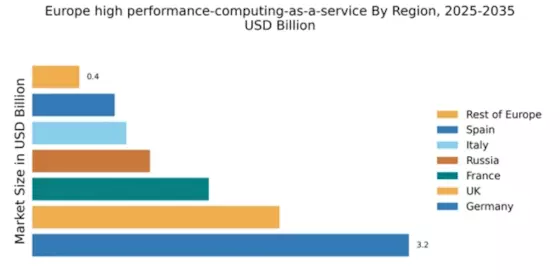

Germany : Strong Infrastructure and Innovation Hub

Germany holds a dominant market share of 3.2% in the high-performance computing-as-a-service (HPCaaS) sector, driven by robust industrial growth and significant investments in technology. Key growth drivers include a strong focus on research and development, government initiatives promoting digital transformation, and a growing demand for data analytics and AI applications. The regulatory environment is supportive, with policies aimed at enhancing cloud computing capabilities and infrastructure development across various sectors.

UK : Innovation and Financial Services Focus

The UK commands a market share of 2.1% in the HPCaaS landscape, fueled by a vibrant tech ecosystem and a strong emphasis on financial services. Demand is driven by the need for advanced data processing capabilities, particularly in sectors like finance, healthcare, and academia. The UK government has initiated several programs to enhance digital infrastructure, including investments in 5G and cloud technologies, which are pivotal for HPCaaS growth.

France : Government Support and Research Initiatives

France's HPCaaS market holds a share of 1.5%, supported by government initiatives aimed at boosting digital transformation and innovation. The demand for HPCaaS is growing in sectors such as aerospace, automotive, and pharmaceuticals, driven by the need for complex simulations and data analysis. Regulatory frameworks are evolving to support cloud adoption, with a focus on data sovereignty and security, enhancing the attractiveness of HPCaaS solutions.

Russia : Focus on National Security and Innovation

Russia's HPCaaS market, with a share of 1.0%, is characterized by strategic investments in technology to enhance national security and innovation. The government is actively promoting the development of domestic cloud services and HPC capabilities, driven by the need for advanced computing in defense and scientific research. Local demand is increasing, particularly in sectors like energy and telecommunications, supported by favorable regulatory policies.

Italy : Cultural Heritage and Industrial Growth

Italy's HPCaaS market, accounting for 0.8%, is gradually evolving, driven by the need for advanced computing in cultural heritage preservation and industrial applications. Key growth drivers include investments in research and development, particularly in the automotive and manufacturing sectors. The Italian government is implementing policies to enhance digital infrastructure, which is crucial for the growth of HPCaaS services across various industries.

Spain : Focus on Tourism and Agriculture

Spain's HPCaaS market, with a share of 0.7%, is witnessing growth driven by sectors such as tourism and agriculture, where data analytics plays a crucial role. The government is promoting digital transformation initiatives, including investments in cloud computing and HPC infrastructure. Local demand is increasing as businesses seek to leverage data for improved decision-making and operational efficiency, supported by favorable regulatory frameworks.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe accounts for a market share of 0.4% in the HPCaaS sector, characterized by diverse market dynamics and varying levels of adoption. Countries in this category are increasingly recognizing the importance of HPCaaS for enhancing competitiveness in sectors like manufacturing, healthcare, and research. Government initiatives aimed at fostering digital innovation and cloud adoption are becoming more prevalent, creating opportunities for growth in this segment.