Market Share

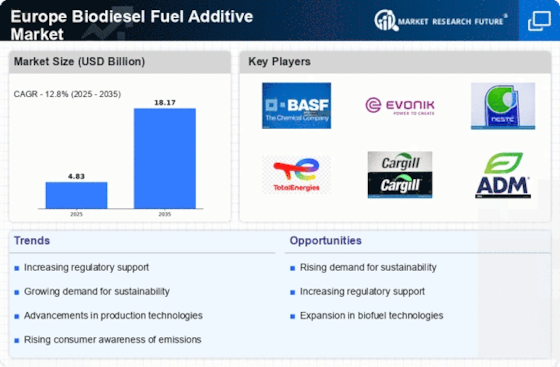

Europe Biodiesel Fuel Additive Market Share Analysis

The Europe Biodiesel Fuel Additive Market is a dynamic landscape, and market share positioning strategies play a pivotal role in determining the success of companies in this sector. Several key strategies contribute to the competitive positioning of businesses operating in the biodiesel fuel additive market in Europe. Companies often strive to stand out by offering unique and innovative biodiesel fuel additives. By focusing on research and development, firms can introduce products with enhanced performance, better compatibility, and improved environmental characteristics, thus gaining a competitive edge in the market. Collaboration is a key strategy to expand market reach. Forming partnerships with biodiesel producers, fuel suppliers, and distribution networks allows companies to leverage existing networks and gain access to a broader customer base. This approach helps in increasing market share by creating a mutually beneficial ecosystem. Ensuring that products comply with stringent environmental regulations is critical. Companies that invest in obtaining certifications for their biodiesel fuel additives demonstrate commitment to quality and environmental standards. This not only enhances credibility but also opens doors to markets where adherence to regulations is a prerequisite. Increasing market share involves educating customers about the benefits of biodiesel fuel additives. Companies looking to bolster their market share often explore opportunities in new regions. Expanding the geographic footprint allows businesses to tap into emerging markets and diversify their customer base. Understanding regional demands and tailoring products to specific needs can be a key driver for success. Competing on the basis of cost is a classic strategy. Streamlining production processes, optimizing supply chains, and achieving economies of scale can enable companies to offer competitive pricing. Cost-effective solutions attract budget-conscious consumers and contribute to increased market penetration. With growing environmental concerns, consumers are increasingly inclined towards sustainable and eco-friendly products. Companies investing in sustainable practices, such as using recycled materials or adopting green manufacturing processes, position themselves as environmentally responsible, attracting a segment of conscious consumers and enhancing market share. The biodiesel fuel additive market is dynamic, with technology and market trends constantly evolving. Companies that prioritize continuous innovation and adaptability to changing market conditions are better positioned to meet customer needs effectively. This adaptability ensures long-term relevance and sustained market share.

Leave a Comment