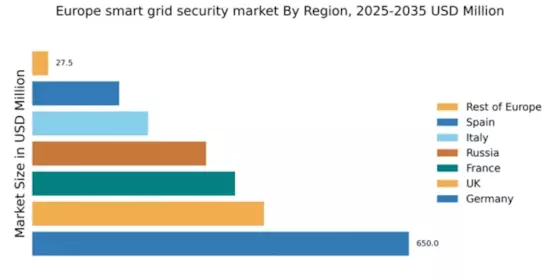

Germany : Robust Infrastructure and Innovation

Germany holds a dominant position in the smart grid-security market, accounting for approximately 40% of the total European market share with a value of 650.0 USD Million. Key growth drivers include the country's commitment to renewable energy integration, stringent regulatory frameworks, and substantial investments in digital infrastructure. The German government has initiated various programs to enhance energy efficiency and cybersecurity, fostering a favorable environment for smart grid technologies.

UK : Innovative Solutions and Investments

Key markets include London, Manchester, and Birmingham, where urbanization drives demand for advanced grid solutions. The competitive landscape features major players like Siemens and ABB, alongside local startups. The business environment is characterized by a strong emphasis on innovation, with applications spanning renewable energy management, electric vehicle integration, and smart metering.

France : Government Support and Innovation

Key markets include Paris and Lyon, where urban infrastructure is rapidly evolving. Major players like Schneider Electric and General Electric are prominent in this landscape, driving competition. The local market is dynamic, with a focus on applications in energy management, smart cities, and industrial automation, supported by a favorable regulatory environment.

Russia : Investment Opportunities and Challenges

Key cities like Moscow and St. Petersburg are central to market activities, with significant investments in energy infrastructure. The competitive landscape includes local players and international firms like Cisco and Honeywell. The business environment is evolving, with applications in energy distribution, monitoring, and management becoming increasingly relevant.

Italy : Focus on Renewable Integration

Key markets include Rome and Milan, where urbanization and energy demands are rising. Major players like Siemens and ABB are active in this space, contributing to a competitive landscape. The local market dynamics favor applications in renewable energy management, smart metering, and energy storage solutions, supported by a proactive regulatory framework.

Spain : Investment in Smart Technologies

Key markets include Madrid and Barcelona, where urban infrastructure is rapidly evolving. The competitive landscape features major players like Siemens and Schneider Electric, alongside local firms. The business environment is characterized by a strong emphasis on innovation, with applications spanning renewable energy management, electric vehicle integration, and smart metering.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include smaller nations with emerging energy sectors. The competitive landscape is diverse, with both local and international players vying for market share. The business environment is characterized by unique challenges and opportunities, with applications in energy management and smart technologies gaining traction.