Growing Aging Population

The global aging population is a significant driver of the Global Cellular Health Screening Market Industry. As individuals age, the risk of developing chronic diseases and cellular abnormalities increases, necessitating regular health screenings. The United Nations projects that the number of people aged 60 years and older will reach 2.1 billion by 2050, highlighting the urgent need for effective screening solutions. This demographic shift is likely to drive demand for cellular health screenings, as older adults seek to manage their health proactively. Consequently, the market is expected to experience substantial growth in response to the needs of this expanding population segment.

Government Initiatives and Funding

Government initiatives aimed at improving public health are playing a crucial role in the expansion of the Global Cellular Health Screening Market Industry. Many governments are investing in healthcare infrastructure and promoting screening programs to enhance early disease detection. For example, national health policies are increasingly incorporating cellular health screenings as essential components of preventive healthcare strategies. Such initiatives not only increase accessibility but also encourage research and development in screening technologies. As a result, the market is poised for growth, supported by favorable government policies and funding aimed at improving population health outcomes.

Rising Prevalence of Chronic Diseases

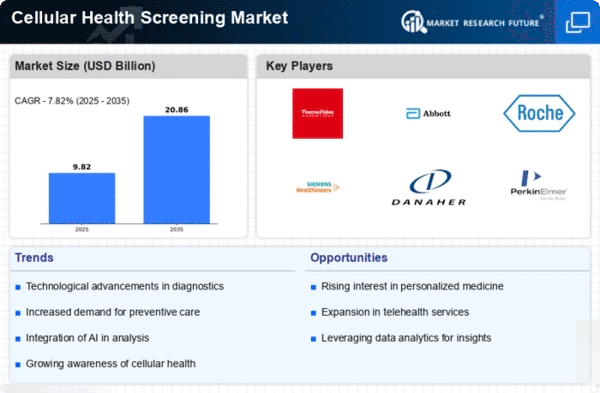

The increasing prevalence of chronic diseases globally is a primary driver for the Global Cellular Health Screening Market Industry. Conditions such as diabetes, cardiovascular diseases, and cancer are on the rise, necessitating early detection and management. For instance, the World Health Organization indicates that chronic diseases account for approximately 71% of all deaths worldwide. This trend underscores the importance of cellular health screening as a preventive measure. As awareness grows, the market is projected to reach 8.45 USD Billion in 2024, reflecting a heightened demand for screening technologies that can identify cellular anomalies early.

Increased Health Awareness and Preventive Care

There is a notable increase in health awareness among populations globally, which is propelling the Global Cellular Health Screening Market Industry. Individuals are becoming more proactive about their health, seeking preventive care and regular screenings to detect potential health issues early. Public health campaigns and educational initiatives are contributing to this trend, encouraging people to prioritize their cellular health. This shift towards preventive care is likely to drive market growth, with projections indicating that the market could reach 19.3 USD Billion by 2035 as more individuals opt for cellular health screenings as part of their routine healthcare.

Technological Advancements in Screening Methods

Technological innovations in cellular health screening methods are significantly influencing the Global Cellular Health Screening Market Industry. Advanced techniques such as next-generation sequencing and high-throughput screening are enhancing the accuracy and efficiency of cellular assessments. These advancements not only improve diagnostic capabilities but also reduce the time required for results, thereby facilitating timely interventions. The integration of artificial intelligence in data analysis further optimizes screening processes. As a result, the market is expected to grow at a CAGR of 7.8% from 2025 to 2035, driven by the continuous evolution of technology in healthcare.