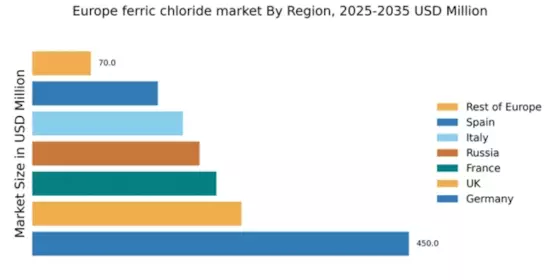

Germany : Strong Demand and Industrial Growth

Key markets include major industrial hubs like North Rhine-Westphalia and Bavaria, where significant consumption occurs. The competitive landscape features major players such as Ferrostaal and BASF, which have established strong market positions. Local dynamics are characterized by a focus on innovation and sustainability, with ferric chloride being widely used in sectors like water purification and electronics manufacturing. The business environment is favorable, supported by a skilled workforce and advanced infrastructure.

UK : Sustainable Practices Drive Market Growth

Key markets include London and Manchester, where water treatment facilities are concentrated. The competitive landscape features players like Kemira and Hawkins, which are well-positioned to meet the growing demand. Local market dynamics are influenced by a shift towards eco-friendly solutions, with ferric chloride being favored for its effectiveness in removing impurities. The business environment is competitive, with ongoing investments in infrastructure and technology to improve efficiency.

France : Diverse Applications Fuel Demand

Key markets include Île-de-France and Provence-Alpes-Côte d'Azur, where industrial activities are concentrated. The competitive landscape features major players like BASF and Tessenderlo Group, which dominate the market. Local dynamics are characterized by a focus on innovation and quality, with ferric chloride being utilized in sectors such as wastewater treatment and chemical synthesis. The business environment is supportive, with government initiatives promoting sustainable practices.

Russia : Industrial Growth Drives Consumption

Key markets include Moscow and St. Petersburg, where industrial consumption is high. The competitive landscape features both local and international players, with companies like Gulbrandsen gaining traction. Local market dynamics are influenced by a growing emphasis on environmental compliance, with ferric chloride being widely used in water purification and industrial processes. The business environment is evolving, with increasing investments in technology and infrastructure.

Italy : Key Player in Southern Europe

Key markets include Lombardy and Emilia-Romagna, where industrial activities are concentrated. The competitive landscape features players like Kemira and Ferrostaal, which have established strong positions. Local dynamics are characterized by a focus on quality and compliance, with ferric chloride being utilized in sectors such as wastewater treatment and food processing. The business environment is competitive, with ongoing investments in technology and innovation.

Spain : Focus on Water Treatment Solutions

Key markets include Catalonia and Madrid, where water treatment facilities are concentrated. The competitive landscape features players like Nouryon and PVS Chemicals, which are well-positioned to meet the growing demand. Local market dynamics are influenced by a shift towards eco-friendly solutions, with ferric chloride being favored for its effectiveness in removing impurities. The business environment is supportive, with ongoing investments in infrastructure and technology to improve efficiency.

Rest of Europe : Diverse Applications Across Regions

Key markets include smaller countries like Belgium and the Netherlands, where industrial activities are emerging. The competitive landscape features a mix of local and international players, with companies like Tessenderlo Group gaining traction. Local dynamics are characterized by a focus on quality and compliance, with ferric chloride being utilized in sectors such as wastewater treatment and food processing. The business environment is evolving, with increasing investments in technology and infrastructure.