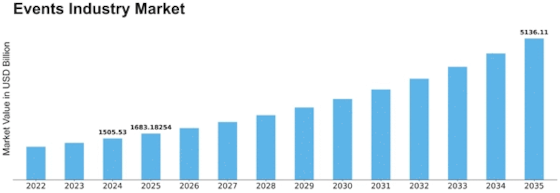

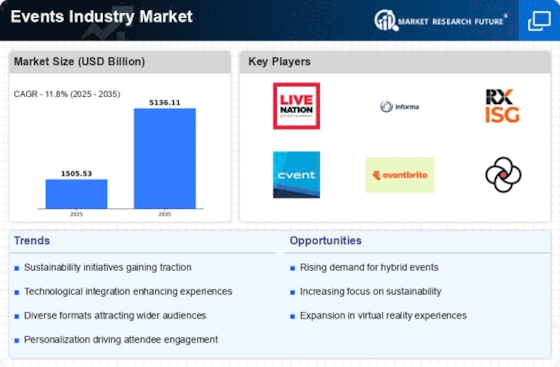

Events Industry Size

Events Industry Market Growth Projections and Opportunities

The events industry market works in a constantly changing environment that is influenced by social trends, technological advancement, and changes in consumer behavior. The market dynamics of the events industry are considerably affected by consumer demand for unique and immersive experiences. People are looking for events that break traditional molds to achieve memorable or engaging experiences. Such digital enhancements play a critical role in shaping the market dynamics of the events industry. Technology integration improves different aspects of event management, execution, and interaction with participants. Organizers apply technologies such as virtual and augmented reality, event apps, and live streaming to make their services interactive and inclusive. Worldwide happenings and societal fashions have an overwhelming impact on what happens in the events industry. Such major global happenings like COVID-19 have forced people to rethink the formats of these meetings, leading to the rise of hybrid ones that can change with circumstances. Advocates for personalized and niche experiences shape the competitive dynamics in the event industry. Organizations come up with customized products targeting specific interests, age groups, or subcultures as required by the target audience. This type of meeting becomes popular because it focuses on one thing only, thus making it special for its attendees, unlike in most others where you would find all sorts of stalls selling all kinds of things like books, t-shirts, DVDs, etcetera. This specific trend towards authentic experiences prompted this increase in speech community-based demands: customers need such tailored impressions due to deeper relationships. Brand presence and sponsorships play a vital role in terms of competitive dynamics within the event industry. Brands yearn to be associated with gathering settings that speak directly to their clients' hearts, using sponsorships as the medium through which they create visibility points. For example, disposable income matters when people decide what to do with their money (including attending one or other eventualities). Fluctuations within the economy may alter the scale and frequency of the events as businesses and consumers may withdraw from participation, considering financial purposes. The distribution and accessibility of events have been transformed by e-commerce and online ticketing platforms. Event information, ticket purchases, and virtual experiences are all available online now that there are various websites dealing with event advertising. Through its direct-to-consumer model, the conference organizers reach a global audience, making the market competitive and diverse.

Leave a Comment