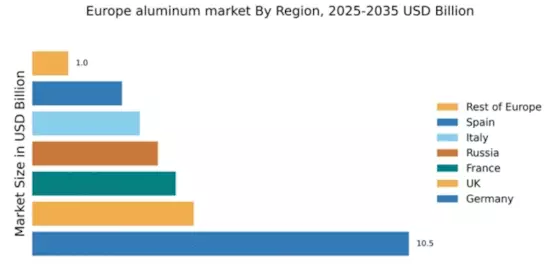

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 10.5% market share in the European aluminum sector, valued at approximately €12 billion. Key growth drivers include a robust automotive industry, increasing demand for lightweight materials, and government initiatives promoting sustainable manufacturing. Regulatory policies favor recycling and energy efficiency, while significant investments in infrastructure and industrial development bolster production capabilities.

UK : Innovation and Sustainability at Forefront

The UK aluminum market accounts for 4.5% of the European share, valued at around €5 billion. Growth is driven by advancements in technology and a shift towards sustainable practices. Demand is rising in construction and automotive sectors, supported by government policies aimed at reducing carbon emissions. The UK’s infrastructure development, particularly in renewable energy, further enhances market potential.

France : Strategic Location and Industrial Base

France captures 4.0% of the European aluminum market, valued at approximately €4.5 billion. The growth is propelled by diverse applications in aerospace, automotive, and packaging industries. Government initiatives focus on promoting circular economy practices, while regulatory frameworks support innovation. The country's strong industrial base and strategic location in Europe facilitate trade and investment.

Russia : Rich Resources and Competitive Pricing

Russia holds a 3.5% share of the European aluminum market, valued at about €3.5 billion. The country benefits from abundant natural resources and competitive pricing, driving demand in construction and manufacturing sectors. Government policies encourage foreign investment and infrastructure development, while local players like Rusal dominate the market landscape, enhancing competitiveness.

Italy : Key Player in European Market

Italy represents 3.0% of the European aluminum market, valued at approximately €3 billion. The growth is driven by a strong manufacturing base, particularly in automotive and machinery sectors. Regulatory policies promote energy efficiency and sustainability, while local demand trends favor lightweight materials. Key cities like Milan and Turin are central to industrial activities, fostering a competitive environment.

Spain : Strategic Growth in Aluminum Sector

Spain accounts for 2.5% of the European aluminum market, valued at around €2.5 billion. The growth is fueled by increasing demand in construction and automotive industries, supported by government initiatives for sustainable development. The competitive landscape features both local and international players, with cities like Barcelona and Madrid serving as key markets for aluminum applications.

Rest of Europe : Diverse Growth Across Smaller Regions

The Rest of Europe holds a modest 1.0% market share in the aluminum sector, valued at approximately €1 billion. Growth is driven by niche markets and emerging opportunities in various industries, including packaging and electronics. Regulatory frameworks across these regions support innovation and sustainability, while local players adapt to specific market needs, enhancing competitiveness.