Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the high performance-computing-as-a-service market. Organizations are increasingly seeking ways to optimize their IT expenditures while maintaining high computational capabilities. By utilizing high performance-computing-as-a-service, companies can avoid the substantial upfront costs associated with purchasing and maintaining physical hardware. Instead, they can leverage a pay-as-you-go model, which allows for better budget management and resource allocation. This model is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the capital for extensive IT infrastructure. As a result, the high performance-computing-as-a-service market is likely to attract a broader customer base, further fueling its growth and adoption across various industries.

Increased Focus on Research and Development

The high performance-computing-as-a-service market is benefiting from an increased focus on research and development (R&D) across multiple sectors. Organizations are investing heavily in R&D to drive innovation and maintain competitive advantages. This trend is particularly evident in industries such as pharmaceuticals, aerospace, and automotive, where complex simulations and modeling are essential for product development. The National Science Foundation has reported that R&D spending in the US reached $680 billion in 2023, highlighting the critical role of advanced computing resources in facilitating these efforts. High performance-computing-as-a-service provides the necessary computational power to support extensive R&D initiatives, thereby positioning itself as an indispensable resource for organizations aiming to push the boundaries of innovation.

Growing Demand for Data-Intensive Applications

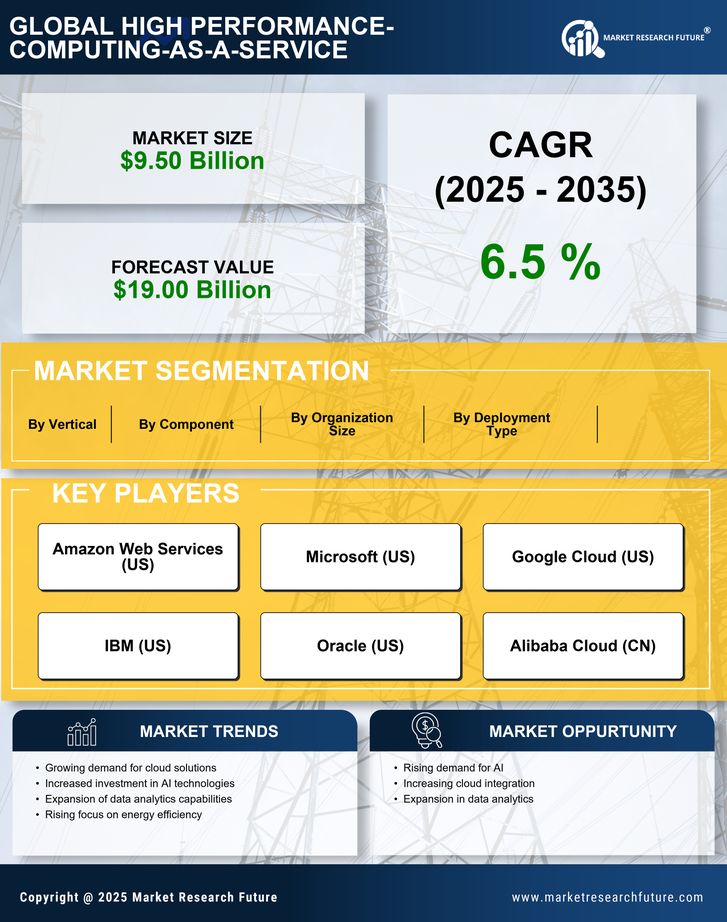

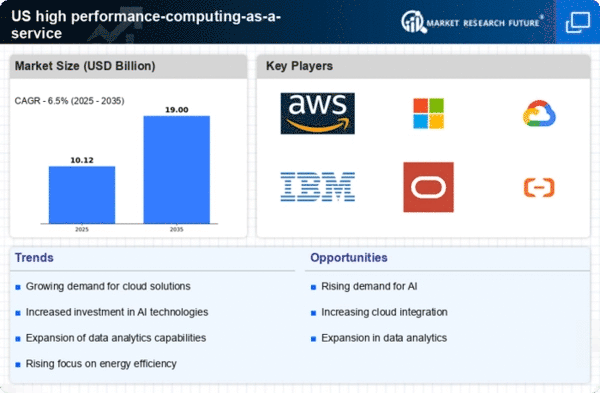

The high performance-computing-as-a-service market is experiencing a surge in demand driven by the increasing reliance on data-intensive applications across various sectors. Industries such as finance, healthcare, and scientific research are leveraging advanced analytics and simulations that require substantial computational power. According to recent estimates, the market for data analytics is projected to reach $274 billion by 2025, indicating a robust growth trajectory. This trend necessitates scalable and flexible computing solutions, which high performance-computing-as-a-service can provide. As organizations seek to enhance their operational efficiency and decision-making capabilities, the demand for high performance-computing-as-a-service solutions is likely to expand, positioning it as a critical component in the technology landscape.

Regulatory Compliance and Data Management Needs

Regulatory compliance and effective data management are increasingly influencing the high performance-computing-as-a-service market. As organizations face stringent regulations regarding data privacy and security, the need for robust computing solutions that can ensure compliance becomes paramount. High performance-computing-as-a-service offers advanced security features and data management capabilities that help organizations navigate these challenges. For instance, industries such as finance and healthcare are subject to regulations that mandate strict data handling practices. The ability to process and analyze large volumes of data securely and efficiently is crucial for compliance. Consequently, the high performance-computing-as-a-service market is likely to see continued growth as organizations prioritize regulatory adherence and effective data management strategies.

Advancements in Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the high performance-computing-as-a-service market. Organizations are increasingly adopting AI and ML to automate processes, improve predictive analytics, and enhance customer experiences. The AI market alone is expected to grow to $190 billion by 2025, which underscores the need for powerful computing resources to support these applications. High performance-computing-as-a-service offers the necessary infrastructure to handle the complex algorithms and large datasets associated with AI and ML, making it an attractive option for businesses aiming to innovate and remain competitive. This trend suggests that the high performance-computing-as-a-service market will continue to evolve in tandem with advancements in AI and ML technologies.