Equine Healthcare Market Summary

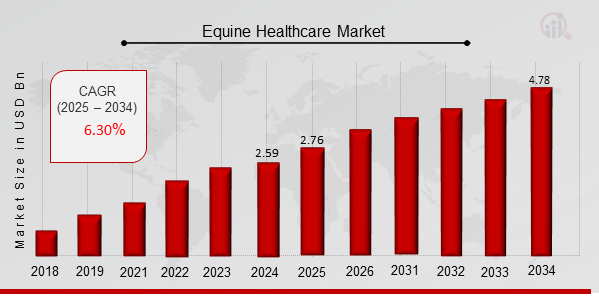

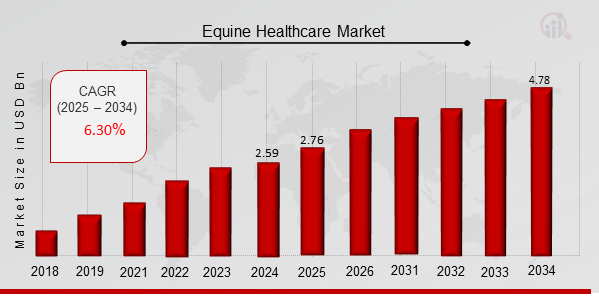

As per Market Research Future Analysis, the Global Equine Healthcare Market was valued at 2.59 USD Billion in 2024 and is projected to grow to 4.78 USD Billion by 2034, with a CAGR of 6.30% from 2025 to 2034. The growth is driven by factors such as rising equine disease prevalence, increased horse population, higher animal health spending, and growing public awareness of equine health benefits. The pharmaceuticals segment leads the market, while the sports/racing activity segment generates the most revenue. North America dominates the market, followed by Europe and Asia-Pacific, with significant growth expected in the latter region due to rising demand for equine healthcare products and government initiatives.

Key Market Trends & Highlights

Key trends driving the equine healthcare market include increased awareness and investment in animal health.

- Equine Healthcare Market Size in 2024: 2.59 USD Billion; Expected to reach 4.78 USD Billion by 2034.

- Pharmaceuticals segment dominated the market, driven by increased spending on equine medications.

- North America holds the largest market share, attributed to high animal health expenditures.

- Asia-Pacific expected to grow at the fastest CAGR from 2024 to 2034 due to rising equine disease prevalence.

Market Size & Forecast

2024 Market Size: USD 2.59 Billion

2034 Market Size: USD 4.78 Billion

CAGR (2025-2034): 6.30%

Largest Regional Market Share in 2024: North America

Major Players

Key players include Zoetis, Boehringer Ingelheim International GmbH, Ceva, MERCK & CO., INC., and IDEXX Laboratories, Inc.

The market's expansion is attributed to a number of market drivers, including an increase in the prevalence of equine diseases, an increase in the number of horses, an increase in animal health spending, an increase in demand for the use of horses for a variety of purposes, an increase in the development of equine healthcare products, an increase in public awareness of the value and advantages of using horses, and a surge in demand for pet insurance.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Equine Healthcare Market Trends

-

Rising awareness of animal healthcare is driving the market growth

The equine healthcare market will expand due to the rising awareness of animal healthcare. Animal health is essential not just for the safety and welfare of the animals themselves, but also for the safety and wellbeing of humans, as people are becoming more aware of the significance of animals in the ecosystem. Governments and commercial organisations are investing in the infrastructure development for animal healthcare in many different nations since human diseases can be easily transmitted from animals to humans. For instance, the US Department of Agriculture announced an S3 billion investment in animal nutrition and health in September 2021.

As a result, during the projected period, the market will experience expansion due to expanding human awareness of the value of animal healthcare and rising investment in this area.

The market's growth is attributed to a number of variables, including a rise in the incidence of equine diseases, an increase in the number of horses, a rise in animal health expenditures, a rise in demand for the use of horses for a variety of purposes, a rise in the development of equine healthcare products, a rise in public awareness of the value and advantages of using horses, and a rise in the demand for pet insurance. The equestrian industry includes horse breeding, keeping, and general management. The economy as a whole is significantly impacted by it.

The industry benefits equestrians, veterinarians, and other specialists. A supply and demand scenario for equine healthcare products is also included. The high economic impact of the horse industry is likely what is driving the equine healthcare market. Horse breeding is an important business in the equestrian sector. Choosing breeding stock and enhancing breed healthcare management are therefore essential to enhancing breeding operations. Another significant source of worry for breeders is equine illnesses. For instance, Potomac horse disease is widespread in the Caribbean and South America.o in

Another significant trend in the market is the release of innovative and potent products by major producers in the field of equine healthcare for the quick identification of illness in the equine population and for better treatment results. For instance, the VetTrue System, a remote temperature-monitoring system for horses, was released in June 2021 by Epona Biotec, a veterinarian startup devoted to improving equine health care. The VetTrue System was created by a group of experts in the veterinary, equestrian, and technology fields to offer veterinarians, horse owners, and equestrian industry professionals a more precise, less invasive health-monitoring system.

One-time use TailTab temperature sensors are used by the VetTrue System and are firmly fastened beneath the tail. As soon as the device is implanted, Bluetooth is used to wirelessly transmit the horse's temperature data to the VetTrue App. Thus, driving the equine healthcare market revenue.

Equine Healthcare Market Segment Insights

Equine Healthcare Product Insights

The equine healthcare market segmentation, based on product includes Vaccines, Pharmaceuticals, Medicinal Feed Additives, Diagnostics, Software & Services and Others. The pharmaceuticals segment dominated the market. There are many equine medications available, including analgesics, anti-inflammatory, anti-infectives, and parasiticides, that are used to treat reproductive, metabolic, infectious, and dermatological conditions in horses. Increased equestrian and general horse health spending has led to growth in the markets for both prescription and over-the-counter drugs.

Equine Healthcare Indication Insights

The equine healthcare market segmentation, based on indication, includes Musculoskeletal Disorders, Parasite Control, Internal Medicine, Equine Herpes Virus, Equine Encephalomyelitis, Equine Influenza, West Nile Virus, Tetanus and Others. The parasite control category generated the most income. There are various ways to administer parasiticides, including sprays, oral solutions, gels, collars, and spot-on treatments. Ectoparasiticides are used to treat external parasites, whereas endoparasiticides treat internal parasites. Additionally, they can be administered topically, intravenously, or orally. Assisting in the treatment of diseases brought on by amoebas, helminths, protozoa, and parasitic fungus.

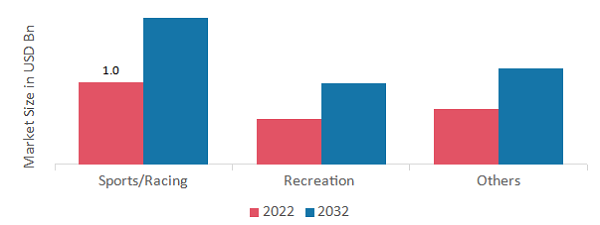

Equine Healthcare Activity Insights

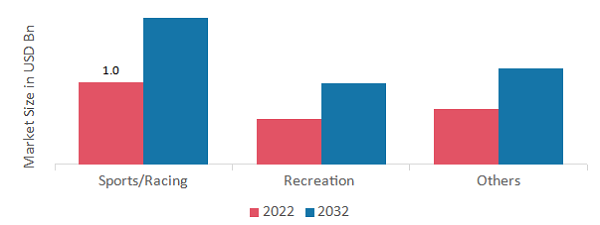

The equine healthcare market segmentation, based on activity, includes Sports/Racing, Recreation and Others. The sports/racing category generated the most income. This is due to a thriving horse sports and racing industry in important markets like the United Kingdom, the United States, the Netherlands, France, China, and Australia. About 8 disciplines in both normal and para-equestrian competition are recognized by the Fédération Équestre Internationale, an organization that oversees equestrian sports internationally.

Figure 1: Equine Healthcare Market, by Activity, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Equine Healthcare Distribution Channel Insights

The equine healthcare market segmentation, based on distribution channel, includes Veterinary Hospitals & Clinics, E-commerce and Others. The veterinary hospitals & clinics category generated the most income. The enormous volume of patients that these clinics see each year is a major reason in the rise. An expansion in the quantity of veterinary hospitals, clinics, and doctors in important marketplaces also fuels the industry.

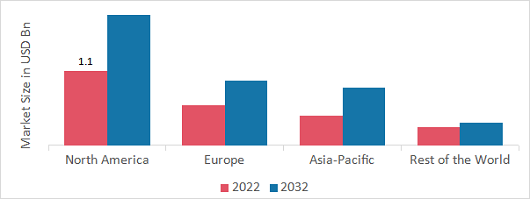

Equine Healthcare Regional Insights

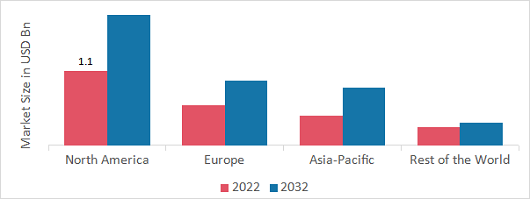

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American equine healthcare market area will dominate this market ascribed to elements like increased spending on animal health and the ease with which goods and services are accessible throughout developing nations. Overall, it is anticipated that in both developing and developed parts of North America, the demand for equine healthcare would increase significantly over the coming years.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: EQUINE HEALTHCARE MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe equine healthcare market accounts for the second-largest market share. The significant market share of the two regions can be linked to a number of factors, including a high adoption rate of horses per family, outstanding animal healthcare expenditures, the effect of animal welfare programs, a robust infrastructure for animal research, and the presence of important suppliers. Further, the German equine healthcare market held the largest market share, and the UK equine healthcare market was the fastest growing market in the European region

The Asia-Pacific Equine Healthcare Market is expected to grow at the fastest CAGR from 2024 to 2034. Some of the drivers driving the market include an increase in the demand for horse medicinal feeds, a growth in the prevalence of equine diseases, and an increase in government initiatives to promote equine health. Moreover, China’s equine healthcare market held the largest market share, and the Indian equine healthcare market was the fastest growing market in the Asia-Pacific region.

Equine Healthcare Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the equine healthcare market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, equine healthcare industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the equine healthcare industry to benefit clients and increase the market sector. In recent years, the equine healthcare industry has offered some of the most significant advantages to medicine. Major players in the equine healthcare market are attempting to increase market demand by investing in research and development operations includes Zoetis; Ceva; Boehringer Ingelheim International GmbH; SOUND; MERCK & CO., INC.; Hallmarq Veterinary Imaging; Vetoquinol S.A.; ESAOTE SPA; IDEXX Laboratories, Inc.; and Dechra Pharmaceuticals PLC.

With an emphasis on livestock and companion animals, Zoetis Inc. (Zoetis) is a firm that provides healthcare for animals. It discovers, develops, produces, and sells drugs, vaccinations, and diagnostic tools. It adds biodevices, genetic diagnostics, and precision livestock husbandry to its product line. In addition to other items, the company sells vaccinations, parasiticides, and medicated feed additives. Through its client supply services (CSS) organization, it also provides third parties with contract manufacturing services.

The research activities of Merck & Co. (Merck Animal healthcare) are dedicated on utilizing the most recent technologies. Through cutting-edge approaches in important therapeutic fields, the firm is committed to developing veterinary care. Merck & Co. would soon become a well-known player in Brazil and, by extension, Latin America, if it acquired Vallée S.A. During the projection period, Merck & Co. is likely to increase its market share in Latin America.

Key Companies in the equine healthcare market include

- Boehringer Ingelheim International GmbH

- Hallmarq Veterinary Imaging

Equine Healthcare Industry Developments

October 2022: For horse veterinarians, Vetoquinol S.A. introduced the Phovia dermatological system. As a part of a program to treat summer sores, phovia can aid in the healing of common horse dermatological issues such as surgical incisions, skin infections, and traumatic wounds.

September 2022: Hassinger Biomedical was the previous owner of the veterinary marketing and distribution rights for the ProVet APC (Autologous Platelet Concentrate) and ProVet BMC (Bone Marrow Concentrate) systems. As a result, their line of equine wellness products was greatly expanded.

November 2021: The model 109 of the Insta-Pulse Equine heart rate monitor was introduced by Biosig Instruments Inc.

Equine Healthcare Market Segmentation

Equine Healthcare Product Outlook (USD Billion, 2018-2032)

Equine Healthcare Activity Outlook (USD Billion, 2018-2032)

Equine Healthcare Distribution Channel Outlook (USD Billion, 2018-2032)

- Veterinary Hospitals & Clinics

Equine Healthcare Indication Outlook (USD Billion, 2018-2032)

- Musculoskeletal Disorders

Equine Healthcare Regional Outlook (USD Billion, 2018-2032)

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

2.59 (USD Billion)

|

|

Market Size 2025

|

2.76 (USD Billion)

|

|

Market Size 2034

|

4.78 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

6.30 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Indication, Activity, Distribution Channel, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Zoetis; Ceva; Boehringer Ingelheim International GmbH; SOUND; MERCK & CO., INC.; Hallmarq Veterinary Imaging; Vetoquinol S.A.; ESAOTE SPA; IDEXX Laboratories, Inc.; and Dechra Pharmaceuticals PLC. |

| Key Market Opportunities |

Growing number of equine diseases |

| Key Market Dynamics |

Spending on animal health is increasing, and more people are using animal insurance |

Frequently Asked Questions (FAQ):

The equine healthcare market size was valued at USD 2.3 Billion in 2022.

The market is projected to grow at a CAGR of 6.30% during the forecast period, 2025-2034.

North America had the largest share in the market

The key players in the market are Zoetis; Ceva; Boehringer Ingelheim International GmbH; SOUND; MERCK & CO., INC.; Hallmarq Veterinary Imaging; Vetoquinol S.A.; ESAOTE SPA; IDEXX Laboratories, Inc.; and Dechra Pharmaceuticals PLC.

The pharmaceuticals category dominated the market in 2022.

The veterinary hospitals & clinics category had the largest share in the market.