Germany : Germany's Pioneering Carbon Capture Efforts

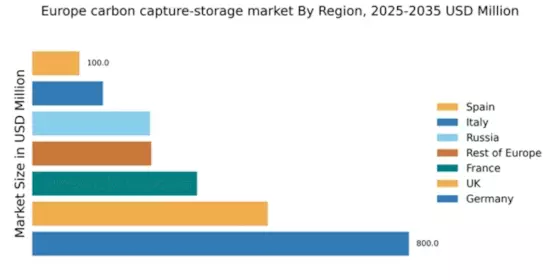

Germany holds a dominant market share of 800.0, representing approximately 31.6% of Europe's carbon capture-storage market. Key growth drivers include robust government policies aimed at reducing emissions, significant investments in renewable energy, and a strong industrial base. The German government has implemented initiatives like the Climate Protection Program 2030, which supports CCS technologies. Infrastructure development, particularly in industrial hubs like North Rhine-Westphalia, further fuels demand for carbon capture solutions.

UK : Driving Innovation in Carbon Management

The UK boasts a market value of 500.0, accounting for about 19.7% of the European market. The UK government has set ambitious targets for net-zero emissions by 2050, driving demand for CCS technologies. Key initiatives include the Carbon Capture Usage and Storage (CCUS) Strategy, which aims to establish CCS clusters in regions like Teesside and Humberside. The competitive landscape features major players like BP and Shell, who are investing heavily in CCS projects to meet regulatory requirements and market demand.

France : Balancing Industry and Environment

France's carbon capture-storage market is valued at 350.0, representing approximately 13.8% of the European total. The French government is committed to reducing emissions through its Multiannual Energy Program, which emphasizes CCS as a key technology. Demand is driven by the industrial sector, particularly in regions like Normandy and Provence-Alpes-Côte d'Azur, where heavy industries are prevalent. Major players like TotalEnergies are actively involved in developing CCS projects, enhancing the competitive landscape.

Russia : Potential in Carbon Management

With a market value of 250.0, Russia holds about 9.8% of the European CCS market. The country is beginning to recognize the importance of CCS in its climate strategy, driven by international pressure and domestic energy needs. Key initiatives are emerging, particularly in Siberia and the Arctic regions, where industrial activities are concentrated. The competitive landscape is still developing, with local players exploring partnerships with international firms like ExxonMobil to enhance their capabilities in CCS technologies.

Italy : Innovative Solutions for Emission Reduction

Italy's carbon capture-storage market is valued at 150.0, making up about 5.9% of the European market. The Italian government is increasingly focusing on CCS as part of its National Energy and Climate Plan, promoting investments in innovative technologies. Key markets include Lombardy and Emilia-Romagna, where industrial emissions are significant. The competitive landscape features local firms collaborating with international players like Chevron to develop CCS projects, enhancing the business environment for carbon management solutions.

Spain : Navigating Towards Carbon Neutrality

Spain's market value stands at 100.0, representing approximately 3.9% of the European CCS market. The Spanish government is committed to achieving carbon neutrality by 2050, with CCS playing a vital role in this transition. Key regions include Catalonia and Andalusia, where industrial emissions are high. The competitive landscape is evolving, with companies like Equinor exploring opportunities in Spain to establish CCS projects, reflecting a growing interest in carbon management solutions.

Rest of Europe : Regional Variations in Carbon Capture

The Rest of Europe accounts for a market value of 253.0, approximately 9.9% of the total European CCS market. This sub-region includes various countries with differing regulatory frameworks and industrial needs. Demand for CCS is driven by local initiatives aimed at reducing emissions, with countries like Norway and the Netherlands leading in technology adoption. The competitive landscape features a mix of local and international players, including Climeworks, who are expanding their footprint in the region.