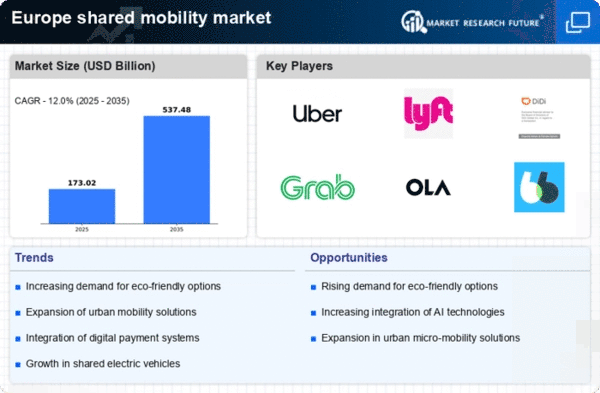

Top Industry Leaders in the Europe Shared-Mobility Market

*Disclaimer: List of key companies in no particular order

Competitive Landscape of Europe's Shared-Mobility Market: A Dynamic Arena

The European shared-mobility market is a vibrant and dynamic space, experiencing robust growth driven by sustainability concerns, urbanization, and technological advancements. This landscape is characterized by a diverse range of players, each vying for market share through strategic maneuvers and innovative offerings. Let's delve into the key elements shaping this competitive scene:

Key Players and Strategies:

-

Established Players: Giants like Uber and Bolt dominate ride-hailing, while established car manufacturers like Daimler and BMW are entering car-sharing with services like ShareNow and DriveNow. These players leverage brand recognition, extensive networks, and economies of scale to maintain their positions. -

Micromobility Specialists: Companies like Voi and Tier, specializing in e-bikes and e-scooters, are rapidly gaining traction, particularly in urban areas. They focus on affordability, convenience, and environmental friendliness to attract users. -

Public Transport Integration: Public transport authorities are increasingly partnering with shared-mobility providers, offering seamless multimodal journeys. This trend is exemplified by MaaS (Mobility as a Service) platforms like Whim and Citymapper, which integrate various transport options into a single app. -

Technology-Driven Innovation: Players are investing heavily in autonomous vehicles and connected car technology, aiming to enhance safety, efficiency, and user experience. Companies like Waymo and Voyage are conducting trials for self-driving taxis, while connected car platforms like Car2Go and ShareNow are integrating features like remote unlocking and vehicle diagnostics.

Factors for Market Share Analysis:

-

Geographic Reach: Companies with wider geographical coverage, particularly across major European cities, have a significant advantage. -

Fleet Size and Diversity: A larger and more diverse fleet, encompassing cars, bikes, and scooters, caters to a broader range of user needs and preferences. -

Pricing and Discounts: Competitive pricing strategies, coupled with attractive discounts and loyalty programs, are crucial for attracting and retaining users. -

Technological Innovation: Companies at the forefront of technological advancements, like autonomous vehicles and MaaS platforms, are well-positioned for future growth. -

Partnerships and Collaborations: Strategic partnerships with public transport authorities, car manufacturers, and technology companies can be a significant driver of market share.

New and Emerging Trends:

-

Subscription Models: Flexible subscription models, offering unlimited rides or minutes for a fixed monthly fee, are gaining popularity, particularly among frequent users. -

Focus on Sustainability: Companies are increasingly focusing on electric vehicles, green energy sources, and carbon-neutral operations to cater to environmentally conscious consumers. -

Data-Driven Personalization: Utilizing user data to personalize pricing, recommendations, and vehicle availability is becoming a key differentiator. -

Integration with Smart Cities: Shared-mobility services are being integrated with smart city infrastructure, leveraging real-time traffic data and intelligent traffic management systems to optimize operations. -

Expansion into New Segments: Companies are exploring new segments beyond personal transportation, such as cargo delivery and carpooling, to diversify their offerings.

Competitive Scenario:

The European shared-mobility market is characterized by intense competition, with established players, micromobility specialists, and new entrants vying for dominance. While established players hold a significant market share, micromobility specialists are gaining ground rapidly due to their agility and focus on specific user needs. The integration of public transport and technology-driven innovation are further shaping the landscape, creating opportunities for new players and partnerships.

Overall, the European shared-mobility market is a dynamic and rapidly evolving space. Companies that can adapt to changing user preferences, embrace technological advancements, and prioritize sustainability are likely to thrive in this competitive environment.

Latest Company Updates:

-

Avis Budget Group (U.S.): announced a partnership with Cityway, a micromobility provider, to offer e-bikes and e-scooters in select European cities. The service is currently available in Madrid, Spain, and will be expanding to other cities in the coming months. (Source: Avis Budget Group press release, January 18, 2024) -

Car2go NA, LLC (U.S.): has been acquired by Stellantis, a European automaker. Stellantis has announced plans to expand Car2go's operations into new European markets, including Italy and France. (Source: Stellantis press release, October 31, 2023) -

Uber Technologies Inc. (U.S.): launched its JUMP e-bike and e-scooter service in Paris, France, in December 2023. Uber is also planning to launch JUMP in other European cities, including Berlin and Amsterdam. (Source: Uber press release, December 5, 2023) -

Lyft, Inc. (U.S.): has no current plans to enter the European shared-mobility market. However, the company is looking to expand its operations in other parts of the world, such as Asia and Latin America. (Source: Lyft investor relations presentation, February 9, 2024) -

Bolt Technology OÜ (Estonia): has expanded its ride-hailing service to new cities in Europe, including Prague, Czech Republic, and Warsaw, Poland. Bolt is also planning to launch a carpooling service in Europe in the coming months. (Source: Bolt Technology press release, January 25, 2024)