Top Industry Leaders in the Ethylene Propylene Diene Monomer Market

Ethylene propylene diene monomer (EPDM), a rubber with a name that rolls off the tongue like a mouthful of marbles, plays a surprisingly vital role in our everyday lives. From weatherproof roofing membranes and durable car parts to earthquake-resistant building materials and cozy shoe soles, EPDM's versatility and resilience make it a ubiquitous presence in the modern world. The global EPDM market is a fast-paced arena where established giants and nimble innovators vie for a share, wielding strategic maneuvers and cutting-edge formulations to gain traction on this rubbery road.

Strategies Sticking Around:

-

Product Diversification: Leading players like Dow are expanding beyond standard black EPDM to develop specialty grades featuring enhanced flame retardancy, improved low-temperature flexibility, or tailored electrical conductivity, catering to niche applications and demanding industries. -

Sustainability Focus: Green shoots are sprouting. Companies like Lanxess are investing in research and development of bio-based EPDM derived from renewable resources like corn oil, aligning with environmental concerns and regulations on fossil fuel-based materials. -

Technological Innovation: R&D labs are bubbling with concoctions. ExxonMobil is pioneering EPDM formulations with self-healing properties, promising extended product lifespan and reduced maintenance costs. -

Regional Expansion: Asia-Pacific, with its booming construction and automotive sectors, holds immense potential. Companies like LG Chem are setting up production facilities in this region to capitalize on the local demand. -

Strategic Partnerships: Collaboration strengthens the bond. For instance, DuPont partnered with a leading roofing manufacturer to develop customized EPDM membranes with superior weather resistance and fire retardancy, cementing both companies' positions in the construction market.

Factors Dictating Market Share:

-

Performance Prowess: Superior weather resistance, ozone resistance, chemical resistance, and long-term durability are crucial metrics. Established brands like Mitsui Chemicals have built reputations for reliable performance, attracting loyal customers in critical applications like roofing membranes and automotive seals. -

Cost-Effectiveness: Price remains a sticky point, particularly in mature markets. Chinese manufacturers often offer lower prices, challenging established players to optimize production and pricing strategies while maintaining quality. -

Regulatory Landscape: Stringent regulations on volatile organic compounds (VOCs) and hazardous materials dictate industry practices. Players who comply with these regulations, like Covestro with its closed-loop recycling systems, gain a competitive edge. -

Application Diversity: Catering to diverse industries offers resilience. Companies with broad product portfolios like Envision Polymers benefit from diversification, mitigating risks in saturated segments.

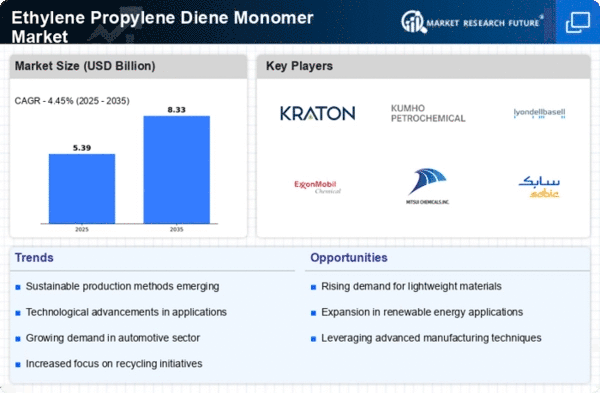

Key Players:

- Carlisle Companies Inc. (US)

- LANXESS AG (Germany)

- SK chemical Co. Ltd (South Korea)

- JSR Corporation (Japan)

- Mitsui Chemicals Inc. (Japan)

- Lion Elastomers (US)

- Sumitomo Chemical Co. Ltd (Japan)

- SABIC (Saudi Arabia)

Recent Developments:

November 2022, Lion Elastomers has chosen ChemSpec Canada Inc., a subsidiary of the Safic-Alcan Group, as its official distributor in Canada. Royalene EPDM, Royaledge EPDM, Royaltherm EPDM, Trilene Liquid EPDM, and other products will be distributed in Canada by the company.

October 2022, Arisan Kimya San ve Tic. A.S. (Arisan Kimya) has been named as Lion Elastomers' official distributor in Turkey for products such as Royalene EPDM, RoyalEdge EPDM, RoyalTherm Silicone Modified EPDM, Trilene Liquid EPDM, and Trilene FreeFlow EPDM.

July, 2022, Versalis has informed trade unions of his goals for industrial expansion. Versalis is likely to offer new grades of EPDM from its Ferrara factory, and it has confirmed a project in Ravenna to increase production of high-added-value thermoplastic elastomers for the automotive industries.