High-Performance Computing as a Service Market Summary

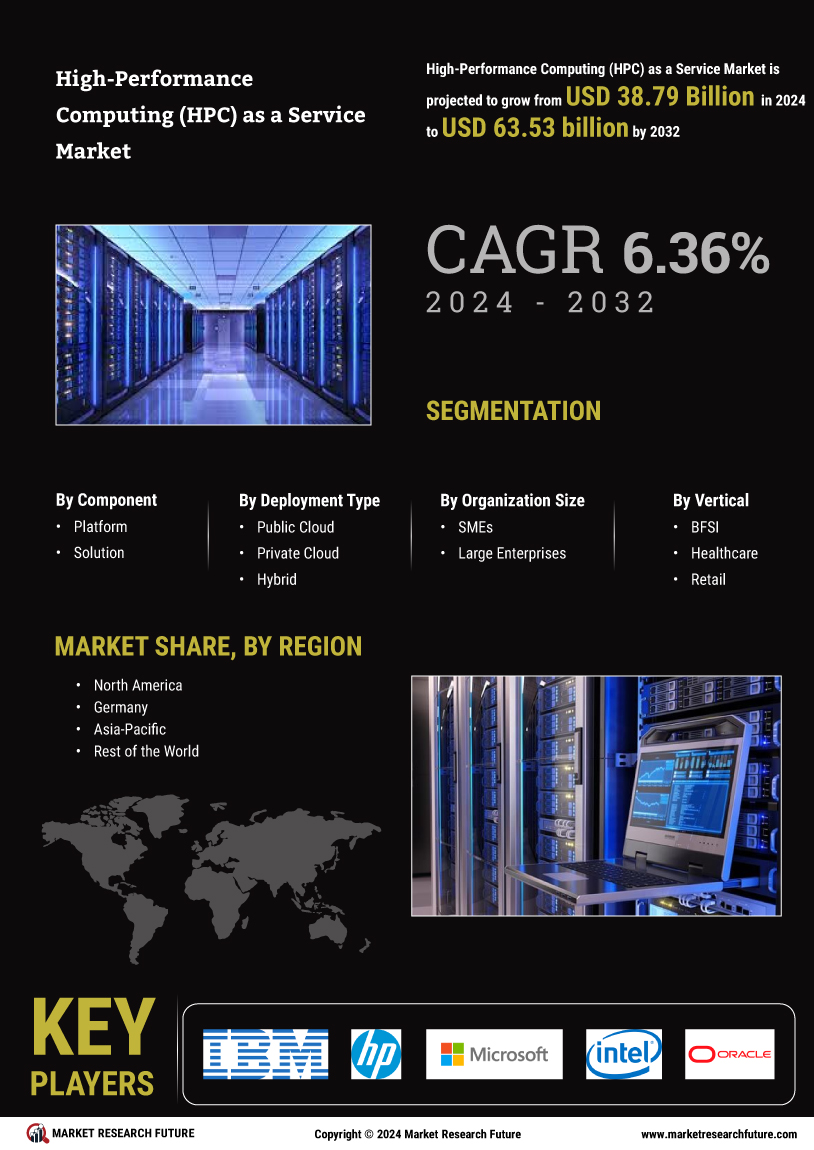

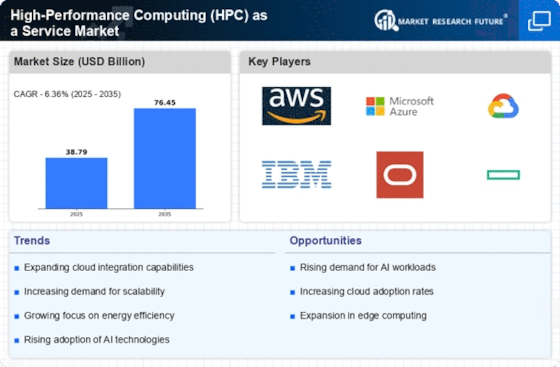

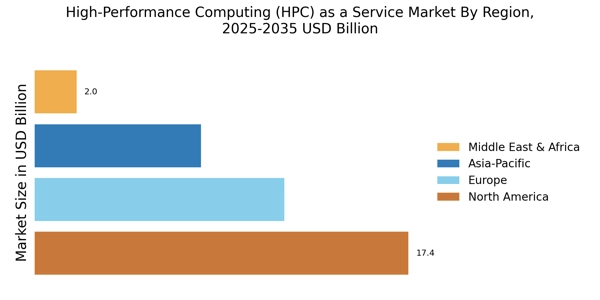

As per Market Research Future analysis, the High-Performance Computing (HPC) as a Service Market Size was estimated at 38.79 USD Billion in 2024. The HPC as a Service industry is projected to grow from 41.26 USD Billion in 2025 to 76.45 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.36% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The High-Performance Computing (HPC) as a Service Market is experiencing robust growth driven by technological advancements and increasing demand for data processing capabilities.

- Cloud adoption continues to rise, enhancing scalability and flexibility for HPC solutions.

- The integration of AI and machine learning technologies is transforming HPC applications across various industries.

- Cost efficiency remains a focal point, as organizations seek to optimize their computing resources.

- Rising demand for data-intensive applications and advancements in cloud technology are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 38.79 (USD Billion) |

| 2035 Market Size | 76.45 (USD Billion) |

| CAGR (2025 - 2035) | 6.36% |

Major Players

Amazon Web Services (US), Microsoft Azure (US), Google Cloud (US), IBM (US), Oracle (US), Hewlett Packard Enterprise (US), NVIDIA (US), Alibaba Cloud (CN), Fujitsu (JP)