Europe PV Inverter Market Overview:

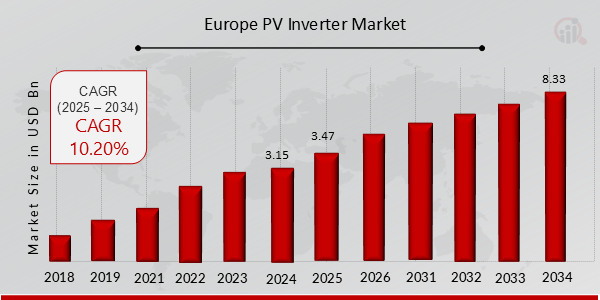

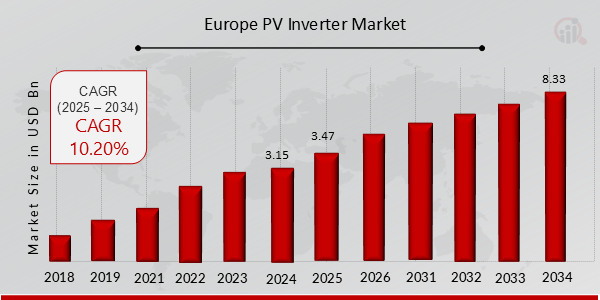

As per MRFR analysis, the Europe PV Inverter Market Size was estimated at 3.15 (USD Billion) in 2024. The Europe PV Inverter Market Industry is expected to grow from 3.47 (USD Billion) in 2025 to 8.33 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 10.20% during the forecast period (2025 - 2034). The declining costs of solar panels and technologies are one of the major market drivers driving the PV Inverter market in Europe. Industries are adopting PV inverters to modernize the power grid to accommodate distributed energy resources.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe PV Inverter Market Trends

-

The growth of smart and hybrid inverters is driving the market growth

The European PV Inverter market CAGR is expanding due to the transition towards smart and hybrid inverters. Smart inverters integrate advanced communication and monitoring capabilities, allowing for better control and optimization of solar energy systems. These inverters facilitate grid integration by providing real-time energy production and consumption data. Additionally, smart inverters support functionalities such as reactive power control and voltage regulation, contributing to grid stability. The European solar industry is increasingly adopting smart inverters to enhance solar P.V. systems' overall efficiency and performance. Moreover, the rise of hybrid inverters, which enable the integration of energy storage solutions, aligns with the growing interest in combining solar power with energy storage for enhanced energy management and grid support. This trend reflects a broader industry focus on creating intelligent and flexible solar energy systems.

Furthermore, the growth of the Europe PV Inverter market is influenced by the dominance of string inverters and the trend towards decentralized solar power generation. String inverters, connected to multiple solar panels in a string configuration, offer cost-effective solutions for residential and commercial solar installations. The preference for string inverters is driven by their scalability, ease of installation, and ability to optimize energy production in variable shading conditions. Furthermore, there is a shift towards decentralized solar power generation, emphasizing distributed energy resources. This trend aligns with the broader goals of achieving energy independence, reducing transmission and distribution losses, and increasing the power grid's resilience. Decentralized solar installations with string inverters allow for local energy production, reducing dependence on centralized power plants and promoting a more sustainable and resilient energy infrastructure in Europe. Thus driving the P.V. Inverter market revenue.

Europe PV Inverter Market Segment Insights:

PV Inverter Product Insights

The Europe PV Inverter market segmentation, based on product, includes String, Micro, Central, Hybrid, and Others. The string segment dominated the market. It is a type of photovoltaic inverter that is prominent for its efficiency in converting direct current (D.C.) generated by solar panels into alternating current (A.C.). Their popularity in the European market is attributed to their modular design, cost-effectiveness, and suitability for residential and commercial solar installations. This product segment is pivotal in advancing solar energy adoption across Europe.

PV Inverter Phase Insights

The Europe PV Inverter market segmentation, based on phase, includes Single, Two, and Three phases. The three-phase category generated the most income. They are widely adopted in solar photovoltaic systems because they handle higher power capacities efficiently. Their robust performance makes them suitable for commercial and industrial applications, providing stable and reliable power conversion for larger European solar installations.

PV Inverter Connectivity Insights

The Europe PV Inverter market segmentation, based on connectivity, includes Standalone, On-grid, and Battery backup. The standalone category generated the most income. These inverters operate independently, converting direct current (D.C.) from solar panels into usable alternating current (A.C.) for electrical systems. This connectivity option provides flexibility and autonomy in solar energy systems, making it a popular choice for photovoltaic inverters in the European market.

PV Inverter Output Power Insights

The Europe PV Inverter market segmentation, based on output power, includes Up to 1 kW, 1-5kW, 5-30kW, 30-70kW, 70-100kW and Above 100kW. The up to 1kW category generated the most income. These inverters cater to smaller-scale solar installations, providing efficient power conversion for residential and small commercial solar photovoltaic (PV) systems. The up-to-1kW segment reflects a growing trend in decentralized and distributed solar energy generation, supporting the integration of renewable energy sources into smaller-scale applications across Europe.

PV Inverter Output Rating Insights

The Europe PV Inverter market segmentation, based on output rating, includes Up to 250V, 250-330V, 330-415V, 415-600V, and more than 600V. The up to 250V category generated the most income. It caters to solar power systems with lower voltage requirements, providing a suitable solution for smaller-scale installations. Inverters in this range are designed to efficiently convert photovoltaic-generated electricity for optimal performance in systems with lower voltage specifications, contributing to the versatility of solar energy applications in the European market.

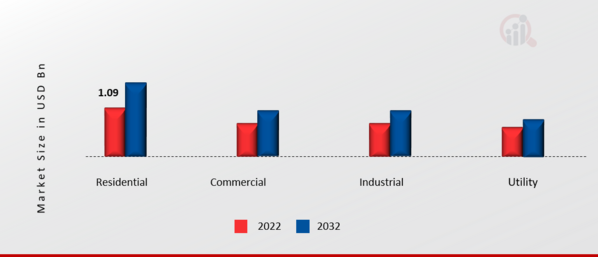

PV Inverter End-user Insights

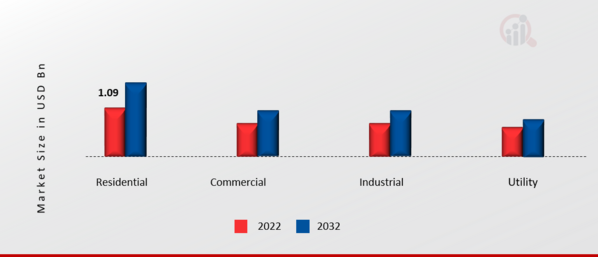

The Europe PV Inverter market segmentation, based on end-user industry, includes Residential, Commercial, Industrial, and Utility. The residential segment generated the most income. With rising awareness of sustainable energy, residential users are installing photovoltaic systems to harness solar power. PV inverters are crucial in converting solar energy into usable electricity for households. This segment witnesses robust growth as individuals seek renewable energy solutions, contributing to the overall expansion of the European PV inverter market.

Figure 1: Europe PV Inverter Market, by End-user Industry, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

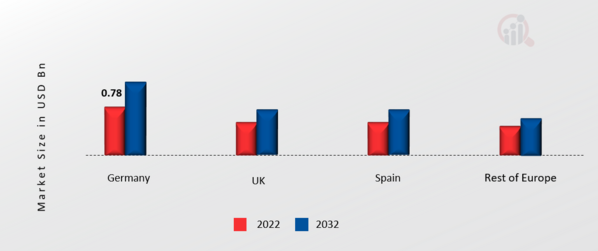

PV Inverter Country Insights

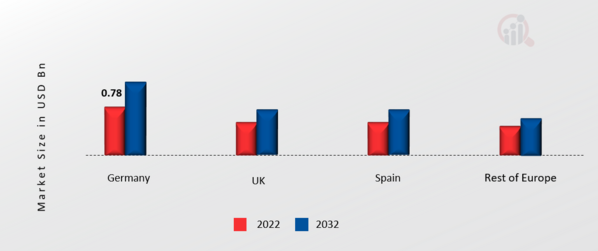

In recent years, the rapid expansion of renewable energy targets has resulted in a boom in demand for PV inverters in Europe. As a solar power leader, Germany boasts a robust market driven by government incentives and a focus on renewable energy. In contrast, Spain has experienced a resurgence in solar projects, stimulating inverter demand. Residential installations and favorable regulatory frameworks drive Italy's market. France emphasizes energy transition, fostering growth in the PV inverter sector. Ambitious renewable energy targets and supportive policies influence the United Kingdom's market. Eastern European countries like Poland and Hungary are witnessing increased solar adoption, contributing to the regional market's expansion. Europe's PV inverter landscape reflects a dynamic mix of policy support, market maturity, and environmental consciousness driving solar energy adoption.

Figure 2: EUROPE PV Inverter Market Share By Region 2022 (Usd Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

PV Inverter Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Europe PV Inverter market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The PV Inverter industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Major players in the Europe PV Inverter market are attempting to increase market demand by investing in research and development operations, including Solar Edge Technologies, Siemens Energy, Fimer Group, SMA Solar Technology AG, Delta Electronics, Inc., Sun Power Corporation, Omron Corporation, Eaton Corporation, Emerson Electric Co. and Power Electronics S.L.

Key Companies in the Europe PV Inverter market include

PV Inverter Industry Developments

July 2021:Solar Edge announced the launch of its 100kW three-phase inverter, SE100K, equipped with synergy technology and designed to improve the profitability of larger PV installations in the U.K.

November 2024: SolarEdge Technologies declared the closure of its energy storage unit, resulting in the loss of roughly 500 jobs, or 12% of the total workforce, primarily in South Korea's manufacturing sector. This decision stemmed from the lowered demand for residential solar across Europe from cheap electricity and rising competition from China.

November 2024: Enphase Energy reported plans to dismiss around 500 employees and contractors, which is about 17% of their global workforce, within a restructuring plan due to a slump in the demand for solar. The company noted that competition is higher than expected, along with reduced electricity prices across Europe.

October 2024: Enphase Energy projected revenues in the fourth quarter to fall below market expectations. The company cited weak demand from specific markets as a key indicator. They reported an increased loss of 15% from the last quarter in Europe and noted the fierce competition and low electricity prices in the Netherlands and Germany as the leading cause for this decline.

January 2025: SolarEdge Technologies announced plans to cut 400 jobs globally, marking its fourth round of cuts in the past year. This comes when the company and the whole industry suffer from weak demand in key markets like Europe, leading to a colossal surplus inventory.

June 2022: SMA Solar Technology AG is set to erect a solar inverter manufacturing gigafactory in Niestetal, Germany. This new gigafactory construction aligns with the company's objective to boost its production capacity from 21 GW in 2021 to 40 GW in 2024. Construction was expected to begin in late 2022.

April 2022: SMA Solar Technology AG unveiled the launch of four models of solar inverters for commercial and residential PV systems expansion, reaching a power output of 135 kW. The new Sunny Tripower-X, 12kW, 15kW, 20kW, and 25kW rated models come with a proprietary systems manager, three independent MPP trackers, and six-string outputs. These new inverters offer grid-friendly power control for vast PV systems over-dimensioning up to 150%.

Europe PV Inverter Market Segmentation:

PV Inverter Product Outlook

PV Inverter Phase Outlook

PV Inverter Connectivity Outlook

PV Inverter Output Power Outlook

PV Inverter Output Rating Outlook

PV Inverter End-user Industry Outlook

PV Inverter Regional Outlook

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

3.15 (USD Billion)

|

|

Market Size 2025

|

3.47 (USD Billion)

|

|

Market Size 2034

|

8.33 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

10.20% (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2019 - 2023

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Phase, Connectivity, Output Power, Output Rating, End-user Industry, and Region |

| Region Covered |

Europe |

| Countries Covered |

Germany, France, UK, Italy, Spain, Sweden, Denmark, Luxembourg, Norway, Austria, and Rest of Europe |

| Key Companies Profiled |

Solar Edge Technologies, Siemens Energy, Fimer Group, SMA Solar Technology AG, Delta Electronics, Inc., Sun Power Corporation, Omron Corporation, Eaton Corporation, Emerson Electric Co., and Power Electronics S.L. |

| Key Market Opportunities |

Ongoing advancements in PV Inverter technologies |

| Key Market Dynamics |

Decrease in the costs of solar photovoltaic technology Educating people about the benefits of solar energy |

Europe PV Inverter Market Highlights:

Frequently Asked Questions (FAQ) :

The Europe PV Inverter market size was valued at USD 3.15 Billion in 2024.

The market is projected to grow at a CAGR of 10.20% during the forecast period, 2025-2034.

The key players in the market are Solar Edge Technologies, Siemens Energy, Fimer Group, SMA Solar Technology AG, Delta Electronics, Inc., Sun Power Corporation, Omron Corporation, Eaton Corporation, Emerson Electric Co., and Power Electronics S.L.

The string category dominated the market in 2022.

The three-phase category had the largest share of the market.

The standalone category had the largest share of the market.

The up to 1 kW category had the largest share in the market.

The up-to-250V category had the largest share of the market.

The residential category had the largest share of the market.