Government Incentives and Policies

Government incentives and policies are instrumental in driving the Energy Storage System Market. Many governments are implementing supportive frameworks to encourage the adoption of energy storage technologies. These include tax credits, grants, and subsidies aimed at reducing the financial burden on consumers and businesses. For example, in several regions, policies that mandate energy storage deployment alongside renewable energy projects are becoming more common. Such initiatives not only stimulate market growth but also align with broader energy transition goals. The cumulative effect of these policies is expected to result in a substantial increase in energy storage installations, with estimates suggesting a market growth rate of over 20% annually in the coming years.

Increased Focus on Energy Security

Increased focus on energy security is emerging as a critical driver for the Energy Storage System Market. As energy systems face challenges from geopolitical tensions and climate change, the need for reliable and resilient energy solutions is becoming more urgent. Energy storage systems provide a buffer against supply disruptions and enhance the reliability of energy supply. This is particularly relevant in regions that experience frequent power outages or have limited access to energy resources. The market for energy storage is expected to expand as businesses and governments prioritize energy independence and resilience. This trend indicates a growing recognition of the strategic importance of energy storage in ensuring a stable energy future.

Rising Demand for Electric Vehicles

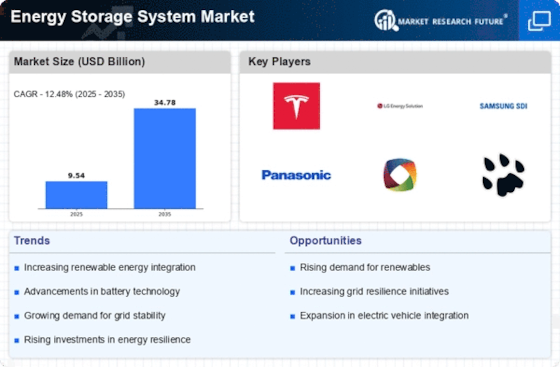

The rising demand for electric vehicles (EVs) is a significant driver for the Energy Storage System Market. As the automotive sector increasingly shifts towards electrification, the need for efficient energy storage solutions becomes paramount. EVs rely heavily on advanced battery technologies, which are also applicable to stationary energy storage systems. The Energy Storage System Market is projected to reach over 30 million units by 2030, creating a parallel demand for energy storage systems that can support charging infrastructure and grid stability. This interconnection between the EV market and energy storage solutions is likely to foster innovation and investment, further propelling the growth of the Energy Storage System Market.

Integration of Renewable Energy Sources

The integration of renewable energy sources, such as solar and wind, is a pivotal driver for the Energy Storage System Market. As the share of renewables in the energy mix increases, the need for energy storage solutions becomes more pronounced. Energy storage systems facilitate the balancing of supply and demand, ensuring that excess energy generated during peak production times can be stored and utilized when generation is low. According to recent data, the energy storage capacity is projected to reach 1,000 GWh by 2030, driven by the growing adoption of renewables. This trend not only enhances grid stability but also supports the transition towards a more sustainable energy landscape, thereby propelling the Energy Storage System Market forward.

Technological Innovations in Energy Storage

Technological innovations play a crucial role in shaping the Energy Storage System Market. Advancements in battery technologies, such as lithium-ion and solid-state batteries, have significantly improved energy density, efficiency, and lifespan. These innovations are expected to reduce costs and enhance the performance of energy storage systems, making them more accessible to a broader range of applications. For instance, the cost of lithium-ion batteries has decreased by approximately 89% since 2010, which has catalyzed the growth of the energy storage sector. Furthermore, emerging technologies like flow batteries and advanced thermal storage systems are likely to diversify the market, catering to various energy storage needs and applications.