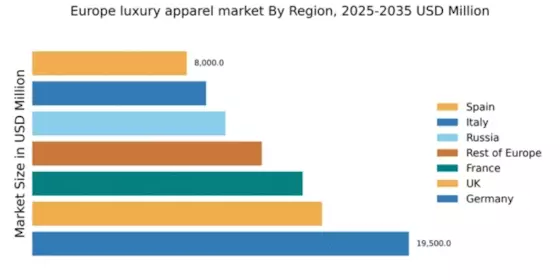

Germany : Strong Demand and Growth Drivers

Germany holds a commanding market share of 29.5% in the luxury apparel sector, valued at €19,500 million. Key growth drivers include a robust economy, increasing disposable incomes, and a growing trend towards sustainable fashion. Demand is particularly strong in urban areas, with consumers increasingly favoring high-quality, ethically produced goods. Government initiatives promoting sustainability and innovation in the textile industry further bolster market growth. Infrastructure development, including improved logistics and retail spaces, supports this dynamic market.

UK : Cultural Hub for Fashion Enthusiasts

The UK luxury apparel market accounts for 22.6% of the European market, valued at €15,000 million. Growth is driven by a strong cultural affinity for fashion, particularly in cities like London and Manchester. The rise of online shopping and luxury resale platforms has transformed consumption patterns, appealing to younger demographics. Regulatory support for e-commerce and retail innovation enhances market accessibility. The competitive landscape features major players like Burberry and Dior, who adapt to local trends and consumer preferences.

France : Heritage and Innovation Combined

France commands a significant 21.1% market share in luxury apparel, valued at €14,000 million. The country's rich heritage in fashion, coupled with innovation, drives demand. Paris remains a global fashion capital, attracting high-end consumers and tourists alike. Government support for the fashion industry, including grants for sustainable practices, fosters growth. The competitive landscape is dominated by iconic brands like Chanel and LVMH, which continuously evolve to meet consumer expectations and maintain their prestigious status.

Russia : Growing Affluence and Aspirational Consumers

Russia holds a 14.5% share of the luxury apparel market, valued at €10,000 million. Key growth drivers include a rising affluent class and increasing interest in luxury brands among younger consumers. Demand is concentrated in major cities like Moscow and St. Petersburg, where international brands are expanding their presence. Regulatory changes aimed at improving foreign investment and trade relations enhance market conditions. The competitive landscape features brands like Gucci and Prada, which cater to the evolving tastes of Russian consumers.

Italy : Heritage Meets Modern Luxury

Italy represents 9.5% of the luxury apparel market, valued at €9,000 million. The country is renowned for its craftsmanship and design, driving demand for high-quality apparel. Key growth factors include a strong domestic market and a flourishing tourism sector, particularly in cities like Milan and Florence. Government initiatives supporting artisanal production and export promotion enhance the market. Major players like Versace and Fendi dominate, leveraging Italy's rich fashion heritage to attract both local and international consumers.

Spain : Cultural Influence and Global Appeal

Spain accounts for 7.9% of the luxury apparel market, valued at €8,000 million. The growth is fueled by a blend of cultural heritage and modern consumer trends, particularly in cities like Barcelona and Madrid. Increasing tourism and a growing middle class contribute to rising demand for luxury goods. Regulatory support for the fashion industry, including tax incentives for local production, enhances market conditions. The competitive landscape features brands like Loewe and Balenciaga, which resonate with both local and international consumers.

Rest of Europe : Varied Trends and Consumer Preferences

The Rest of Europe holds a market share of 17.5%, valued at €11,884.73 million. This diverse region showcases varied consumer preferences and trends, influenced by local cultures and economic conditions. Growth drivers include increasing disposable incomes and a rising interest in luxury brands across countries like Belgium and the Netherlands. Regulatory frameworks supporting trade and e-commerce enhance market accessibility. The competitive landscape features a mix of local and international brands, adapting to regional tastes and preferences.