Growing Environmental Regulations

The tightening of environmental regulations across Europe is influencing the electric scooter-battery market. Governments are implementing stricter emissions standards and promoting the use of electric vehicles to combat air pollution and climate change. For example, the European Union has set ambitious targets to reduce greenhouse gas emissions by at least 55% by 2030. This regulatory environment is likely to encourage consumers and businesses to adopt electric scooters as a cleaner alternative to conventional vehicles. Consequently, the electric scooter-battery market is poised for growth as compliance with these regulations becomes increasingly essential.

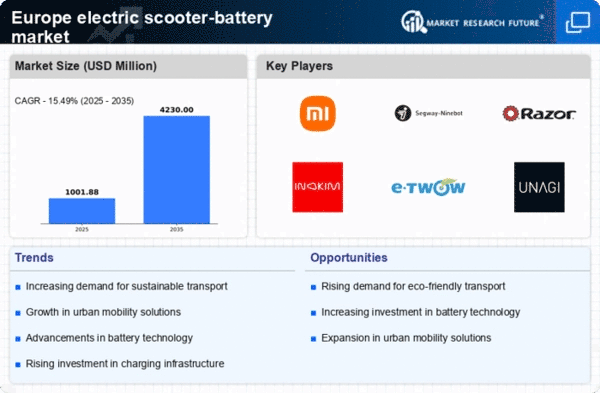

Advancements in Battery Technology

Innovations in battery technology are significantly impacting the electric scooter-battery market. Developments in lithium-ion and solid-state batteries are enhancing energy density, reducing charging times, and extending the lifespan of batteries. For instance, the introduction of fast-charging capabilities is likely to appeal to consumers who require quick recharges during their daily commutes. The market is witnessing a shift towards batteries that can provide longer ranges, with some models achieving up to 100 km on a single charge. This technological evolution is expected to drive consumer adoption and expand the electric scooter-battery market in Europe.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a pivotal factor driving the electric scooter-battery market in Europe. As more charging stations are installed in urban areas, the convenience of owning an electric scooter increases. This development is crucial for alleviating range anxiety among potential users. In 2025, it is estimated that the number of public charging points will exceed 500,000 across Europe, facilitating easier access to charging facilities. This growth in infrastructure is expected to enhance consumer confidence and encourage the adoption of electric scooters, thereby propelling the electric scooter-battery market forward.

Increased Focus on Cost-Effectiveness

As the electric scooter-battery market matures, cost-effectiveness is becoming a crucial driver for growth. Consumers are increasingly looking for affordable options that do not compromise on quality or performance. The average price of electric scooters has been decreasing, with many models now available for under €500. This trend is likely to attract a broader customer base, including budget-conscious individuals and families. Additionally, the long-term savings associated with electric scooters, such as lower maintenance and fuel costs, further enhance their appeal. This focus on affordability is expected to stimulate demand within the electric scooter-battery market.

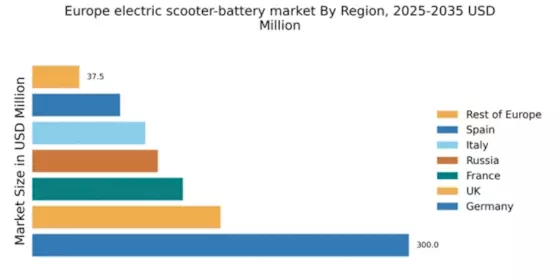

Rising Urbanization and Mobility Needs

The increasing urbanization across Europe is driving the demand for efficient and sustainable transportation solutions. As cities become more congested, the need for compact and eco-friendly vehicles, such as electric scooters, is becoming more pronounced. This trend is likely to boost the electric scooter-battery market, as consumers seek alternatives to traditional vehicles. In 2025, urban areas are projected to house over 75% of the European population, leading to a heightened focus on mobility solutions. The electric scooter-battery market is expected to benefit from this shift, as urban dwellers prioritize convenience and sustainability in their transportation choices.