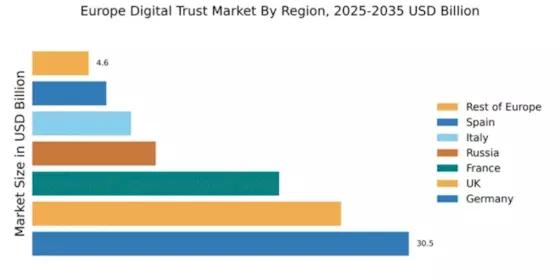

Germany : Strong Growth Driven by Innovation

Germany holds a commanding 30.5% market share in the digital trust sector, valued at approximately €1.5 billion. Key growth drivers include a robust industrial base, increasing cybersecurity threats, and a strong emphasis on data protection regulations like the GDPR. The demand for digital certificates and secure transactions is rising, fueled by e-commerce and digital transformation initiatives across various sectors. Government initiatives promoting digitalization further bolster this growth, supported by advanced infrastructure and a skilled workforce.

UK : Innovation and Regulation Drive Growth

The UK commands a 25.0% share of the digital trust market, valued at around €1.2 billion. Growth is driven by increasing online transactions, stringent data protection laws, and a thriving fintech sector. The UK government has implemented various initiatives to enhance cybersecurity, including the National Cyber Security Strategy, which encourages businesses to adopt secure digital practices. The demand for digital signatures and certificates is particularly high in finance and healthcare sectors, reflecting changing consumption patterns.

France : Regulatory Framework Enhances Security

France holds a 20.0% market share in the digital trust sector, valued at approximately €950 million. The growth is propelled by the increasing need for secure online transactions and compliance with the EU's eIDAS regulation. French businesses are increasingly adopting digital certificates to enhance security and trust in e-commerce. Government initiatives, such as the France 2030 plan, aim to boost digital innovation and infrastructure, further driving market demand.

Russia : Regulatory Changes Foster Growth

Russia's digital trust market accounts for 10.0% of the European share, valued at about €500 million. Key growth drivers include increasing internet penetration and a rising number of online businesses. The Russian government has introduced regulations to enhance cybersecurity, such as the Federal Law on Personal Data, which mandates secure data handling practices. This regulatory environment is fostering demand for digital certificates and secure communications across various sectors.

Italy : E-commerce Boosts Digital Trust Needs

Italy represents 8.0% of the digital trust market, valued at approximately €400 million. The growth is driven by the rapid expansion of e-commerce and increasing awareness of cybersecurity threats. Italian regulations, including the Digital Administration Code, promote secure digital transactions and data protection. The demand for digital signatures and certificates is particularly strong in the retail and finance sectors, reflecting changing consumer behaviors and business practices.

Spain : Evolving Regulations and Demand

Spain holds a 6.0% share of the digital trust market, valued at around €300 million. The growth is fueled by the increasing adoption of digital services and a focus on cybersecurity. The Spanish government has implemented various initiatives to enhance digital security, including the National Cybersecurity Strategy. The demand for digital certificates is particularly high in sectors like tourism and finance, driven by the need for secure online transactions and data protection.

Rest of Europe : Fragmented Market with Growth Potential

The Rest of Europe accounts for 4.57% of the digital trust market, valued at approximately €200 million. This sub-region includes various countries with differing regulatory environments and market dynamics. Growth is driven by increasing digitalization and the need for secure online transactions. Local governments are implementing regulations to enhance cybersecurity, creating opportunities for digital trust solutions. The competitive landscape is diverse, with both local and international players vying for market share.