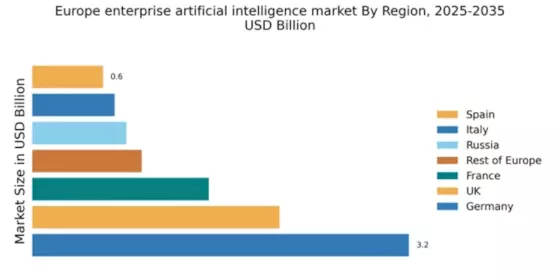

Germany : Strong Growth and Innovation Hub

Germany holds a commanding market share of 3.2% in the enterprise AI sector, driven by robust industrial automation and a strong focus on R&D. Key growth drivers include government initiatives like the AI Strategy 2025, which promotes AI integration across sectors. The demand for AI solutions is rising, particularly in manufacturing and automotive industries, supported by advanced infrastructure and a skilled workforce.

UK : Innovation and Investment Surge

The UK boasts a market share of 2.1% in the enterprise AI space, fueled by significant investments in tech startups and research. London, as a tech hub, drives demand for AI in finance and healthcare. Government policies, such as the National AI Strategy, encourage AI adoption, while a vibrant venture capital scene supports innovation. The competitive landscape features major players like Google and IBM, alongside emerging local firms.

France : Government Support and Innovation

France's enterprise AI market holds a 1.5% share, bolstered by government initiatives like the AI for Humanity strategy. This policy aims to position France as a leader in AI ethics and innovation. Demand is particularly strong in sectors like transportation and healthcare, with Paris emerging as a key market. The competitive landscape includes local firms and global giants like Microsoft, fostering a collaborative environment.

Russia : Potential for Rapid Growth

With a market share of 0.8%, Russia's enterprise AI sector is on the rise, driven by increasing digitalization across industries. Government initiatives, such as the Digital Economy program, aim to enhance AI capabilities. Key cities like Moscow and St. Petersburg are central to AI development, with a growing presence of local startups and international players like SAP, creating a competitive landscape.

Italy : Focus on Manufacturing and Services

Italy's enterprise AI market, with a share of 0.7%, is characterized by a strong focus on manufacturing and service sectors. Government initiatives, such as the National Plan for AI, aim to boost AI adoption. Key markets include Milan and Turin, where major players like IBM and local firms are active. The competitive landscape is evolving, with increasing collaboration between tech companies and traditional industries.

Spain : Investment in Tech and Innovation

Spain's enterprise AI market holds a 0.6% share, driven by investments in technology and innovation. The Spanish government promotes AI through initiatives like the AI Strategy 2022, focusing on sectors such as tourism and agriculture. Key cities like Barcelona and Madrid are emerging as AI hubs, with a mix of local startups and international firms like Amazon enhancing the competitive landscape.

Rest of Europe : Varied Growth and Opportunities

The Rest of Europe accounts for a market share of 0.93%, showcasing diverse AI adoption across various countries. Growth is driven by localized government initiatives and sector-specific demands. Countries like the Netherlands and Sweden are notable for their tech-friendly environments. The competitive landscape features a mix of local startups and established players, creating a dynamic business environment.