Government Support and Subsidies

Government initiatives aimed at enhancing agricultural productivity are playing a crucial role in the Farm Management Software Market. Various governments are implementing policies that provide financial support and subsidies to farmers who adopt modern farming technologies. This support not only encourages the adoption of farm management software but also fosters innovation within the industry. For instance, programs that promote digital agriculture are gaining traction, leading to increased investments in software solutions. As a result, the Farm Management Software Market is likely to see a surge in demand, as farmers leverage these incentives to enhance their operations.

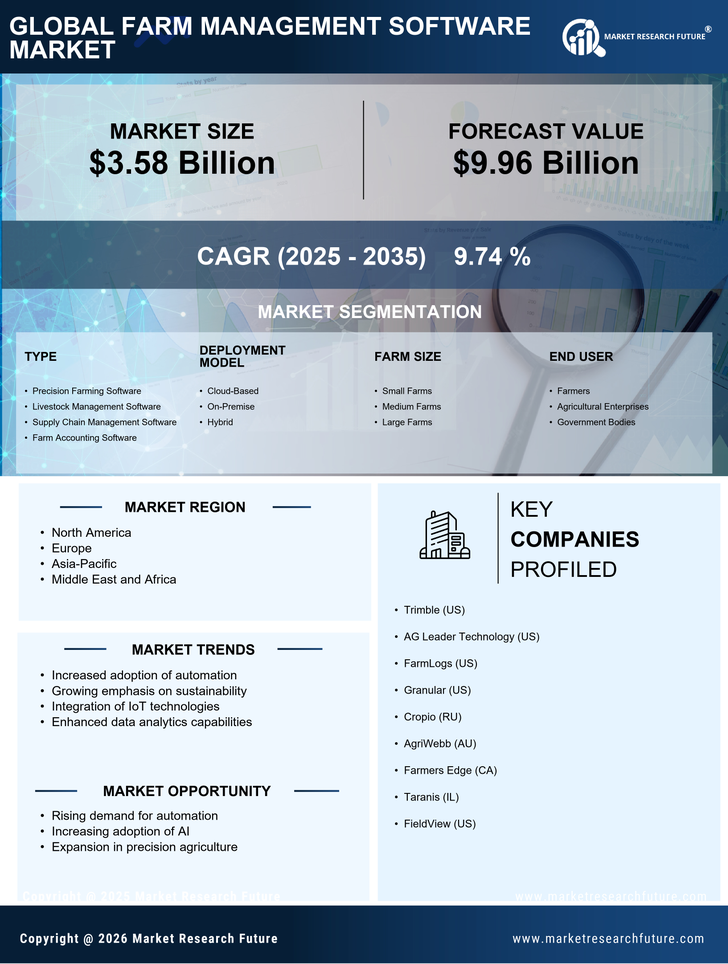

Advancements in Agricultural Technology

Technological advancements are significantly influencing the Farm Management Software Market. Innovations such as artificial intelligence, machine learning, and big data analytics are transforming traditional farming methods. These technologies enable farmers to analyze vast amounts of data, leading to improved crop yields and operational efficiency. The integration of these technologies into farm management software is becoming increasingly prevalent, as evidenced by the growing number of software solutions that incorporate these features. This trend suggests that the Farm Management Software Market is poised for growth, driven by the need for more sophisticated tools that enhance productivity and decision-making.

Growing Need for Efficient Resource Management

The Farm Management Software Market is witnessing a growing need for efficient resource management among farmers. As agricultural practices evolve, the demand for tools that optimize resource allocation, such as water, fertilizers, and labor, is becoming more pronounced. Software solutions that provide real-time data and analytics enable farmers to make informed decisions regarding resource usage, ultimately leading to cost savings and increased productivity. This trend is underscored by the rising costs of inputs, which necessitate more efficient management practices. Therefore, the Farm Management Software Market is likely to expand as farmers seek solutions that enhance resource efficiency.

Rising Demand for Sustainable Farming Practices

The Farm Management Software Market is experiencing a notable shift towards sustainable farming practices. As consumers increasingly prioritize environmentally friendly products, farmers are compelled to adopt methods that minimize ecological impact. This trend is reflected in the growing adoption of software solutions that facilitate sustainable practices, such as crop rotation and resource optimization. According to recent data, the market for sustainable agriculture is projected to reach substantial figures, indicating a robust demand for software that supports these initiatives. Consequently, the Farm Management Software Market is likely to benefit from this rising demand, as farmers seek tools that align with sustainability goals.

Increasing Focus on Crop Monitoring and Yield Prediction

The emphasis on crop monitoring and yield prediction is significantly shaping the Farm Management Software Market. Farmers are increasingly recognizing the importance of data-driven insights to enhance crop performance and profitability. Software solutions that offer features such as satellite imagery, soil analysis, and weather forecasting are gaining popularity, as they provide critical information for effective crop management. This trend is supported by the growing awareness of the benefits of precision agriculture, which relies heavily on accurate data for decision-making. Consequently, the Farm Management Software Market is expected to grow as farmers invest in technologies that facilitate better monitoring and yield prediction.