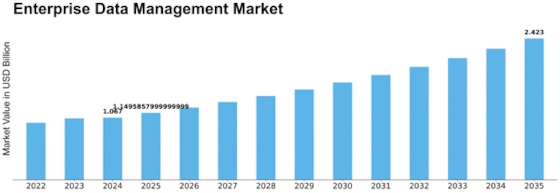

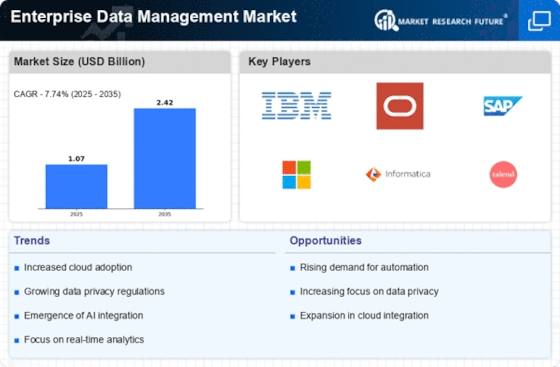

Enterprise Data Management Size

Enterprise Data Management Market Growth Projections and Opportunities

The Enterprise Data Management (EDM) market is a powerful scene formed by a heap of market factors that assume a critical part in its development and advancement. One of the essential drivers of this market is the remarkable development of data produced by organizations across different ventures. As associations progressively depend on data-driven dynamic cycles, the interest for vigorous EDM arrangements heightens. The sheer volume, speed, and assortment of data produced require modern devices and stages for powerful management.

Besides, administrative consistence is another vital element impacting the EDM market. With the execution of rigid data insurance regulations and security guidelines internationally, organizations are constrained to take on far reaching data management methodologies to guarantee consistence. This has prompted a flood in the reception of EDM arrangements that deal highlights like data administration, metadata management, and data quality confirmation, empowering associations to flawlessly explore the complex administrative scene.

The rising pervasiveness of distributed computing is additionally contributing altogether to the development of the EDM market. Cloud-based EDM arrangements give adaptability, adaptability, and openness, making them an appealing choice for organizations hoping to effectively oversee and examine their data. The shift towards cloud-based sending models lines up with the more extensive pattern of computerized change, where associations look to modernize their IT foundation for further developed dexterity and seriousness.

Moreover, the raising consciousness of the significance of data-driven bits of knowledge among organizations is cultivating the reception of EDM arrangements. Associations perceive the need to outfit the maximum capacity of their data resources for gain an upper hand and drive development. This mindfulness is driving interests in EDM devices that proposition progressed examination, AI, and man-made reasoning abilities, empowering organizations to get significant bits of knowledge from their data for vital navigation.

Nonetheless, difficulties, for example, data security concerns and the rising intricacy of data scenes present critical obstacles for the EDM market. As digital dangers keep on developing, organizations are focusing on data security, prompting a developing interest for EDM arrangements that consolidate vigorous security highlights. Moreover, the different and appropriated nature of data sources inside associations can muddle data management endeavors. This intricacy requires thorough arrangements that can flawlessly coordinate with different data vaults and guarantee a brought together perspective on the whole data biological system.

The cutthroat scene and merchant elements likewise assume a vital part in forming the EDM market. As the interest for EDM arrangements develops, various merchants are entering the market with different contributions. This opposition cultivates advancement, pushing sellers to persistently improve their answers and give extraordinary highlights to take care of explicit industry needs. The market is seeing vital organizations, consolidations, and acquisitions as merchants expect to reinforce their situation and grow their item portfolios to meet the advancing prerequisites of organizations.

Leave a Comment