Advancements in Network Infrastructure

The ongoing improvements in network infrastructure across Europe are significantly impacting the ip telephony market. The expansion of high-speed internet access, including fiber-optic networks, is enabling more businesses to adopt ip telephony solutions. Enhanced bandwidth and reduced latency contribute to improved call quality and reliability, which are critical factors for organizations considering a transition to ip-based communication. As network capabilities continue to evolve, the ip telephony market is likely to see increased adoption rates, as businesses seek to leverage these advancements for better communication solutions.

Cost Efficiency and Operational Savings

The ip telephony market in Europe is experiencing a surge in interest due to the cost-saving potential of VoIP solutions. Businesses are increasingly recognizing the financial benefits associated with transitioning from traditional telephony systems to ip-based communication. By leveraging ip telephony, organizations can reduce operational costs by up to 30%, as they eliminate the need for extensive hardware and maintenance associated with legacy systems. This financial incentive is driving many companies to invest in ip telephony solutions, which not only enhance communication but also contribute to overall business efficiency and profitability.

Growing Demand for Remote Work Solutions

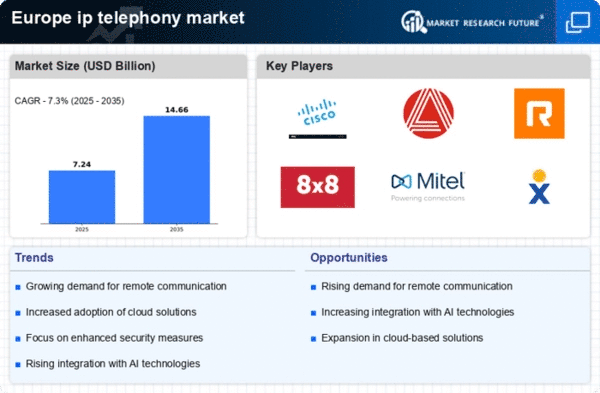

The rise in remote work has catalyzed a notable shift in the ip telephony market across Europe. Organizations are increasingly seeking flexible communication solutions that facilitate collaboration among distributed teams. This demand is reflected in the market, which is projected to grow at a CAGR of approximately 12% from 2025 to 2030. Companies are investing in ip telephony systems that support video conferencing, instant messaging, and VoIP services, enabling seamless communication regardless of location. As businesses adapt to hybrid work models, the need for reliable and scalable ip telephony solutions becomes paramount, driving innovation and competition within the industry.

Regulatory Compliance and Data Protection

In Europe, stringent regulations such as the General Data Protection Regulation (GDPR) have heightened the focus on data security within the ip telephony market. Companies are compelled to adopt communication solutions that ensure compliance with these regulations, which has led to an increased demand for secure ip telephony systems. The market is witnessing a shift towards solutions that offer end-to-end encryption and robust data protection features. This trend is likely to influence purchasing decisions, as organizations prioritize vendors that can demonstrate compliance and security capabilities, thereby shaping the competitive landscape of the industry.

Integration with Unified Communications Platforms

The trend towards unified communications (UC) is reshaping the ip telephony market in Europe. Organizations are increasingly looking for integrated solutions that combine voice, video, messaging, and collaboration tools into a single platform. This integration enhances user experience and streamlines communication processes, making it more efficient for teams to collaborate. The market is responding to this demand by offering ip telephony solutions that seamlessly integrate with existing UC platforms. As businesses recognize the value of cohesive communication systems, the adoption of ip telephony solutions is expected to rise, further driving growth in the industry.