Research Methodology on Electroplating Market

Introduction

The electroplating market is expected to witness considerable growth in the coming years (2023 to 2030) due to the increasing demand for surface-decorated and corrosion-resistant components used in automotive, electronics and other industries. The recently published report by Market Research Future provides an in-depth analysis of the market trends and growth drivers, as well as their effects on the market structure.

This report also provides detailed insights into the various technologies used for electroplating, product type, application type, component type, material type and region. Furthermore, the report highlights product manufacturers and their strategies to gain market share. Additionally, the report provides an industry analysis, Porter’s Five forces analysis, market dominance analysis and technology usage analysis.

Research Objectives and Methodology

The report compiled for this study focuses on three main aspects namely, market and technology changes, growth potential, and competitive landscape. The study involves a comprehensive evaluation of the market based on different parameters, such as size, share, production trends, applications, type, form, and geography. For this, primary and secondary data gathering has been done.

Research Objectives

The main objectives of this research report are as follows:

To understand the current trends in the electroplating market

To analyze market dynamics including drivers, restraints and opportunities

To identify potential opportunities in the electroplating market

To gain a competitive edge over competitors in the electroplating market

To analyze the various technologies used in the electroplating market

To segment and forecast the electroplating market based on various parameters

To gain insights into the key industry players, their strategies and market share

Research Methodology

This research report is based on both primary and secondary data collection techniques. For the primary data collection, interviews with industry participants, market experts and key opinion leaders are done. Furthermore, the secondary data is gathered from whitepapers, forums, books, articles and journals. The secondary data is then analyzed and validated to ensure accuracy and reliability.

The market sizing and forecasting are done using the bottom-up approach. Data points from various sources are collected, aggregated, and synthesized for market analysis. The forecasts are validated using the top-down approach which helps to analyze the current and future trends of the electroplating market.

Moreover, Porter’s Five Forces Analysis, Industry Analysis and Market Dominance Analysis are conducted to understand and analyze the competitive landscape, market dynamics, and techno-economic factors influencing the market.

Conclusion

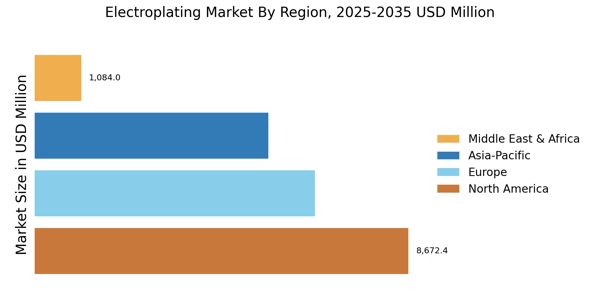

The report provides an insight into the key trends, challenges and opportunities in the electroplating market. Furthermore, the report provides a comprehensive analysis of the different technologies and product types used in the electroplating industry, their applications, and market potential in different geographical locations. Additionally, the report looks into the competitive landscape, key industry players and their strategies, and market shares. All these insights and analyses are expected to help stakeholders make informed decisions and gain a competitive edge in the electroplating market.