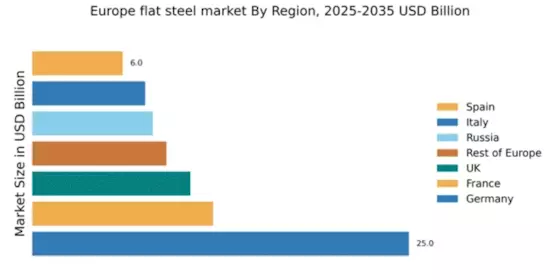

Germany : Strong industrial base drives growth

Germany holds a commanding 25.0% share of the European flat steel market, valued at approximately €10 billion. Key growth drivers include robust automotive and machinery sectors, which are increasingly demanding high-quality flat steel products. Government initiatives aimed at reducing carbon emissions are also influencing production methods, pushing for more sustainable practices. Infrastructure investments, particularly in renewable energy projects, are further boosting demand for flat steel.

UK : Diverse applications fuel demand

The UK flat steel market accounts for 10.5% of the European share, valued at around €4 billion. Growth is driven by the construction and automotive sectors, with increasing demand for lightweight and high-strength materials. Regulatory policies focused on sustainability are prompting manufacturers to adopt greener technologies. The ongoing recovery from the pandemic is also contributing to a resurgence in demand, particularly in urban development projects.

France : Strong industrial demand persists

France captures 12.0% of the European flat steel market, valued at approximately €5 billion. The automotive and construction industries are primary growth drivers, with a shift towards advanced manufacturing techniques. Government policies promoting energy efficiency and sustainability are reshaping production practices. Additionally, investments in infrastructure projects, such as rail and road networks, are expected to sustain demand for flat steel.

Russia : Resource-rich and expanding

Russia holds an 8.0% share of the European flat steel market, valued at about €3 billion. The country's vast natural resources and growing industrial base are key growth drivers. Demand is particularly strong in the energy and construction sectors, supported by government initiatives to modernize infrastructure. However, geopolitical tensions and regulatory challenges may impact market stability and growth prospects.

Italy : Manufacturing sector remains robust

Italy accounts for 7.5% of the European flat steel market, valued at approximately €2.8 billion. The automotive and construction sectors are significant demand drivers, with a focus on high-quality and innovative steel products. Regulatory frameworks promoting sustainability are encouraging manufacturers to invest in cleaner technologies. The competitive landscape includes major players like ArcelorMittal and Thyssenkrupp, which dominate the market.

Spain : Construction and automotive thrive

Spain represents 6.0% of the European flat steel market, valued at around €2.2 billion. The construction and automotive industries are the primary growth drivers, with increasing investments in infrastructure projects. Government initiatives aimed at boosting local manufacturing and sustainability are also influencing market dynamics. Major players like ArcelorMittal have a significant presence, contributing to a competitive landscape.

Rest of Europe : Varied demand across regions

The Rest of Europe holds an 8.91% share of the flat steel market, valued at approximately €3.5 billion. This sub-region encompasses various countries with distinct market characteristics and demand drivers. Key sectors include construction, automotive, and energy, with varying regulatory environments influencing production practices. Local players and international firms compete for market share, adapting to regional needs and preferences.