Advancements in Chemical Formulations

Innovations in chemical formulations are playing a pivotal role in shaping the Ferric Chloride as Etchant Market. Recent advancements have led to the development of more efficient and effective ferric chloride solutions, enhancing etching precision and speed. These improvements are particularly relevant in the electronics sector, where the demand for high-quality etching processes is paramount. The introduction of formulations that minimize waste and improve recyclability could further stimulate market growth. As manufacturers seek to optimize their processes, the Ferric Chloride as Etchant Market is likely to benefit from these technological enhancements.

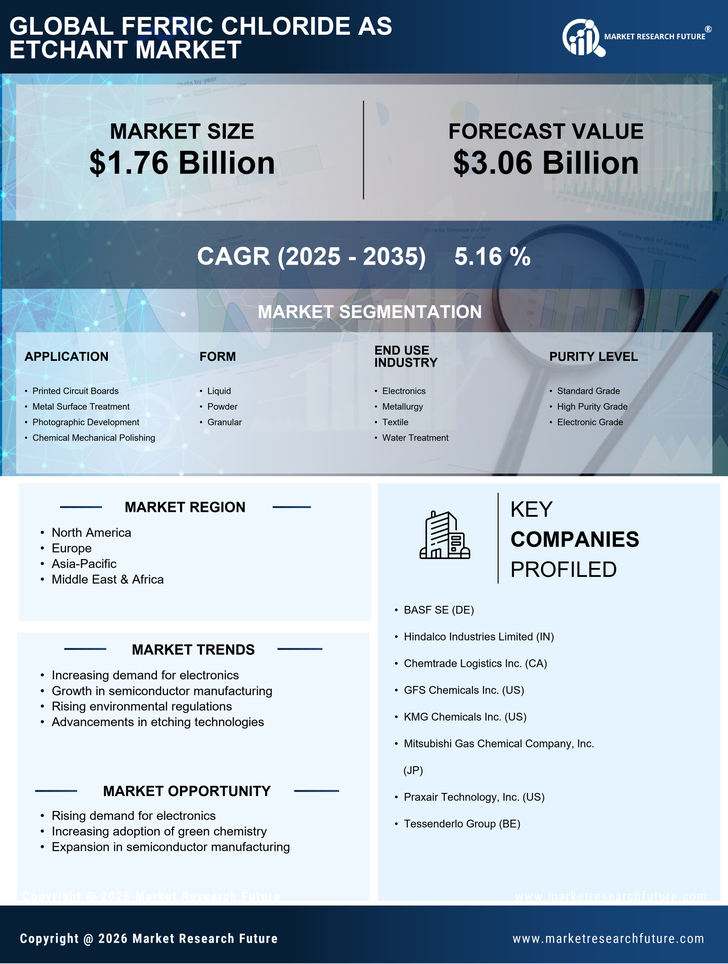

Emerging Markets and Industrial Growth

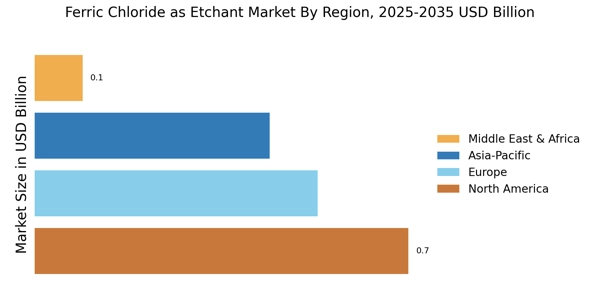

Emerging markets are becoming increasingly important for the Ferric Chloride as Etchant Market. As industrialization accelerates in various regions, the demand for etching solutions is likely to rise. Countries with burgeoning electronics and manufacturing sectors are expected to drive the consumption of ferric chloride. Market data suggests that regions such as Asia-Pacific are witnessing rapid industrial growth, which could lead to a significant increase in the use of ferric chloride as an etchant. This trend indicates a promising future for the Ferric Chloride as Etchant Market, as manufacturers in these regions seek reliable etching solutions to support their expanding operations.

Environmental Regulations and Compliance

The Ferric Chloride as Etchant Market is significantly influenced by stringent environmental regulations aimed at reducing hazardous waste. As industries face increasing pressure to comply with environmental standards, the demand for safer etching alternatives has risen. Ferric chloride, being less toxic compared to other etchants, positions itself as a favorable option for manufacturers. Regulatory bodies are emphasizing the need for sustainable practices, which could potentially enhance the market for Ferric Chloride as an etchant. The industry may witness a shift towards more eco-friendly solutions, thereby driving the adoption of ferric chloride in various applications.

Rising Demand in Electronics Manufacturing

The Ferric Chloride as Etchant Market is experiencing a notable surge in demand, primarily driven by the expanding electronics manufacturing sector. As electronic devices become increasingly sophisticated, the need for precise etching processes has intensified. Ferric chloride, known for its effectiveness in etching printed circuit boards (PCBs), plays a crucial role in this process. Recent data indicates that the electronics sector is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years. This growth is likely to bolster the Ferric Chloride as Etchant Market, as manufacturers seek reliable and efficient etching solutions to meet the rising production demands.

Increased Adoption in Solar Panel Production

The Ferric Chloride as Etchant Market is witnessing increased adoption in the solar panel production sector. As the demand for renewable energy sources rises, manufacturers are turning to ferric chloride for its effectiveness in etching silicon wafers used in solar cells. This trend is expected to grow, with the solar energy market projected to expand significantly in the coming years. The efficiency of ferric chloride in producing high-quality solar panels positions it as a key player in this evolving market. Consequently, the Ferric Chloride as Etchant Market may experience substantial growth driven by the renewable energy sector.