Cost Efficiency and Scalability

Cost efficiency remains a significant driver in the IP Telephony UCaaS Market. Organizations are increasingly seeking solutions that reduce operational costs while providing robust communication capabilities. UCaaS offers a subscription-based model that eliminates the need for extensive on-premises infrastructure, thereby lowering capital expenditures. Furthermore, the scalability of UCaaS solutions allows businesses to adjust their services according to changing needs without incurring substantial costs. This flexibility is particularly appealing to small and medium-sized enterprises (SMEs) that may have limited budgets. Market analysis indicates that companies can save up to 30% on communication costs by transitioning to UCaaS. As a result, the financial advantages associated with UCaaS are driving its adoption across various sectors, reinforcing its position within the IP Telephony UCaaS Market.

Focus on Enhanced Security Features

The emphasis on enhanced security features is a crucial driver in the IP Telephony UCaaS Market. As cyber threats continue to evolve, organizations are prioritizing secure communication solutions to protect sensitive information. UCaaS providers are responding by implementing advanced security measures, including end-to-end encryption, multi-factor authentication, and compliance with industry regulations. This focus on security not only safeguards data but also builds trust with customers and stakeholders. Recent studies indicate that businesses are willing to invest significantly in secure communication solutions, with a reported increase of 20% in budget allocations for cybersecurity in communication tools. Consequently, the heightened awareness of security risks is propelling the adoption of UCaaS solutions, reinforcing their importance in the IP Telephony UCaaS Market.

Growing Need for Collaboration Tools

The growing need for collaboration tools is a vital driver in the IP Telephony UCaaS Market. As teams become more dispersed, the demand for integrated communication platforms that facilitate collaboration has intensified. UCaaS solutions provide a comprehensive suite of tools, including video conferencing, instant messaging, and file sharing, which are essential for effective teamwork. Market data suggests that organizations utilizing UCaaS experience a 30% improvement in collaboration efficiency. This trend is particularly evident in industries that rely heavily on project-based work, where seamless communication is critical. The ability to collaborate in real-time, regardless of location, positions UCaaS as an indispensable asset for modern businesses. Thus, the increasing emphasis on collaboration tools is driving the growth of the IP Telephony UCaaS Market.

Integration with Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and machine learning, is transforming the IP Telephony UCaaS Market. These technologies enhance the functionality of UCaaS solutions by providing features like intelligent call routing, automated transcription, and predictive analytics. The incorporation of AI-driven tools not only improves user experience but also streamlines operations, allowing organizations to make data-driven decisions. As businesses increasingly rely on data to inform their strategies, the demand for UCaaS solutions that leverage these technologies is expected to rise. Market forecasts suggest that the integration of AI in communication platforms could lead to a 40% increase in efficiency for customer service operations. This trend indicates a significant shift in how organizations approach communication, further solidifying the role of UCaaS in the IP Telephony UCaaS Market.

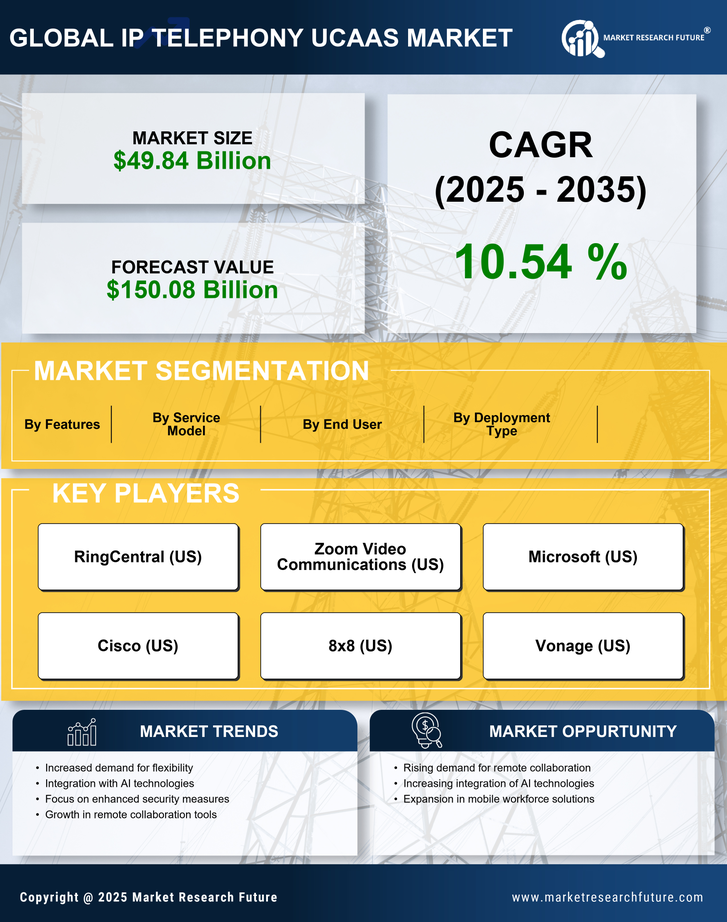

Rising Demand for Remote Communication Solutions

The increasing need for effective remote communication solutions is a primary driver in the IP Telephony UCaaS Market. As organizations continue to embrace remote work, the demand for unified communication as a service (UCaaS) solutions has surged. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is fueled by the necessity for seamless collaboration tools that integrate voice, video, and messaging functionalities. Companies are increasingly recognizing the value of UCaaS in enhancing productivity and maintaining connectivity among distributed teams. The ability to access communication tools from any location further solidifies the relevance of UCaaS in today's business landscape, making it a pivotal component of the IP Telephony UCaaS Market.