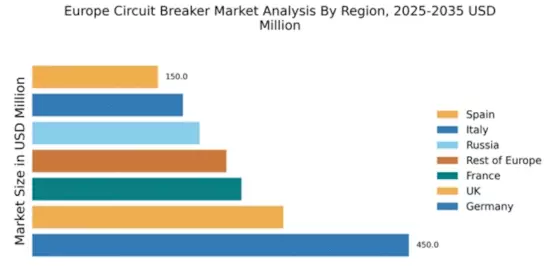

Germany : Strong industrial base drives growth

Germany holds a dominant position in the European circuit breaker market, accounting for 450.0 million, representing approximately 30% of the total market share. Key growth drivers include the robust manufacturing sector, increasing investments in renewable energy, and stringent safety regulations. The demand for advanced circuit protection solutions is rising, driven by the expansion of smart grid technologies and industrial automation. Government initiatives promoting energy efficiency further bolster market growth, alongside significant infrastructure development projects.

UK : Diverse applications fuel demand

The UK circuit breaker market is valued at 300.0 million, capturing about 20% of the European market. Growth is driven by the increasing need for reliable electrical systems in residential, commercial, and industrial sectors. The shift towards sustainable energy solutions and smart technologies is also influencing demand. Regulatory frameworks, such as the UK’s Energy Act, promote energy efficiency and safety, enhancing market prospects. The ongoing infrastructure upgrades in cities like London and Manchester further support growth.

France : Focus on energy efficiency and safety

France's circuit breaker market is valued at 250.0 million, representing 16.7% of the European market. The growth is propelled by the country's commitment to energy transition and the adoption of smart grid technologies. Demand is increasing for innovative circuit protection solutions that enhance safety and efficiency. Regulatory policies, including the Energy Transition for Green Growth Act, encourage investments in renewable energy and energy-efficient technologies, driving market expansion. The industrial sector, particularly in regions like Île-de-France, is a key consumer.

Russia : Infrastructure development drives demand

Russia's circuit breaker market is valued at 200.0 million, accounting for 13.3% of the European market. The growth is primarily driven by significant investments in infrastructure and energy projects, particularly in urban areas like Moscow and St. Petersburg. The demand for reliable electrical systems is increasing, supported by government initiatives aimed at modernizing the energy sector. The competitive landscape includes both local and international players, with a focus on adapting to local market needs and regulatory requirements.

Italy : Industrial growth fuels circuit breaker needs

Italy's circuit breaker market is valued at 180.0 million, representing 12% of the European market. The growth is driven by the resurgence of the manufacturing sector and increasing investments in renewable energy. Demand trends indicate a shift towards more efficient and reliable circuit protection solutions. Regulatory policies, including the National Energy Strategy, promote energy efficiency and safety standards. Key markets include Lombardy and Emilia-Romagna, where industrial activities are concentrated, fostering a competitive environment.

Spain : Focus on renewable energy integration

Spain's circuit breaker market is valued at 150.0 million, capturing 10% of the European market. The growth is driven by the increasing integration of renewable energy sources and the need for advanced electrical protection solutions. Government initiatives, such as the Renewable Energy Plan, support investments in smart grid technologies. Key markets include Catalonia and Madrid, where urbanization and industrial activities are prominent. The competitive landscape features both local and international players adapting to evolving market demands.

Rest of Europe : Varied growth across multiple countries

The Rest of Europe circuit breaker market is valued at 232.0 million, accounting for 15.5% of the total market. This sub-region encompasses a variety of countries, each with distinct market dynamics and growth drivers. Demand is influenced by local regulations, infrastructure projects, and industrial activities. Countries like the Netherlands and Belgium are focusing on energy efficiency and smart technologies, while Eastern European nations are investing in modernization. The competitive landscape includes a mix of regional and global players.