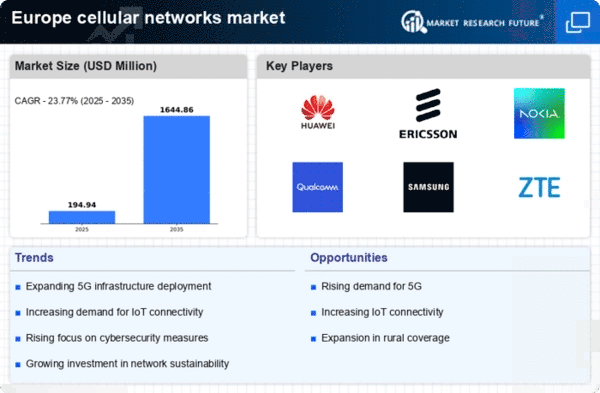

Rising Demand for Mobile Data Services

The demand for mobile data services in Europe is escalating, driven by the proliferation of smartphones and mobile applications. As of 2025, mobile data traffic is projected to increase by 40% annually, reflecting a shift in consumer behavior towards data-intensive applications such as streaming and gaming. This surge in demand compels network operators to enhance their infrastructure, thereby stimulating growth within the cellular networks market. The increasing reliance on mobile connectivity for both personal and professional use underscores the necessity for robust and reliable network services, prompting investments that could exceed €30 billion in the next few years.

Regulatory Support and Policy Frameworks

The regulatory landscape in Europe plays a pivotal role in shaping the cellular networks market. Governments are increasingly recognizing the importance of robust telecommunications infrastructure for economic growth. Initiatives such as the European Electronic Communications Code aim to streamline regulations and promote competition among service providers. This regulatory support is expected to lead to a 15% increase in market investments by 2027, as companies seek to comply with new standards and leverage opportunities for expansion. Furthermore, favorable policies regarding spectrum allocation are likely to enhance the efficiency of network operations, thereby fostering innovation within the cellular networks market.

Integration of IoT and Smart Technologies

The integration of Internet of Things (IoT) devices and smart technologies is transforming the cellular networks market in Europe. As industries adopt IoT solutions for automation and efficiency, the demand for reliable cellular connectivity is intensifying. It is estimated that by 2026, there will be over 1 billion connected IoT devices in Europe, necessitating a robust network infrastructure to support this growth. This trend is likely to drive investments in cellular networks, with projections indicating an increase of €20 billion in funding for IoT-related network enhancements. The ability to support a vast array of connected devices is crucial for the future of the cellular networks market.

Consumer Expectations for Enhanced Connectivity

Consumer expectations regarding connectivity are evolving, with users demanding faster, more reliable, and seamless mobile experiences. The cellular networks market in Europe must adapt to these changing preferences, as consumers increasingly rely on mobile services for everyday activities. Surveys indicate that 75% of users prioritize network reliability and speed when choosing a service provider. This shift in consumer behavior is likely to compel operators to invest in network upgrades and enhancements, potentially leading to a market growth of 10% by 2027. Meeting these expectations is essential for maintaining competitiveness in the cellular networks market.

Technological Advancements in Network Infrastructure

The cellular networks market in Europe is experiencing a surge in technological advancements, particularly with the rollout of 5G technology. This evolution is not merely about speed; it encompasses enhanced capacity, lower latency, and improved reliability. As of 2025, it is estimated that 5G networks will cover approximately 70% of the European population, facilitating new applications in IoT and smart cities. The investment in advanced network infrastructure is projected to reach €50 billion by 2026, indicating a robust commitment to modernizing cellular networks. This driver is crucial as it enables service providers to offer innovative solutions, thereby enhancing user experience and driving market growth.