Market Analysis

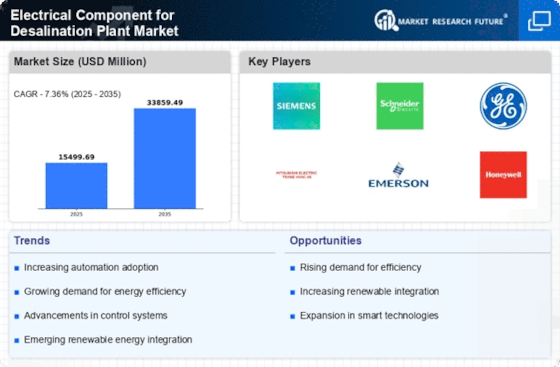

In-depth Analysis of Electrical Component for Desalination Plant Market Industry Landscape

The market dynamics of electrical components for desalination plants are driven by several factors that influence their growth, trends, and competitiveness within the industry. Electrical components for desalination plants encompass a wide range of equipment and devices essential for the operation and control of desalination processes, including pumps, valves, sensors, control systems, and electrical panels.

One significant driver of market dynamics in the electrical components for desalination plants is the increasing global demand for fresh water. Population growth, urbanization, and industrial development have resulted in growing water scarcity in many regions, driving the need for alternative water sources such as desalination. As desalination plants expand to meet this demand, there is a corresponding increase in the demand for electrical components required to power and automate these facilities.

Technological advancements play a crucial role in shaping the market dynamics of electrical components for desalination plants. Innovations in electrical engineering, automation, and control systems have led to the development of more efficient and reliable components for desalination plants. Manufacturers are investing in research and development to introduce advanced electrical components that optimize energy consumption, enhance process efficiency, and reduce maintenance requirements.

Regulatory standards and government policies also influence the market dynamics of electrical components for desalination plants. Governments around the world are implementing regulations and incentives to promote the development and adoption of desalination technology as a solution to water scarcity. Compliance with regulatory standards related to safety, quality, and environmental sustainability is essential for manufacturers of electrical components to enter and succeed in the market.

Market competition is another key factor driving the dynamics of the electrical components for desalination plants market. The industry is characterized by the presence of numerous manufacturers competing to offer high-quality components at competitive prices. Companies differentiate themselves through product innovation, reliability, after-sales service, and strategic partnerships with desalination plant operators and system integrators.

Environmental sustainability has emerged as a significant consideration in the market dynamics of electrical components for desalination plants. Desalination processes often require large amounts of energy, and the efficiency of electrical components directly impacts the overall energy consumption and environmental footprint of desalination plants. Manufacturers are increasingly focused on developing energy-efficient components and incorporating renewable energy sources such as solar and wind power to reduce the environmental impact of desalination.

Supply chain factors also influence the market dynamics of electrical components for desalination plants. The availability of raw materials, manufacturing capabilities, transportation logistics, and geopolitical factors can impact production costs, lead times, and product availability. Additionally, economic conditions and investment trends in the water infrastructure sector influence market demand for electrical components for desalination plants.

Leave a Comment