Integration of Smart Technologies

The integration of smart technologies into electric scooters is a key driver for the electric scooter-battery market. Features such as GPS navigation, mobile app connectivity, and advanced safety systems enhance user experience and convenience. As consumers increasingly demand smart solutions, manufacturers are incorporating these technologies into their products. In 2025, it is estimated that over 40% of new electric scooters will feature smart technology, which could significantly influence purchasing decisions. This trend indicates a shift towards more connected and user-friendly electric scooters, potentially increasing market penetration and driving growth in the electric scooter-battery market.

Advancements in Battery Technology

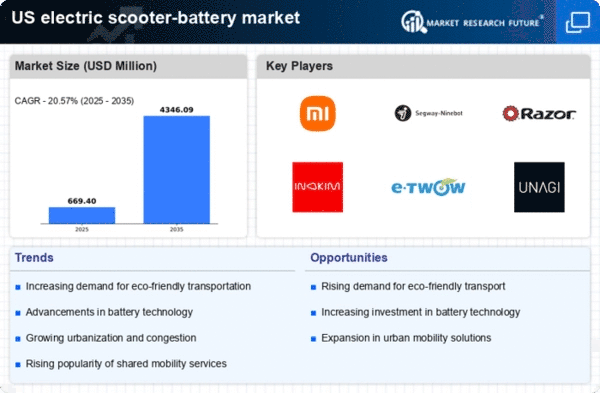

The electric scooter-battery market is significantly influenced by advancements in battery technology. Innovations such as lithium-ion and solid-state batteries enhance energy density, charging speed, and overall performance. These improvements not only extend the range of electric scooters but also reduce charging times, making them more appealing to consumers. In 2025, the average range of electric scooters is expected to increase to approximately 50 km on a single charge, which could boost adoption rates. As battery technology continues to evolve, the electric scooter-battery market is likely to see a surge in demand, with projections indicating a compound annual growth rate (CAGR) of around 15% through 2030.

Environmental Regulations and Policies

The electric scooter-battery market is shaped by stringent environmental regulations and policies aimed at reducing carbon emissions. In the US, various states have implemented laws promoting electric mobility, which encourages the adoption of electric scooters. For instance, California's Clean Air Act mandates a reduction in greenhouse gas emissions, indirectly boosting the electric scooter-battery market. As more states adopt similar regulations, the market is expected to expand, with estimates suggesting a potential increase in market size by 20% by 2026. This regulatory environment creates a favorable landscape for electric scooter manufacturers and battery producers, driving innovation and investment in the sector.

Rising Fuel Prices and Economic Factors

The electric scooter-battery market is also influenced by rising fuel prices and broader economic factors. As gasoline prices fluctuate, consumers increasingly seek cost-effective alternatives for daily commuting. Electric scooters, with lower operational costs compared to traditional vehicles, present an attractive option. In 2025, the average cost of operating an electric scooter is projected to be 60% lower than that of a gasoline-powered scooter. This economic advantage, coupled with the growing awareness of environmental issues, is likely to propel the electric scooter-battery market forward. The potential for savings on fuel and maintenance could lead to a market growth rate of approximately 12% annually over the next five years.

Increasing Urbanization and Traffic Congestion

The electric scooter-battery market is experiencing growth due to increasing urbanization and traffic congestion in major US cities. As urban populations expand, the demand for efficient and eco-friendly transportation solutions rises. Electric scooters, powered by advanced batteries, offer a practical alternative to traditional vehicles, reducing traffic congestion and lowering emissions. In 2025, urban areas are projected to account for over 70% of the US population, further driving the need for sustainable transport options. This trend suggests that the electric scooter-battery market will continue to thrive as cities seek to implement greener transportation initiatives, potentially leading to a market value exceeding $5 billion by 2027.