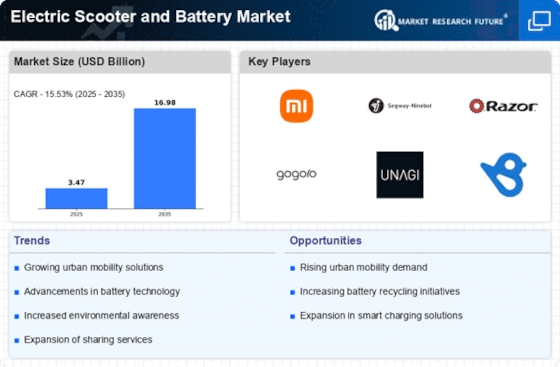

Urbanization and Mobility Needs

The increasing trend of urbanization is reshaping transportation dynamics, leading to a heightened demand for efficient mobility solutions. As urban populations swell, the Electric Scooter and Battery Market is witnessing a surge in interest, particularly in densely populated areas where traditional vehicles may be impractical. The convenience and compact nature of electric scooters make them an appealing choice for short-distance travel. According to recent data, urban areas are projected to account for a significant portion of electric scooter sales, with estimates suggesting that urban mobility solutions could grow by over 30% in the coming years. This shift indicates a clear opportunity for the Electric Scooter and Battery Market to cater to the evolving needs of urban commuters.

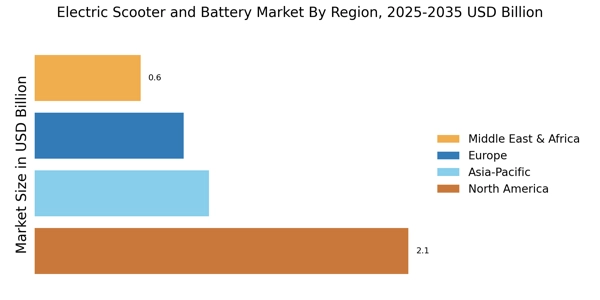

Increased Investment in Infrastructure

Investment in infrastructure to support electric mobility is crucial for the growth of the Electric Scooter and Battery Market. Cities are increasingly recognizing the need for dedicated lanes, charging stations, and parking facilities for electric scooters. This infrastructure development not only enhances the usability of electric scooters but also encourages more consumers to adopt them as a viable transportation option. Recent reports indicate that cities investing in electric mobility infrastructure are experiencing a rise in electric scooter usage by up to 50%. This trend underscores the importance of supportive infrastructure in fostering a conducive environment for the Electric Scooter and Battery Market, ultimately leading to greater market penetration.

Rising Fuel Prices and Economic Factors

Fluctuating fuel prices are prompting consumers to seek alternative transportation options, thereby boosting the Electric Scooter and Battery Market. As gasoline prices rise, the cost-effectiveness of electric scooters becomes increasingly attractive. Economic factors, including inflation and the rising cost of living, are also influencing consumer behavior, leading to a shift towards more affordable and sustainable modes of transport. Data indicates that in regions where fuel prices have surged, electric scooter sales have increased by as much as 40%. This trend suggests that economic pressures are likely to continue driving demand for electric scooters, positioning the Electric Scooter and Battery Market for sustained growth.

Environmental Regulations and Incentives

Stringent environmental regulations are increasingly influencing the transportation sector, driving the adoption of electric scooters. Governments are implementing policies aimed at reducing carbon emissions, which directly benefits the Electric Scooter and Battery Market. Incentives such as tax rebates and subsidies for electric vehicle purchases are becoming more common, encouraging consumers to opt for electric scooters over traditional gasoline-powered vehicles. Data indicates that regions with robust regulatory frameworks are experiencing faster growth in electric scooter adoption, with some markets reporting increases of up to 25% annually. This regulatory support not only fosters a favorable environment for the Electric Scooter and Battery Market but also aligns with broader sustainability goals.

Technological Advancements in Battery Technology

Innovations in battery technology are playing a pivotal role in enhancing the performance and appeal of electric scooters. The Electric Scooter and Battery Market is benefiting from advancements such as lithium-ion batteries, which offer improved energy density and faster charging times. These technological improvements are crucial in addressing consumer concerns regarding range anxiety and charging infrastructure. Recent studies suggest that the efficiency of battery systems is expected to improve by approximately 15% over the next few years, potentially leading to longer-lasting and more reliable electric scooters. As battery technology continues to evolve, the Electric Scooter and Battery Market is likely to see increased consumer confidence and adoption rates.