Growing Awareness of Soil Health

The growing awareness of soil health and its impact on agricultural productivity is influencing the copper fungicides market. Farmers are increasingly recognizing that healthy soil is fundamental to sustainable crop production. This awareness has led to a shift towards practices that enhance soil quality, including the use of copper fungicides, which can help manage soil-borne diseases. In Europe, initiatives promoting soil health have gained momentum, with investments in research and education aimed at improving soil management practices. As the focus on soil health intensifies, the copper fungicides market is expected to benefit from the integration of these products into holistic soil management strategies.

Increased Crop Disease Incidence

The rising incidence of crop diseases poses a significant challenge for European agriculture, thereby driving the copper fungicides market. Reports indicate that fungal infections have increased by approximately 15% over the past five years, leading to substantial crop losses. Farmers are compelled to seek effective solutions to protect their yields, and copper fungicides have emerged as a reliable option. These products not only provide effective disease control but also enhance the overall resilience of crops. As the agricultural sector grapples with the threat of diseases, the copper fungicides market is expected to witness heightened demand as growers prioritize crop protection strategies.

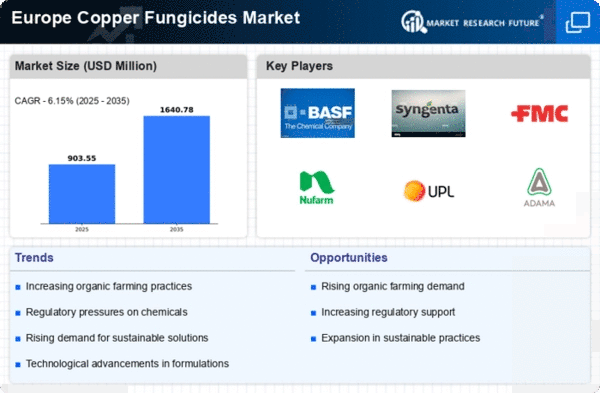

Rising Demand for Organic Produce

The increasing consumer preference for organic produce is a pivotal driver in the copper fungicides market. As health-conscious consumers seek food free from synthetic chemicals, the demand for organic farming practices has surged. This trend is reflected in the European market, where organic food sales reached approximately €45 billion in 2023, indicating a growth of around 10% annually. Consequently, farmers are adopting copper fungicides as a viable solution to combat fungal diseases while adhering to organic standards. The copper fungicides market is likely to benefit from this shift, as more growers recognize the efficacy of copper-based products in maintaining crop health without compromising organic integrity.

Technological Advancements in Agriculture

Technological advancements in agricultural practices are reshaping the copper fungicides market. Innovations such as precision agriculture and integrated pest management are enabling farmers to apply fungicides more efficiently and effectively. The adoption of drones and satellite imagery allows for targeted application, reducing waste and enhancing efficacy. This trend is particularly relevant in Europe, where the agricultural technology market is projected to grow by 12% annually, reaching €10 billion by 2026. As farmers increasingly leverage technology to optimize their operations, the copper fungicides market stands to gain from the enhanced application methods that improve crop protection outcomes.

Regulatory Framework Supporting Sustainable Practices

The regulatory framework in Europe is increasingly favoring sustainable agricultural practices, which is a crucial driver for the copper fungicides market. Policies aimed at reducing chemical inputs and promoting environmentally friendly solutions are gaining traction. The European Union's Farm to Fork Strategy, which aims to make food systems fair, healthy, and environmentally-friendly, is a prime example. This initiative encourages the use of copper fungicides as a sustainable alternative to synthetic chemicals, aligning with the EU's goal of reducing pesticide use by 50% by 2030. As regulations evolve, the copper fungicides market is likely to experience growth as farmers adapt to comply with these new standards.