Aging Population and Mental Health Needs

Japan's demographic shift towards an aging population presents a unique challenge and opportunity for the depression screening-mental-health market. With over 28% of the population aged 65 and older, there is a significant need for mental health services tailored to older adults. This demographic is particularly vulnerable to depression, often exacerbated by isolation and health issues. As a result, healthcare providers are increasingly focusing on screening and intervention strategies for this age group. The market is likely to grow as more resources are allocated to address the mental health needs of the elderly.

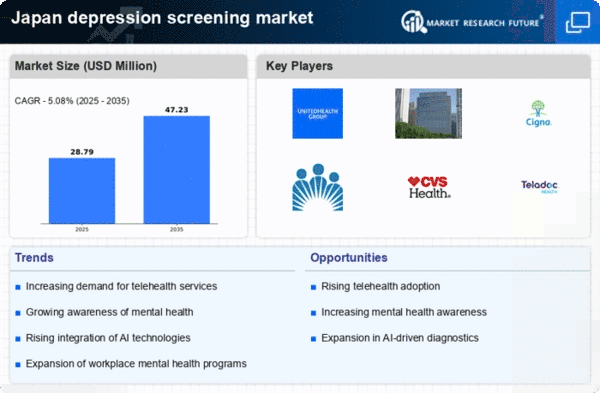

Rising Awareness of Mental Health Issues

In Japan, there is a growing awareness regarding mental health issues, particularly depression. depression screening services. Public campaigns and educational programs have been instrumental in reducing stigma associated with mental health, encouraging individuals to seek help. According to recent surveys, approximately 30% of the population acknowledges experiencing mental health challenges, which indicates a substantial market potential. As more people recognize the importance of mental health, the depression screening-mental-health market is expected to expand, with increased participation in screening programs and consultations.

Technological Advancements in Screening Tools

Technological advancements are playing a crucial role in the evolution of the depression screening-mental-health market in Japan. The development of digital tools and mobile applications for mental health assessment is gaining traction, allowing for more accessible and efficient screening processes. These innovations can potentially reach a broader audience, particularly younger populations who are more inclined to use technology for health-related issues. As these tools become more sophisticated and user-friendly, they are likely to enhance the overall effectiveness of screening efforts, thereby contributing to the growth of the market.

Integration of Mental Health into Primary Care

Integrating mental health services into primary care settings is increasingly prevalent in Japan. This approach facilitates early detection and intervention for depression, thereby enhancing the effectiveness of the depression screening-mental-health market. By training primary care providers to recognize and address mental health issues, the likelihood of individuals receiving timely screenings increases. Studies suggest that integrated care models can improve patient outcomes and reduce healthcare costs, making this a promising direction for the market. As more healthcare systems adopt this model, the demand for screening services is expected to rise.

Increased Investment in Mental Health Infrastructure

The Japanese government has recognized the necessity of improving mental health infrastructure, which is expected to bolster the depression screening-mental-health market. Recent budget allocations indicate a commitment to enhancing mental health services, with an increase of approximately 15% in funding for mental health programs. This investment aims to expand access to screening and treatment options, particularly in underserved areas. As facilities improve and more professionals enter the field, the market is poised for growth, providing better resources for individuals seeking mental health support.