Market Trends

Key Emerging Trends in the Europe power transmission infrastructure Market

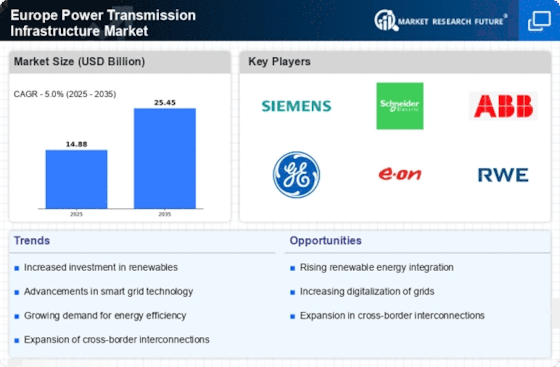

The European power transmission infrastructure market is witnessing notable trends driven by various factors influencing the energy landscape. One significant trend is the transition towards renewable energy sources, such as wind and solar power, as countries aim to reduce carbon emissions and meet sustainability goals outlined in agreements like the Paris Agreement. This shift is leading to increased investments in upgrading and expanding the transmission infrastructure to accommodate the decentralized nature of renewable energy generation.

Moreover, there is a growing focus on interconnecting grids across different countries to facilitate the efficient transmission of electricity. This trend is driven by the need to enhance energy security, optimize resource utilization, and foster greater integration of renewable energy sources into the grid. Projects like the North Sea Wind Power Hub and various interconnection initiatives between European countries are examples of efforts aimed at strengthening cross-border transmission infrastructure.

Another noteworthy trend is the modernization of existing transmission networks to improve efficiency, reliability, and resilience. Aging infrastructure in many European countries requires upgrades to accommodate changing demand patterns, integrate new technologies, and mitigate risks associated with extreme weather events and cyber threats. As a result, investments in smart grid technologies, advanced monitoring and control systems, and grid automation are on the rise.

Furthermore, the electrification of transportation and heating sectors is driving the need for additional transmission capacity and infrastructure upgrades. The adoption of electric vehicles (EVs) and the electrification of heating systems in buildings are expected to increase electricity demand significantly in the coming years. To support this transition, investments in expanding and reinforcing transmission networks are essential to ensure reliable and resilient supply to meet growing demand from these sectors.

Additionally, regulatory frameworks and policies play a crucial role in shaping market trends in the European power transmission infrastructure sector. Initiatives such as the European Green Deal and the Clean Energy Package set ambitious targets for decarbonization, energy efficiency, and renewable energy deployment, driving investments in clean energy infrastructure, including transmission networks. Moreover, regulatory reforms aimed at promoting competition, fostering innovation, and ensuring fair access to the grid are influencing investment decisions and market dynamics.

The European power transmission infrastructure market is characterized by a dynamic landscape shaped by the transition towards renewable energy, cross-border grid integration, modernization efforts, electrification trends, and evolving regulatory frameworks. As countries strive to build more sustainable, resilient, and interconnected energy systems, investments in upgrading and expanding transmission infrastructure will continue to play a crucial role in shaping the future of Europe's energy landscape.

Leave a Comment