Evolving Consumer Preferences

The luxury fashion market in Europe is currently experiencing a shift in consumer preferences, with a growing inclination towards personalized and unique products. This trend is driven by affluent consumers seeking distinctiveness in their fashion choices, which reflects their individuality. As a result, brands are increasingly focusing on limited edition collections and bespoke services to cater to this demand. According to recent data, approximately 60% of luxury consumers in Europe express a desire for personalized shopping experiences. This evolving consumer behavior is reshaping the luxury fashion market, compelling brands to innovate and adapt their offerings to meet these expectations.

Cultural Influences and Trends

Cultural influences play a pivotal role in shaping the luxury fashion market in Europe. The region's rich history and diverse cultural heritage inspire designers and brands, leading to innovative collections that resonate with consumers. For instance, the integration of traditional craftsmanship with modern aesthetics has become a hallmark of many luxury brands. This cultural synergy not only enhances the appeal of luxury fashion but also fosters a sense of authenticity and heritage. As consumers increasingly seek products that reflect their cultural identity, the luxury fashion market is likely to see a rise in demand for culturally inspired collections.

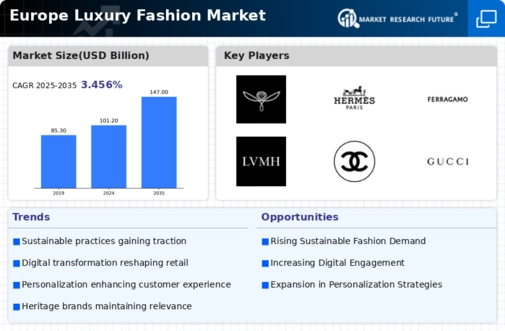

Economic Resilience and Growth

The luxury fashion market in Europe benefits from a robust economic environment, characterized by rising disposable incomes among affluent consumers. Economic indicators suggest that the wealth of high-net-worth individuals in Europe has increased by 8% over the past year, contributing to a more favorable landscape for luxury spending. This economic resilience is likely to bolster the luxury fashion market, as consumers feel more confident in their purchasing power. Furthermore, the increasing number of affluent individuals in emerging markets within Europe is expected to further drive demand for luxury fashion products, enhancing market growth prospects.

Sustainability and Ethical Practices

The luxury fashion market in Europe is increasingly influenced by sustainability and ethical practices. Consumers are becoming more aware of the environmental and social implications of their purchases, leading to a demand for brands that prioritize sustainable sourcing and production methods. Recent surveys indicate that over 70% of luxury consumers in Europe consider sustainability when making purchasing decisions. This shift is prompting luxury brands to adopt more transparent supply chains and eco-friendly materials, thereby enhancing their brand image and appeal. As sustainability becomes a core value for consumers, the luxury fashion market is likely to evolve, with brands that embrace these practices gaining a competitive edge.

Technological Advancements in Retail

The luxury fashion market in Europe is witnessing a transformation driven by technological advancements in retail. Innovations such as augmented reality (AR) and virtual reality (VR) are enhancing the shopping experience, allowing consumers to engage with products in immersive ways. Additionally, the integration of artificial intelligence (AI) in customer service is streamlining the purchasing process, making it more efficient. Recent studies indicate that luxury brands adopting these technologies have seen a 15% increase in customer engagement. As these technological trends continue to evolve, they are expected to significantly impact the luxury fashion market, creating new opportunities for brands to connect with consumers.