Ethyl Acetate Size

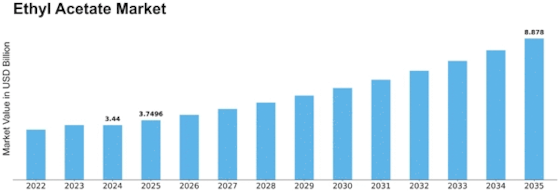

Ethyl Acetate Market Growth Projections and Opportunities

The ethyl acetate market is influenced by a variety of market factors that shape supply, demand, and pricing dynamics. One significant factor is the global economic conditions. Economic growth and stability drive industrial activities, which in turn affect the demand for ethyl acetate, a solvent commonly used in industries such as coatings, adhesives, and pharmaceuticals. During periods of economic expansion, there is typically higher demand for ethyl acetate as manufacturing activities increase. Conversely, economic downturns may lead to reduced demand as industries cut back on production.

Ethyl acetate is an organic compound that has so many uses, such as artificial fruit essences, artificial flavor, ice cream, cakes, tea and coffee, and nail polish. It is also known as ethyl ethanoate.

Another critical factor is the availability and cost of raw materials. Ethyl acetate is primarily produced through the esterification of ethanol with acetic acid, both of which are derived from petrochemical feedstocks. Fluctuations in the prices of these feedstocks, influenced by factors such as crude oil prices and supply disruptions, directly impact the production cost of ethyl acetate. Additionally, factors like government policies, trade regulations, and environmental considerations can affect the availability and cost of raw materials, further influencing the ethyl acetate market.

Technological advancements also play a significant role in the ethyl acetate market. Innovations in manufacturing processes, such as the development of more efficient catalysts or novel production methods, can lead to cost reductions and increased production capacity. These advancements contribute to the competitiveness of ethyl acetate producers and may influence market dynamics by altering supply levels and pricing structures.

Environmental regulations and sustainability initiatives are increasingly shaping the ethyl acetate market. As awareness of environmental issues grows, there is a growing emphasis on reducing volatile organic compound (VOC) emissions and adopting more sustainable production practices. Ethyl acetate, being a volatile organic compound, is subject to regulations aimed at controlling its emissions and promoting the use of eco-friendly alternatives. This regulatory landscape can impact both production processes and market demand for ethyl acetate, as industries seek to comply with regulations and meet sustainability goals.

Market competition is another key factor influencing the ethyl acetate market. The presence of multiple suppliers and producers fosters competition based on factors such as product quality, price, and customer service. Additionally, the entry of new players or the expansion of existing facilities can influence market dynamics by altering supply levels and intensifying price competition. Market players may also engage in strategic alliances, mergers, or acquisitions to strengthen their market position or gain access to new markets, further shaping the competitive landscape of the ethyl acetate market.

Moreover, consumer preferences and trends can impact the demand for ethyl acetate-containing products. For instance, the growing popularity of eco-friendly products may drive demand for coatings, adhesives, and solvents formulated with bio-based or low-VOC alternatives to ethyl acetate. Similarly, evolving trends in industries such as pharmaceuticals and food and beverage packaging can influence the use of ethyl acetate in these applications, affecting market demand patterns.

Leave a Comment