOR COMPETITORS 66

-

MARLEY ENGINEERED PRODUCTS: SWOT ANALYSIS 68

-

STIEBEL ELTRON INC.: SWOT ANALYSIS 70

-

MARKEL PRODUCTS COMPANY: SWOT ANALYSIS 72

-

INGERSOLL-RAND PLC: FINANCIAL OVERVIEW 73

-

TRANE: SWOT ANALYSIS 74

-

BROAN, INC.: SWOT ANALYSIS 76

-

WARMLYYOURS.COM, INC.: SWOT ANALYSIS 78

-

KING ELECTRIC: SWOT ANALYSIS 80

-

INDEECO: SWOT ANALYSIS 82

-

GLEN DIMPLEX GROUP: SWOT ANALYSIS 84

-

RADIANT SYSTEMS: SWOT ANALYSIS 86

Leave a Comment