Government Initiatives and Funding

Government initiatives aimed at improving mental health services play a significant role in driving the depression screening-mental-health market. The UK government has committed substantial funding to mental health programs, with an investment of over £2 billion in mental health services announced recently. These initiatives focus on enhancing access to screening and treatment for depression, particularly in underserved populations. By prioritizing mental health, the government encourages healthcare providers to adopt standardized screening practices, which may lead to earlier diagnosis and intervention. This proactive approach not only benefits individuals but also alleviates the broader societal burden of untreated mental health conditions. As a result, the depression screening-mental-health market is likely to experience sustained growth due to these supportive policies.

Growing Public Awareness and Advocacy

Public awareness and advocacy for mental health issues are crucial drivers of the depression screening-mental-health market. Campaigns aimed at reducing stigma surrounding mental health have gained momentum in recent years, encouraging individuals to seek help. This cultural shift is reflected in the increasing number of people willing to participate in screening programs. Organizations and charities are actively promoting the importance of mental health screenings, which may lead to higher engagement rates among the population. As awareness continues to grow, the demand for accessible and effective screening methods is likely to rise. This trend not only benefits individuals but also supports the overall development of the depression screening-mental-health market, as more resources are allocated to meet the needs of those seeking assistance.

Increased Focus on Preventative Healthcare

The shift towards preventative healthcare is influencing the depression screening-mental-health market significantly. There is a growing recognition that early intervention can mitigate the long-term effects of mental health disorders, including depression. This trend is reflected in the increasing integration of mental health screenings into routine health assessments. Healthcare providers are now more inclined to incorporate mental health evaluations as part of comprehensive care, which may lead to higher detection rates of depression. The emphasis on preventative measures aligns with public health goals, potentially reducing the overall healthcare costs associated with untreated mental health issues. As this focus on prevention continues, the depression screening-mental-health market is expected to expand, driven by the demand for early detection and intervention strategies.

Rising Prevalence of Mental Health Disorders

The increasing prevalence of mental health disorders in the UK is a critical driver for the depression screening-mental-health market. Recent data indicates that approximately 1 in 6 adults experience mental health issues, with depression being one of the most common conditions. This rising incidence necessitates effective screening methods to identify individuals in need of support. As awareness grows, healthcare providers are more likely to implement screening protocols, thereby expanding the market. The National Health Service (NHS) has recognized the importance of early detection, which may lead to increased funding and resources allocated to mental health services. Consequently, the depression screening-mental-health market is poised for growth as more individuals seek help and healthcare systems adapt to meet this demand.

Technological Innovations in Screening Tools

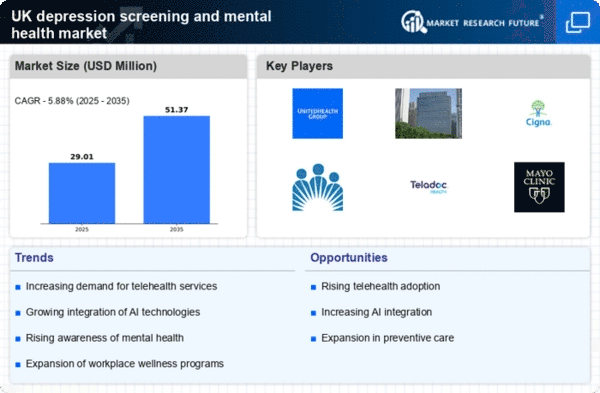

Technological innovations are transforming the landscape of the depression screening-mental-health market. The development of digital tools and mobile applications for mental health assessment is gaining traction in the UK. These technologies offer convenient and accessible screening options, allowing individuals to assess their mental health from the comfort of their homes. Furthermore, advancements in artificial intelligence and machine learning are enhancing the accuracy of screening tools, enabling more precise identification of depression symptoms. As these technologies become more widely adopted, they are likely to increase the overall efficiency of mental health services. The integration of technology into screening processes may also attract younger demographics, further expanding the market's reach and impact.