Increase in Horse Ownership

The equine healthcare market is experiencing growth due to an increase in horse ownership across South America. This trend is driven by a combination of factors, including the rise of recreational riding and the establishment of equestrian clubs. As more individuals acquire horses, the demand for healthcare services, including vaccinations, dental care, and nutritional products, is expected to rise. Market analysts project that the number of horse owners will increase by approximately 5% annually, leading to a corresponding growth in the equine healthcare market. This burgeoning ownership base underscores the need for comprehensive healthcare solutions tailored to the diverse needs of horse owners.

Expansion of Veterinary Services

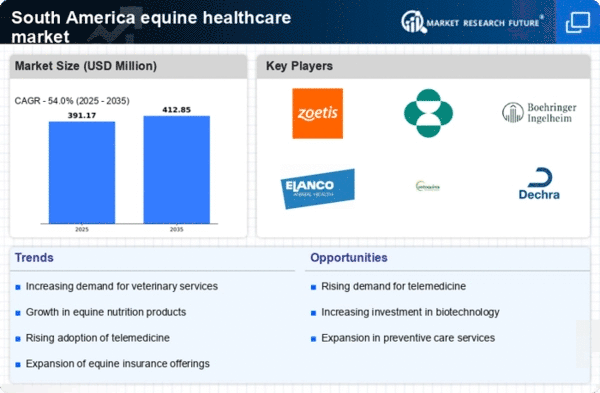

The equine healthcare market in South America is benefiting from the expansion of veterinary services, particularly in rural areas where access to quality care has historically been limited. The establishment of mobile veterinary clinics and telemedicine services is enhancing the availability of healthcare for horses. This trend is crucial as it addresses the needs of horse owners who may have previously faced challenges in accessing veterinary expertise. The increase in veterinary professionals specializing in equine care is also noteworthy, with a projected rise of 10% in the number of certified equine veterinarians over the next few years, thereby bolstering the equine healthcare market.

Growing Demand for Equine Sports

The equine healthcare market in South America is experiencing a notable surge in demand due to the increasing popularity of equestrian sports. Events such as show jumping, dressage, and polo are gaining traction, leading to a heightened focus on the health and performance of horses. This trend is reflected in the rising expenditure on veterinary services, supplements, and specialized care, which is projected to grow at an annual rate of approximately 8% over the next five years. As more individuals engage in equestrian activities, the need for comprehensive healthcare solutions tailored to athletic horses becomes paramount, thereby driving growth in the equine healthcare market.

Rising Awareness of Animal Welfare

In South America, there is a growing awareness regarding animal welfare, which significantly impacts the equine healthcare market. This heightened consciousness has led to increased advocacy for better living conditions and healthcare for horses. As a result, horse owners are more inclined to invest in preventive care, regular veterinary check-ups, and nutritional support. The market for equine healthcare products and services is expected to expand as owners prioritize the well-being of their animals. This shift in mindset is likely to contribute to a projected growth rate of around 6% in the sector, reflecting a commitment to ethical treatment and care.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools are transforming the equine healthcare market in South America. The introduction of advanced imaging techniques, such as MRI and ultrasound, is enabling veterinarians to diagnose conditions more accurately and efficiently. This not only improves treatment outcomes but also enhances the overall quality of care provided to horses. As these technologies become more accessible, the market is likely to witness a growth rate of approximately 7% as horse owners seek out cutting-edge solutions for their animals. The integration of technology into veterinary practices is thus a key driver of change within the equine healthcare market.