Market Analysis

In-depth Analysis of Europe Warehouse Robotics Market Industry Landscape

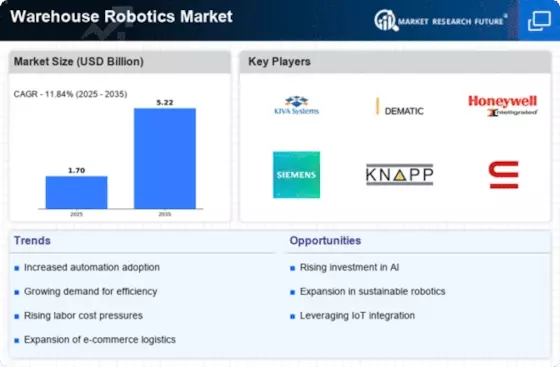

The market dynamics of the Europe warehouse robotics sector are shaped by a multitude of factors that influence the overall growth and evolution of the industry. One of the primary dynamics driving this market is the increasing adoption of automation across various industries. As businesses strive for operational efficiency and cost-effectiveness, the demand for warehouse robotics continues to rise. This trend is particularly evident in the e-commerce and retail sectors, where the need for quick and accurate order fulfillment has become a top priority.

The labor landscape is another significant factor influencing the dynamics of the warehouse robotics market in Europe. With an aging population and changing demographics, there is a growing scarcity of manual labor in the region. As a result, companies are turning to robotic solutions to address labor shortages and ensure a reliable and consistent workflow in warehouses. The flexibility and scalability offered by robotics systems make them well-suited to adapt to fluctuating labor dynamics, contributing to their increasing adoption.

Technological advancements play a pivotal role in shaping the market dynamics of warehouse robotics in Europe. Innovations in artificial intelligence, machine learning, and sensor technologies have led to the development of more sophisticated and capable robotic systems. These advancements empower robots to handle complex tasks, navigate dynamic environments, and collaborate seamlessly with human workers. The continuous evolution of technology ensures that warehouse robotics remain at the forefront of addressing the evolving needs of the logistics and supply chain industry.

Moreover, the COVID-19 pandemic has significantly impacted the market dynamics of warehouse robotics in Europe. The disruptions caused by the pandemic highlighted the vulnerabilities of traditional supply chain models, prompting a reassessment of strategies. The need for resilient and adaptable supply chains became evident, and warehouse robotics emerged as a solution that can operate efficiently in challenging circumstances. The pandemic accelerated the adoption of robotics as businesses sought ways to enhance their supply chain resilience and prepare for future disruptions.

Government initiatives and regulations also influence the market dynamics of warehouse robotics in Europe. As governments recognize the economic benefits and competitive advantages of automation, they implement policies and incentives to support the adoption of robotics technologies. These initiatives create a conducive environment for businesses to invest in warehouse robotics, driving market growth. Additionally, regulatory frameworks addressing safety standards and ethical considerations play a role in shaping the responsible deployment of robotic systems in warehouses.

The focus on sustainability is a growing dynamic in the Europe warehouse robotics market. Businesses are increasingly incorporating environmental considerations into their operations, and warehouse robotics align with this trend. Automated systems are designed to optimize energy usage, reduce waste, and minimize the environmental impact of warehouse operations. As sustainability becomes a key criterion for decision-making, the integration of eco-friendly warehouse robotics solutions gains traction in the market.

Market competition is a fundamental dynamic that shapes the strategies and actions of companies in the warehouse robotics sector. The presence of multiple players vying for market share leads to continuous innovation, competitive pricing, and a focus on customer satisfaction. Companies employ various strategies, such as product differentiation, strategic partnerships, and geographical expansion, to gain a competitive edge and capture a larger share of the market.

Leave a Comment