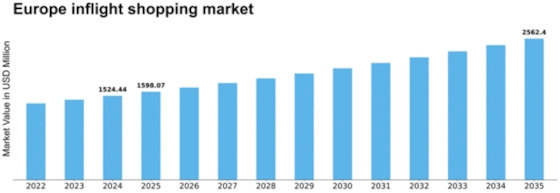

Europe Inflight Shopping Size

Europe Inflight Shopping Market Growth Projections and Opportunities

The Europe inflight shopping market is influenced by a variety of factors that shape its dynamics and growth prospects. Firstly, the overall state of the aviation industry in Europe plays a significant role in determining the demand for inflight shopping. Economic conditions, including GDP growth, disposable income levels, and tourism trends, directly impact passenger traffic and their willingness to spend on retail products during flights.

Secondly, technological advancements and changes in consumer behavior have a significant impact on the Europe inflight shopping market. The proliferation of smartphones, tablets, and other digital devices has transformed how passengers browse and purchase products onboard. Airlines are increasingly investing in inflight Wi-Fi and onboard entertainment systems, allowing passengers to shop conveniently from their personal devices, thereby expanding the reach of inflight retail.

Furthermore, the competitive landscape among airlines and duty-free operators is a crucial factor shaping the Europe inflight shopping market. Airlines vie for passenger loyalty and ancillary revenue by offering unique and diverse product selections, attractive promotions, and exclusive partnerships with renowned brands and duty-free operators. This competition drives innovation and creativity in inflight shopping, benefiting both passengers and industry stakeholders.

Government regulations and policies also play a significant role in influencing the Europe inflight shopping market. Regulatory bodies impose rules and guidelines regarding duty-free allowances, customs regulations, and import tariffs, which directly impact the availability and pricing of products onboard. Airlines must navigate these regulatory frameworks to optimize their inflight retail offerings and ensure compliance with applicable laws.

Moreover, macroeconomic factors such as currency fluctuations, inflation rates, and exchange rates can affect the affordability and purchasing power of passengers, influencing their spending behavior onboard. Airlines must adapt their pricing strategies and product offerings in response to changing economic conditions to remain competitive in the market.

Consumer preferences and cultural trends also shape the Europe inflight shopping market. European passengers have diverse tastes and preferences influenced by factors such as regional customs, fashion trends, and lifestyle choices. Airlines tailor their inflight retail offerings to cater to these preferences, ensuring a relevant and appealing shopping experience for passengers.

Additionally, the impact of external events such as the COVID-19 pandemic has significantly affected the Europe inflight shopping market. Travel restrictions, reduced passenger traffic, and changes in consumer behavior have led to a decline in inflight retail sales. However, as travel gradually resumes and passenger confidence improves, there are opportunities for recovery and growth in the inflight shopping market, driven by pent-up demand and evolving consumer preferences.

Leave a Comment