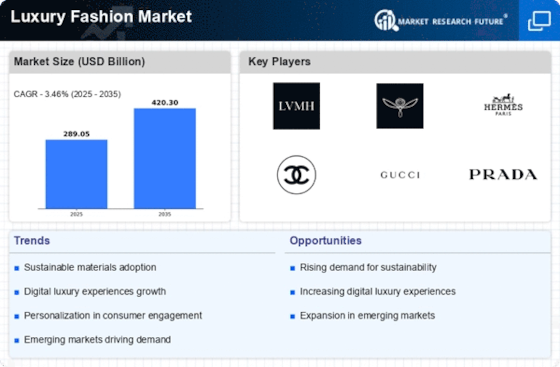

The Luxury Fashion Market is currently characterized by a dynamic competitive landscape, driven by evolving consumer preferences and a heightened focus on sustainability and digital innovation. Major players such as LVMH (FR), Kering (FR), and Gucci (IT) are strategically positioning themselves to leverage these trends. LVMH (FR) continues to emphasize its commitment to craftsmanship and exclusivity, while Kering (FR) is increasingly focusing on sustainability initiatives across its brands. Gucci (IT), on the other hand, is enhancing its digital presence, aiming to attract a younger demographic through innovative marketing strategies. Collectively, these strategies not only enhance brand equity but also intensify competition, as companies vie for market share in an increasingly discerning consumer environment. Key business tactics within the Luxury Fashion Market include localized manufacturing and supply chain optimization, which are essential for maintaining quality and responsiveness to market demands. The market structure appears moderately fragmented, with a few dominant players exerting considerable influence. This fragmentation allows for niche brands to emerge, yet the collective power of established companies like Dior (FR) and Chanel (FR) shapes overall market dynamics, often setting trends that smaller brands follow.

In August Kering (FR) announced a partnership with a leading technology firm to enhance its digital supply chain capabilities. This strategic move is likely to streamline operations and improve transparency, aligning with the growing consumer demand for sustainability. By integrating advanced technologies, Kering (FR) aims to not only optimize its logistics but also to reinforce its commitment to ethical practices, thereby enhancing its brand reputation.

In September Gucci (IT) launched a new line of eco-friendly luxury handbags, utilizing innovative materials sourced from recycled plastics. This initiative reflects a broader trend within the industry towards sustainability, appealing to environmentally conscious consumers. The introduction of this product line not only diversifies Gucci's offerings but also positions the brand as a leader in sustainable luxury fashion, potentially attracting a new customer base.

In October LVMH (FR) unveiled its latest digital marketing campaign, which incorporates augmented reality experiences for consumers. This initiative is indicative of the brand's commitment to digital transformation, aiming to enhance customer engagement and create immersive shopping experiences. By leveraging cutting-edge technology, LVMH (FR) is likely to strengthen its market position and appeal to tech-savvy consumers, further differentiating itself from competitors.

As of October the Luxury Fashion Market is witnessing a pronounced shift towards digitalization, sustainability, and the integration of artificial intelligence in operations. Strategic alliances are increasingly shaping the competitive landscape, enabling brands to pool resources and expertise. Moving forward, competitive differentiation is expected to evolve, with a greater emphasis on innovation and technology rather than traditional price-based competition. Companies that successfully navigate these trends will likely emerge as leaders in the luxury fashion sector, setting new standards for quality, sustainability, and consumer engagement.