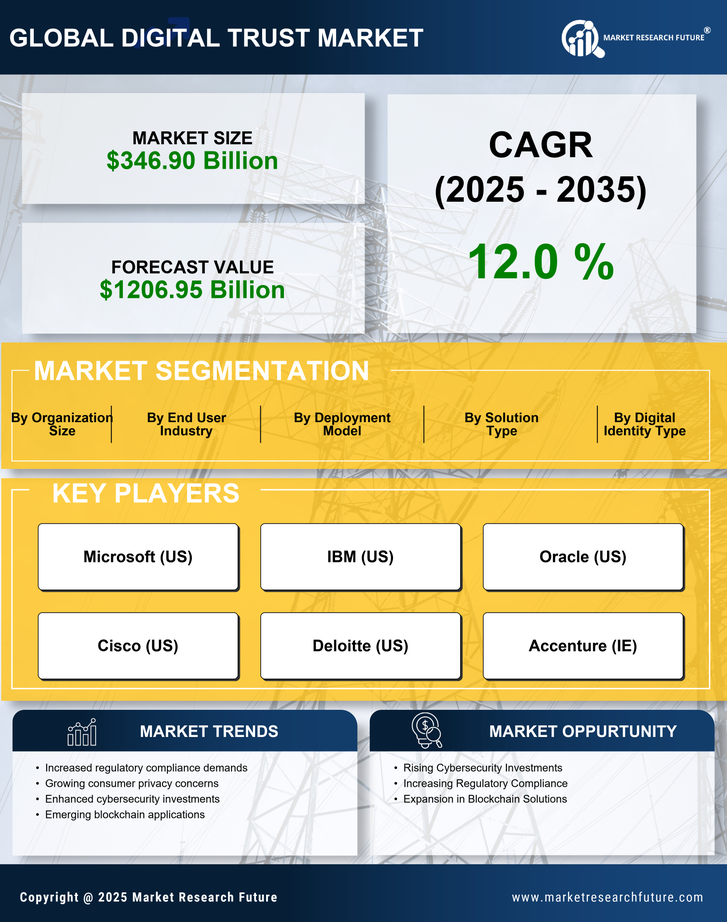

Emergence of Privacy Regulations

The Digital Trust Market is significantly influenced by the emergence of stringent privacy regulations. Governments worldwide are enacting laws aimed at protecting consumer data, which compels organizations to adopt comprehensive data protection strategies. For instance, regulations such as the General Data Protection Regulation (GDPR) have set high standards for data privacy, leading to increased compliance costs for businesses. As organizations strive to meet these regulatory requirements, the demand for digital trust solutions is expected to rise. In 2025, the market for compliance-related services within the Digital Trust Market is projected to grow by 15%, indicating a robust response to the evolving regulatory landscape.

Growing Awareness of Cyber Threats

The Digital Trust Market is propelled by a growing awareness of cyber threats among businesses and consumers alike. As cyberattacks become more sophisticated, organizations are increasingly recognizing the importance of safeguarding their digital assets. Reports indicate that cybercrime costs businesses over 6 trillion USD annually, underscoring the urgency for enhanced security measures. This heightened awareness drives investments in cybersecurity solutions, including identity verification and threat detection systems. Consequently, the Digital Trust Market is likely to expand as companies seek to mitigate risks and protect sensitive information from potential breaches.

Advancements in Blockchain Technology

The Digital Trust Market is witnessing transformative advancements in blockchain technology, which enhances transparency and security in digital transactions. Blockchain's decentralized nature offers a robust framework for verifying identities and securing data, making it an attractive solution for various sectors. In 2025, the blockchain technology market is projected to reach 67 billion USD, indicating its growing adoption across industries. This trend is likely to bolster the Digital Trust Market as organizations leverage blockchain to establish trust with consumers and partners, thereby fostering a secure digital ecosystem.

Rising Demand for Secure Digital Transactions

The Digital Trust Market experiences a notable surge in demand for secure digital transactions. As businesses increasingly shift towards online platforms, the necessity for robust security measures becomes paramount. In 2025, it is estimated that the value of secure digital transactions will reach approximately 10 trillion USD, reflecting a growing reliance on digital payment systems. This trend is driven by consumer expectations for seamless and secure transactions, compelling organizations to invest in advanced security solutions. Consequently, the Digital Trust Market is likely to witness significant growth as companies prioritize the implementation of encryption technologies and secure payment gateways to enhance consumer confidence.

Increased Investment in Digital Identity Solutions

The Digital Trust Market is characterized by increased investment in digital identity solutions, which are essential for establishing trust in online interactions. As digital services proliferate, the need for secure identity verification becomes critical. In 2025, the digital identity market is expected to exceed 30 billion USD, driven by the demand for solutions that enhance user authentication and prevent fraud. Organizations are increasingly adopting biometric technologies and multi-factor authentication to strengthen their identity management systems. This trend is likely to propel the Digital Trust Market forward, as businesses prioritize the protection of user identities in an increasingly digital world.