Advancements in Equine Nutrition

The equine healthcare market is being significantly influenced by advancements in equine nutrition, as horse owners become more aware of the impact of diet on health and performance. Innovative feed formulations and supplements are emerging, tailored to meet the specific needs of different equine breeds and activities. This trend is likely to enhance the overall well-being of horses, reducing the incidence of diet-related health issues. As a result, the demand for nutritional consulting and specialized veterinary services is expected to grow, further propelling the equine healthcare market. In 2025, the nutritional segment is projected to account for around 20% of the total market value.

Growing Investment in Equine Health

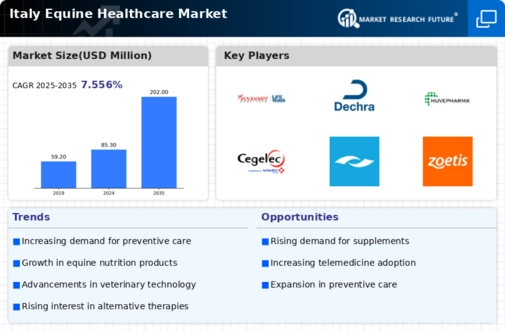

The equine healthcare market in Italy is experiencing a notable increase in investment, driven by both private and public sectors. This influx of capital is primarily directed towards enhancing veterinary services, improving facilities, and expanding research initiatives. In 2025, the market is projected to reach approximately €1.2 billion, reflecting a growth rate of around 5% annually. This financial commitment underscores the importance of equine health, as stakeholders recognize the economic benefits associated with a healthy equine population. Furthermore, the investment is likely to facilitate the development of innovative treatments and preventive measures, thereby enhancing the overall quality of care within the equine healthcare market.

Rising Popularity of Equestrian Sports

The equestrian sports sector in Italy is witnessing a surge in popularity, which is positively impacting the equine healthcare market. With an increasing number of individuals participating in activities such as show jumping, dressage, and eventing, the demand for specialized veterinary services is on the rise. In 2025, it is estimated that the equestrian sports industry will contribute approximately €300 million to the overall equine healthcare market. This growth is likely to drive the need for preventive care, routine check-ups, and specialized treatments, thereby creating new opportunities for veterinary professionals and service providers within the equine healthcare market.

Increased Focus on Equine Rehabilitation

The equine healthcare market is experiencing a shift towards rehabilitation services, as horse owners and trainers recognize the importance of recovery in maintaining equine health. This trend is driven by advancements in rehabilitation techniques and technologies, such as physiotherapy and hydrotherapy, which are becoming more accessible to equine professionals. The growing awareness of the benefits of rehabilitation is likely to lead to an increase in demand for specialized services, thereby expanding the equine healthcare market. In 2025, it is anticipated that rehabilitation services will represent a significant portion of the market, reflecting a broader understanding of holistic equine care.

Regulatory Support for Veterinary Practices

Regulatory frameworks in Italy are evolving to support the equine healthcare market, fostering a conducive environment for veterinary practices. Recent legislative changes have streamlined the approval processes for veterinary drugs and treatments, which may lead to quicker access to essential healthcare solutions for horses. Additionally, the Italian government has introduced incentives for veterinary professionals to pursue continuing education, thereby enhancing their skills and knowledge. This regulatory support is expected to bolster the equine healthcare market, as it encourages the adoption of best practices and innovative approaches in veterinary care, ultimately benefiting horse owners and equine athletes alike.