Growing Environmental Awareness

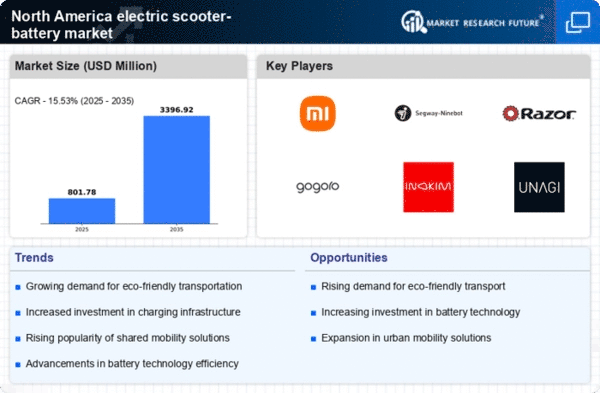

The increasing concern for environmental sustainability is driving the electric scooter-battery market in North America. Consumers are becoming more conscious of their carbon footprints and are seeking eco-friendly transportation alternatives. This shift in consumer behavior is reflected in the rising sales of electric scooters, which are perceived as a cleaner option compared to traditional gasoline-powered vehicles. In 2025, the market for electric scooters is projected to grow by approximately 15%, indicating a robust demand for electric scooter-battery solutions. As more individuals opt for electric scooters, the need for efficient and long-lasting batteries becomes paramount, thereby propelling advancements in battery technology within the electric scooter-battery market.

Integration of Smart Technologies

The integration of smart technologies into electric scooters is emerging as a key driver for the electric scooter-battery market in North America. Features such as GPS tracking, app connectivity, and advanced battery management systems are enhancing the user experience and promoting the adoption of electric scooters. These smart technologies not only improve the functionality of electric scooters but also optimize battery performance and longevity. As consumers increasingly seek tech-savvy solutions, the electric scooter-battery market is likely to see a surge in demand for scooters equipped with these innovations. In 2025, it is anticipated that smart electric scooters will account for over 25% of total sales, underscoring the importance of integrating technology into battery systems.

Urbanization and Traffic Congestion

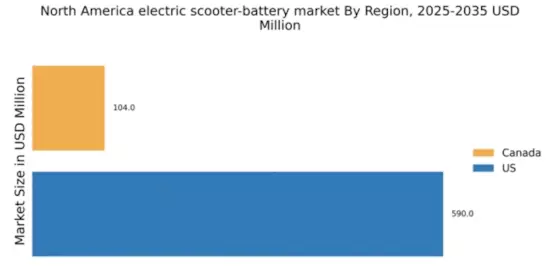

Rapid urbanization in North America is contributing to increased traffic congestion, prompting a shift towards electric scooters as a viable transportation solution. As cities expand, the demand for efficient and compact modes of transport rises. Electric scooters offer a practical alternative for short-distance travel, alleviating congestion on busy roads. The electric scooter-battery market is likely to benefit from this trend, as urban dwellers seek convenient and agile transportation options. In 2025, it is estimated that urban areas will see a 20% increase in electric scooter usage, further emphasizing the need for reliable battery systems that can support this growing demand.

Advancements in Charging Infrastructure

The development of charging infrastructure is a critical driver for the electric scooter-battery market in North America. As more charging stations are installed in urban areas, the convenience of using electric scooters increases, encouraging more users to adopt this mode of transport. The expansion of charging networks is expected to grow by 30% in the next few years, facilitating easier access to charging facilities. This improvement in infrastructure not only enhances the user experience but also supports the electric scooter-battery market by increasing the overall adoption rate of electric scooters. Consequently, the demand for high-capacity batteries that can withstand frequent charging cycles is likely to rise.

Cost Competitiveness of Electric Scooters

The declining costs of electric scooters and their batteries are making them more accessible to a broader audience in North America. As battery technology improves, the prices of lithium-ion batteries have decreased significantly, leading to lower overall costs for electric scooters. This trend is expected to continue, with battery prices projected to drop by 10% annually over the next few years. The electric scooter-battery market stands to gain from this cost competitiveness, as more consumers are likely to invest in electric scooters for their daily commutes. The affordability of electric scooters, combined with their environmental benefits, positions them as an attractive alternative to traditional vehicles.