Expansion of Smart Devices

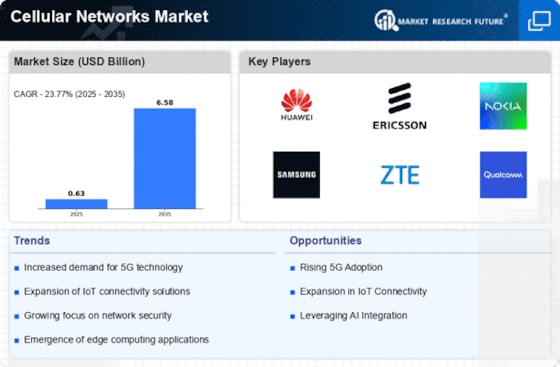

The proliferation of smart devices is significantly influencing the Cellular Networks Market. With the advent of smartphones, tablets, and wearables, the number of connected devices continues to rise exponentially. Reports suggest that the number of connected devices is expected to surpass 30 billion by 2025, creating an immense demand for robust cellular networks capable of supporting this connectivity. This surge in smart device adoption necessitates the enhancement of network capacity and reliability, prompting cellular network operators to invest in advanced technologies. As a result, the industry is likely to witness a shift towards more sophisticated network architectures, including the integration of 5G and beyond, to meet the evolving needs of consumers and businesses.

Emergence of Edge Computing

The emergence of edge computing is poised to transform the Cellular Networks Market. By processing data closer to the source, edge computing reduces latency and enhances the performance of applications reliant on real-time data. This trend is particularly relevant as the demand for low-latency applications, such as autonomous vehicles and augmented reality, continues to grow. The integration of edge computing with cellular networks is likely to enable more efficient data handling and improve overall network performance. As a result, cellular network providers may increasingly adopt edge computing solutions to meet the demands of modern applications, thereby driving innovation and enhancing service offerings within the industry.

Increased Focus on Cybersecurity

As the Cellular Networks Market evolves, the focus on cybersecurity has become increasingly paramount. With the rise of interconnected devices and the growing reliance on mobile networks for critical services, the potential for cyber threats has escalated. Network operators are now prioritizing the implementation of robust security measures to protect user data and maintain trust. This shift is likely to drive investments in advanced security technologies, including encryption and intrusion detection systems, as operators seek to safeguard their networks against potential breaches. Consequently, the emphasis on cybersecurity may influence the design and deployment of future cellular network infrastructures, ensuring they are resilient against emerging threats.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the Cellular Networks Market. Many governments are actively promoting the deployment of advanced cellular technologies to enhance national infrastructure and stimulate economic growth. For instance, regulatory frameworks are being established to facilitate the rollout of 5G networks, which are anticipated to drive innovation across various sectors. Additionally, public funding and incentives are often provided to encourage investment in telecommunications infrastructure. This supportive environment is likely to accelerate the adoption of new technologies, thereby fostering competition among service providers and enhancing the overall quality of cellular networks available to consumers.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver in the Cellular Networks Market. As consumers and businesses alike seek faster internet speeds for various applications, including streaming, gaming, and remote work, the need for advanced cellular networks becomes evident. According to recent data, the number of mobile broadband subscriptions has surged, with projections indicating that the number of 5G subscriptions could reach 1.5 billion by 2025. This trend underscores the necessity for network providers to enhance their infrastructure to accommodate the growing traffic and ensure seamless connectivity. Consequently, investments in cellular network technologies are likely to escalate, fostering competition among service providers and driving innovation within the industry.